Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi please answer Question 6 only. Please see Question 4 for reference. thank you! would appreciate to have the answers ASAP. SECURITY WARNING External Data

Hi please answer Question 6 only. Please see Question 4 for reference. thank you! would appreciate to have the answers ASAP.

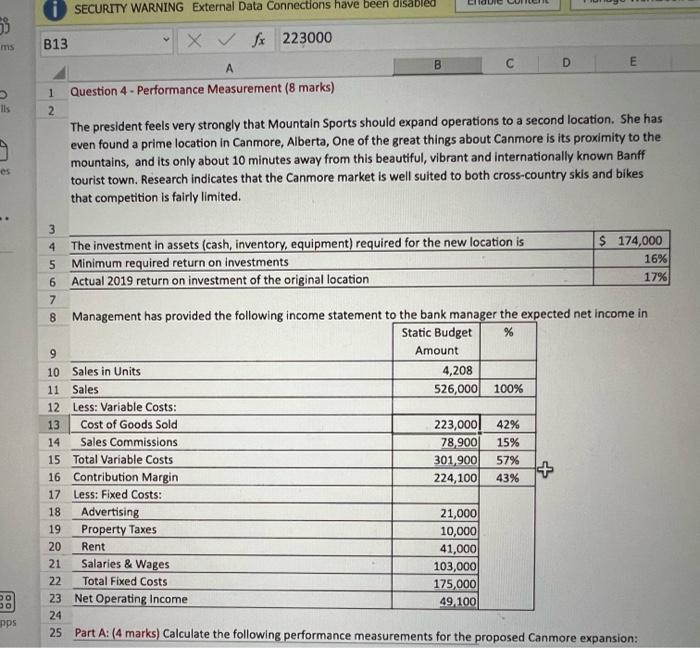

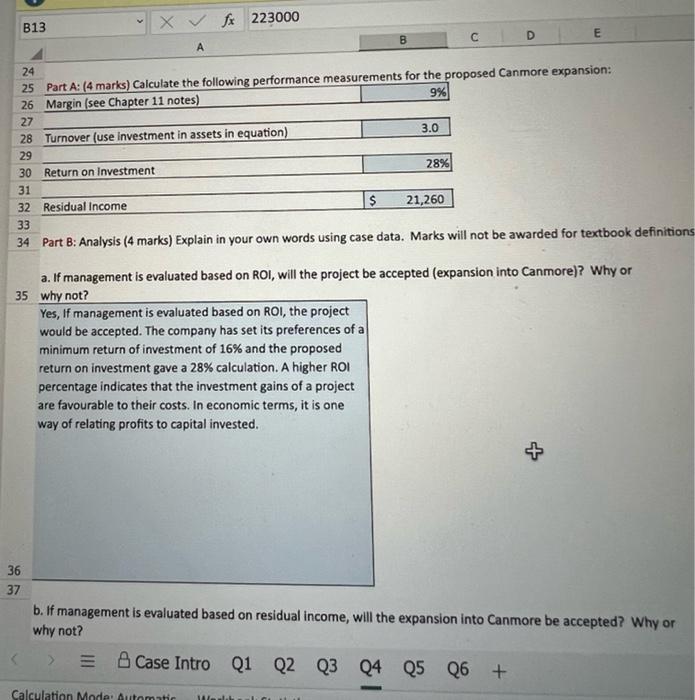

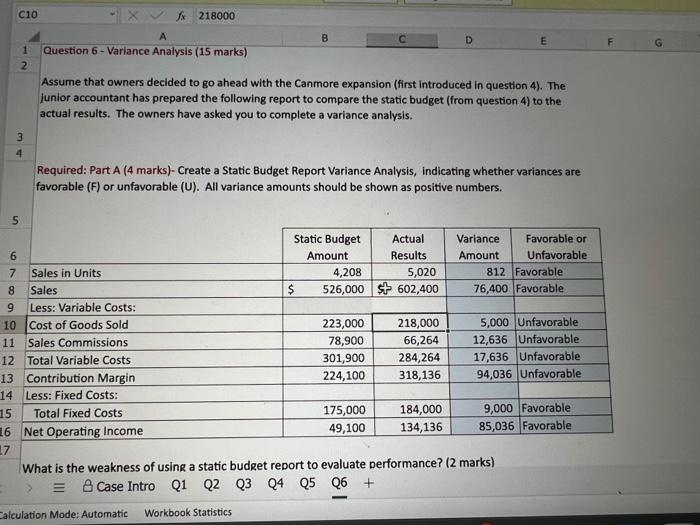

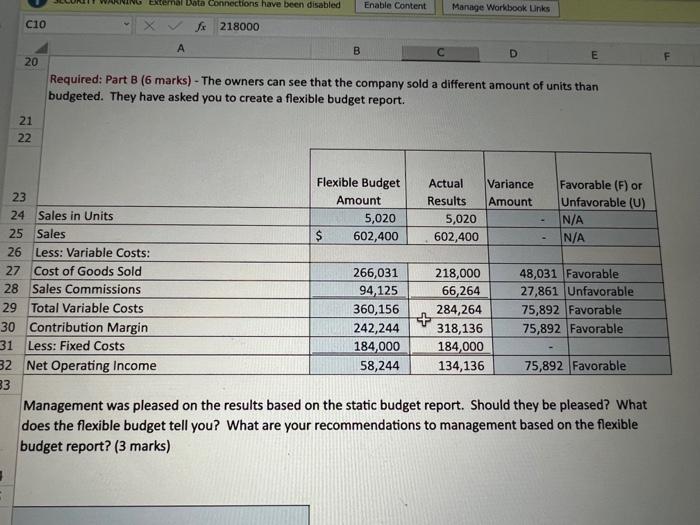

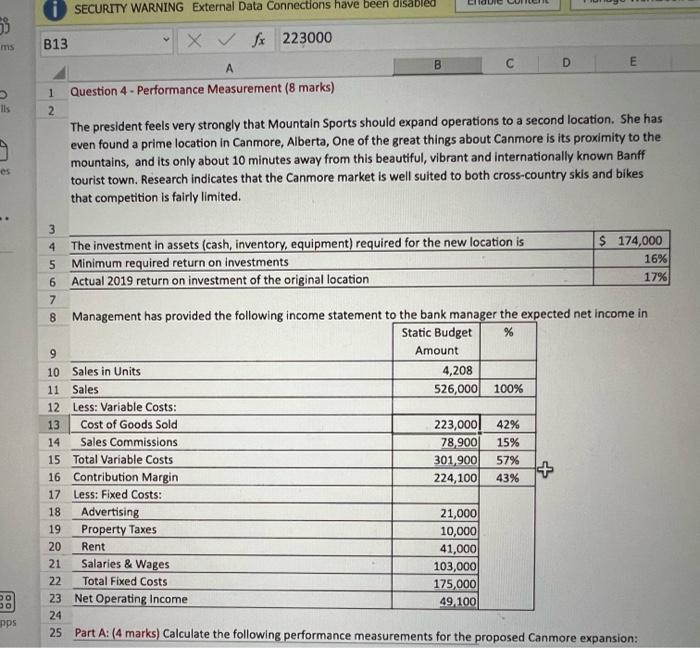

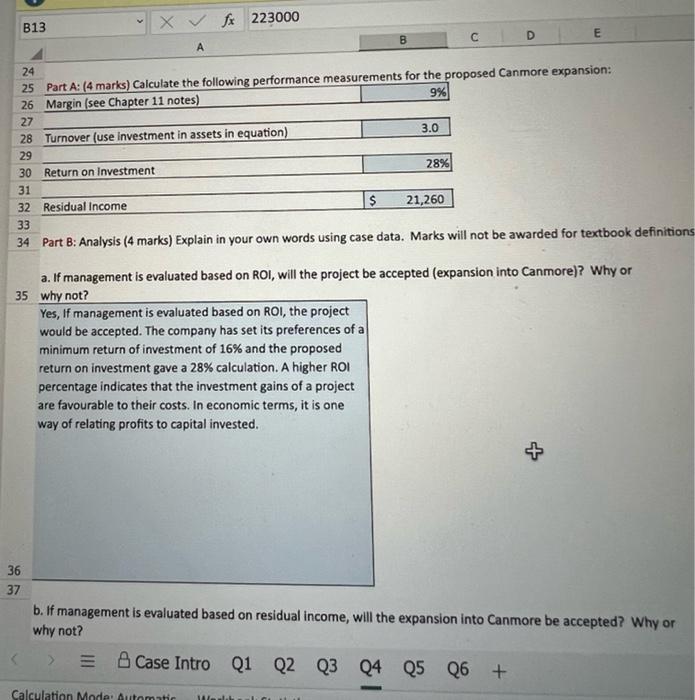

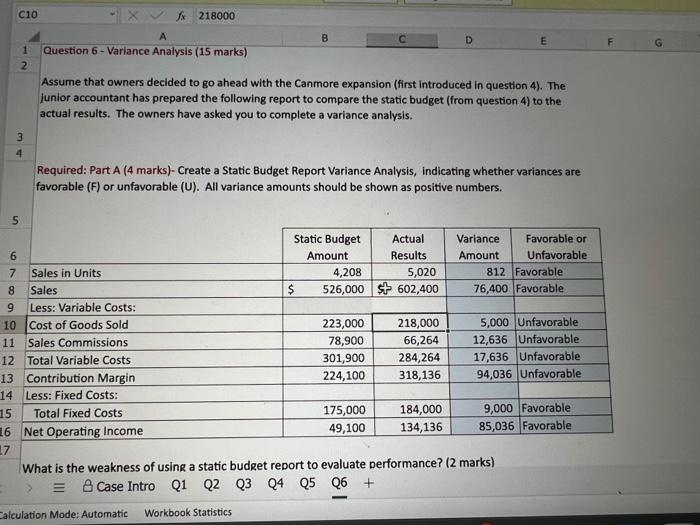

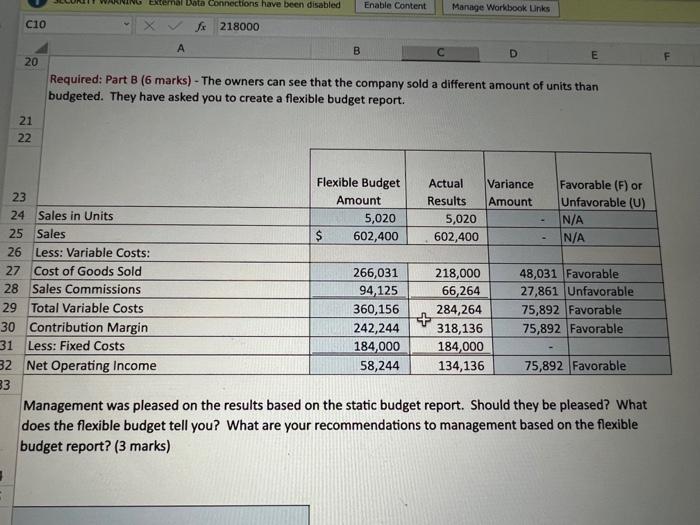

SECURITY WARNING External Data Connections have been disabled 53 ms B13 fx 223000 D B E Question 4 - Performance Measurement (8 marks) 1 2 Ils 9 The president feels very strongly that Mountain Sports should expand operations to a second location. She has even found a prime location in Canmore, Alberta, One of the great things about Canmore is its proximity to the mountains, and its only about 10 minutes away from this beautiful, vibrant and internationally known Banff tourist town. Research indicates that the Canmore market is well suited to both cross-country skis and bikes that competition is fairly limited. es 3 4 The investment in assets (cash, inventory, equipment) required for the new location is $ 174,000 5 