HI PLEASE ANSWER WITH EXCEL FILE SOLUTION :(( THANK YOU SO MUCH

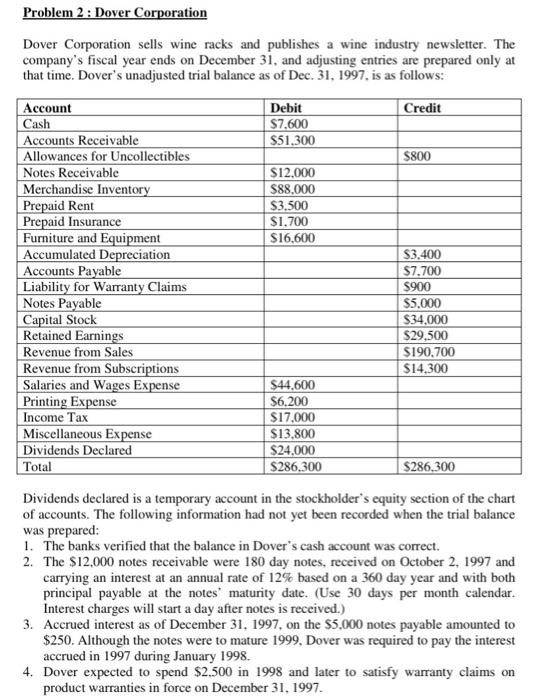

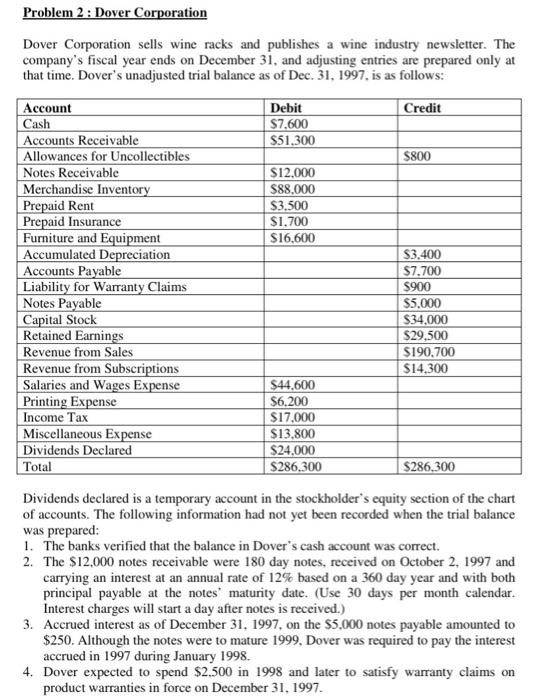

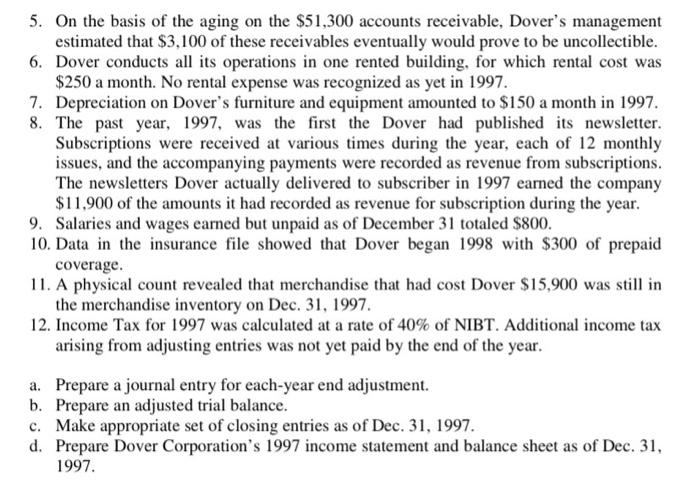

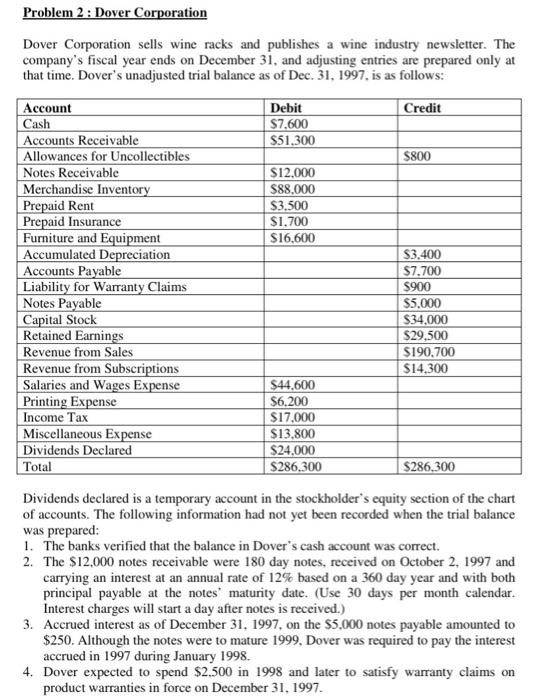

Problem 2: Dover Corporation Dover Corporation sells wine racks and publishes a wine industry newsletter. The company's fiscal year ends on December 31, and adjusting entries are prepared only at that time. Dover's unadjusted trial balance as of Dec. 31, 1997. is as follows: Credit Debit $7.600 $51.300 $800 $12.000 $88.000 $3,500 $1,700 $16,600 Account Cash Accounts Receivable Allowances for Uncollectibles Notes Receivable Merchandise Inventory Prepaid Rent Prepaid Insurance Furniture and Equipment Accumulated Depreciation Accounts Payable Liability for Warranty Claims Notes Payable Capital Stock Retained Earnings Revenue from Sales Revenue from Subscriptions Salaries and Wages Expense Printing Expense Income Tax Miscellaneous Expense Dividends Declared Total $3.400 $7,700 $900 $5,000 $34,000 $29,500 $190,700 $14,300 $44,600 $6.200 $17,000 $13,800 $24,000 $286,300 $286,300 Dividends declared is a temporary account in the stockholder's equity section of the chart of accounts. The following information had not yet been recorded when the trial balance was prepared: 1. The banks verified that the balance in Dover's cash account was correct. 2. The $12.000 notes receivable were 180 day notes, received on October 2. 1997 and carrying an interest at an annual rate of 12% based on a 360 day year and with both principal payable at the notes' maturity date. (Use 30 days per month calendar. Interest charges will start a day after notes is received.) 