Minimum required return on investments 16% 6 Actual 2019 return on investment of the original location 17% 7 8 Management has provided the following income statement to the bank manager the expected net income in Static Budget % 9 Amount 10 Sales in Units 4,208 11 Sales 526,000 100% 12 Less: Variable Costs: 13 Cost of Goods Sold 223,000! 42% 14 Sales Commissions 78,900 15% 15 Total Variable Costs 301,900 57% 16 Contribution Margin + 224,100 43% 17 Less: Fixed Costs: 18 Advertising 21,000 19 Property Taxes 10,000 20 Rent 41,000 21 Salaries & Wages 103,000 22 Total Fixed Costs 175,000 23 Net Operating Income 49.100 24 pps 25 Part A: (4 marks) Calculate the following performance measurements for the proposed Canmore expansion: B13 Xfx 223000 B D E A 9% 24 25 Part A: (4 marks) Calculate the following performance measurements for the proposed Canmore expansion: 26 Margin (see Chapter 11 notes) 27 28 Turnover (use Investment in assets in equation) 3.0 29 30 Return on Investment 28% 31 32 Residual Income $ 21,260 33 34 Part B: Analysis (4 marks) Explain in your own words using case data. Marks will not be awarded for textbook definitions a. If management is evaluated based on ROI, will the project be accepted (expansion into Canmore)? Why or 35 why not? Yes, If management is evaluated based on ROI, the project would be accepted. The company has set its preferences of a minimum return of investment of 16% and the proposed return on investment gave a 28% calculation. A higher ROI percentage indicates that the investment gains of a project are favourable to their costs. In economic terms, it is one way of relating profits to capital invested. 36 37 b. If management is evaluated based on residual income, will the expansion into Canmore be accepted? Why or why not? = Case Intro Q1 Q2 Q3 04 Q5 Q6 + Calculation Mode: Automatic C10 X $ 218000 B E F 1 2 Question 6 - Variance Analysis (15 marks) Assume that owners decided to go ahead with the Canmore expansion (first introduced in question 4). The junior accountant has prepared the following report to compare the static budget (from question 4) to the actual results. The owners have asked you to complete a variance analysis. 3 4 Required: Part A (4 marks)- Create a Static Budget Report Variance Analysis, indicating whether variances are favorable (F) or unfavorable (U). All variance amounts should be shown as positive numbers. 5 N Static Budget Actual Variance Favorable or 6 Amount Results Amount Unfavorable 7 Sales in Units 4,208 5,020 812 Favorable 8 Sales $ 526,000 st 602,400 76,400 Favorable 9 Less: Variable Costs: 10 Cost of Goods Sold 223,000 218,000 5,000 Unfavorable 11 Sales Commissions 78,900 66,264 12,636 Unfavorable 12 Total Variable Costs 301,900 284,264 17,636 Unfavorable 13 Contribution Margin 