3. Accrued interest as of December 31, 1997, on the $5,000 notes payable amounted to $250. Although the notes were to mature 1999, Dover was required to pay the interest accrued in 1997 during January 1998. 4. Dover expected to spend $2.500 in 1998 and later to satisfy warranty claims on product warranties in force on December 31, 1997. 5. On the basis of the aging on the $51,300 accounts receivable, Dover's management estimated that $3,100 of these receivables eventually would prove to be uncollectible. 6. Dover conducts all its operations in one rented building, for which rental cost was $250 a month. No rental expense was recognized as yet in 1997. 7. Depreciation on Dover's furniture and equipment amounted to $150 a month in 1997. 8. The past year, 1997, was the first the Dover had published its newsletter Subscriptions were received at various times during the year, each of 12 monthly issues, and the accompanying payments were recorded as revenue from subscriptions. The newsletters Dover actually delivered to subscriber in 1997 earned the company $11,900 of the amounts it had recorded as revenue for subscription during the year. 9. Salaries and wages earned but unpaid as of December 31 totaled $800. 10. Data in the insurance file showed that Dover began 1998 with $300 of prepaid coverage. 11. A physical count revealed that merchandise that had cost Dover $15,900 was still in the merchandise inventory on Dec. 31, 1997. 12. Income Tax for 1997 was calculated at a rate of 40% of NIBT. Additional income tax arising from adjusting entries was not yet paid by the end of the year. a. Prepare a journal entry for each-year end adjustment. b. Prepare an adjusted trial balance. c. Make appropriate set of closing entries as of Dec. 31, 1997. d. Prepare Dover Corporation's 1997 income statement and balance sheet as of Dec. 31, 1997