224,100 318,136 94,036 Unfavorable 14 Less: Fixed Costs: 15 Total Fixed Costs 175,000 184,000 9,000 Favorable 16 Net Operating Income 49,100 134,136 85,036 Favorable 17 What is the weakness of using a static budget report to evaluate performance? (2 marks) > Case Intro Q1 Q2 Q3 24 25 26 + Calculation Mode: Automatic Workbook Statistics Excemal Data Connections have been disabled Enable Content Manage Workbook Unks C10 Xfx 218000 A B D E 20 Required: Part B (6 marks) - The owners can see that the company sold a different amount of units than budgeted. They have asked you to create a flexible budget report. 21 22 Flexible Budget Actual Variance Favorable (F) or 23 Amount Results Amount Unfavorable (U) 24 Sales in Units 5,020 5,020 IN/A 25 Sales $ 602,400 602,400 IN/A 26 Less: Variable Costs: 27 Cost of Goods Sold 266,031 218,000 48,031 Favorable 28 Sales Commissions 94, 125 66,264 27,861 Unfavorable 29 Total Variable Costs 360,156 284,264 75,892 Favorable 30 Contribution Margin 242,244 318,136 75,892 Favorable 31 Less: Fixed Costs 184,000 184,000 32 Net Operating Income 58,244 134,136 75,892 Favorable 33 Management was pleased on the results based on the static budget report. Should they be pleased? What does the flexible budget tell you? What are your recommendations to management based on the flexible budget report

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started