Question

Hi, please check through each question one by one and answer accordingly, and do not give automated answers that dont answer the questions full and

Hi, please check through each question one by one and answer accordingly, and do not give automated answers that dont answer the questions full and correct but gives half answers please.

Additional information:

The following is an extract from the partner agreement and except where it is stated differently, has not yet been taken into account:

Interest on capital is calculated at 9% per annum.

Interest on current accounts (opening balances) at 7% per annum.

Interest on drawings must be calculated at 5% per annum on the average monthly amount outstanding on the partners drawings accounts. (These amounts have already been calculated correctly as N$640 for Arthur and N$500 for Blaise. No entry has been made yet)

A managerial salary of N$6 000 per year must be paid to Blaise. This amount has already been paid to Blaise and recorded under Salaries and Wages.

Arthur is entitled to a bonus calculated at 5% on the comprehensive income for the year after taking into account the salary of Blaise and any adjustments for interest on capital, current account and drawings.

An outstanding debt of N$600 is irrecoverable and must be written off.

The allowance for credit losses must be adjusted to N$5 300 at year-end.

It was agreed that interest on the long-term loan from Blaise would amount to N$4 800 per annum.

Depreciation must be provided for at 15% per annum on furniture and equipment according to the diminishing-balance method.

Inventories on hand at 31 December 2020:

Merchandise N$122 000

Stationary N$ 200

There was no opening stationary inventory at the beginning of the year.

The following expenses have been prepaid:

Insurance N$ 124

Advertising N$ 1 896

Admission of new partner

Arthur and Blaises youngest brother, Claude, recently graduated as a sound engineer and Arthur and Blaise decided to admit Claude as a third partner of Ubisoft Entertainment on 01 January 2021.

A revaluation of all assets and liabilities were done. It was decided to show the following assets at their revalued amounts:

Furniture and equipment N$50 000

Inventory N$121 670

All other assets and liabilities are correctly valued in the books.

Goodwill will not be shown in the new partnerships books.

Partners will share profits in the ratio 1:1:1.

Claude will acquire 25% of the net assets of the partnership, for which she will pay N$150 000. Claude recently inherited money from her grandfather, so she is able to pay for her part of the assets in cash.

prepare the following:

2.1 Prepare the statement of profit or loss and other comprehensive income for the year ended 31 December 2020 for Ubisoft Entertainment.

2.2 Prepare the Profit Appropriation account as at 31 December 2020 before Claude was admitted as a partner.

2.3 Provide all the journal entries for Claudes admission as a partner on 01 January 2021. Journal narrations are not required.

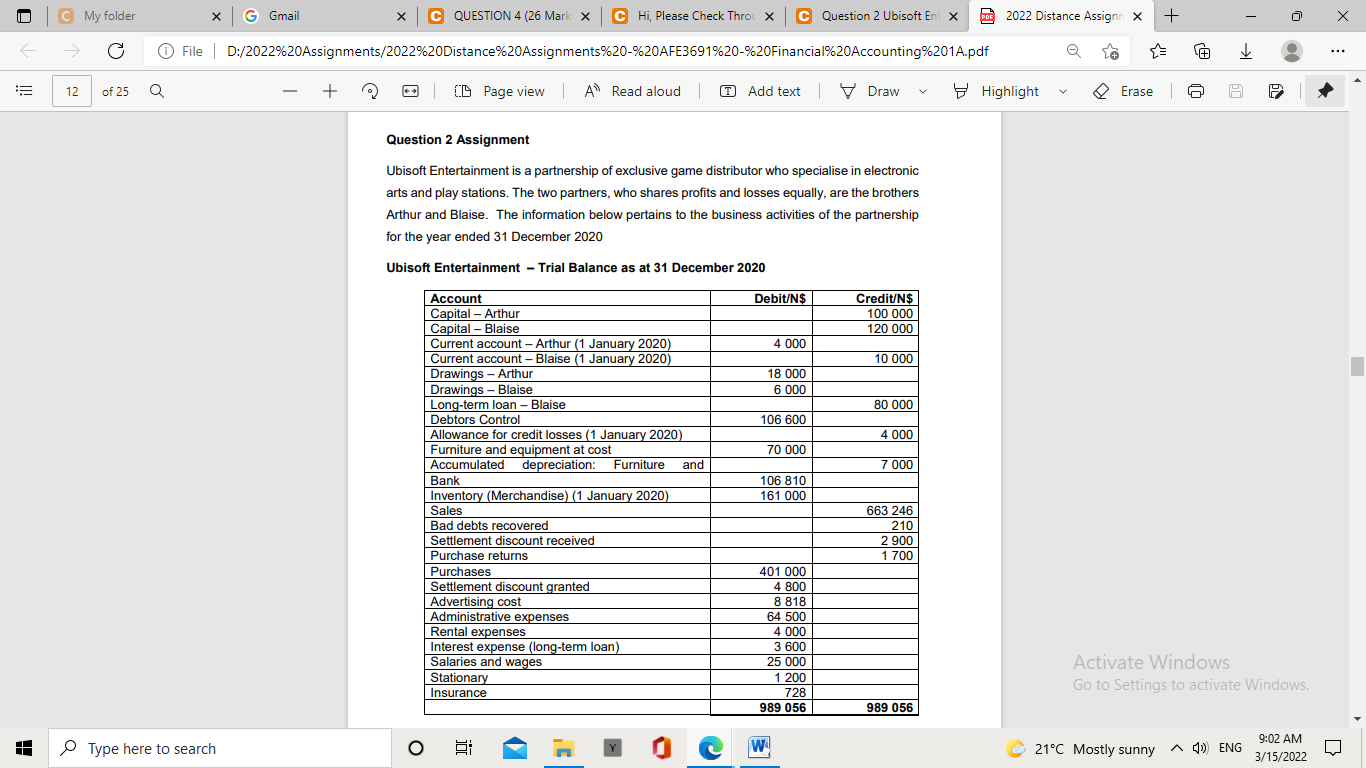

| C My folder + X * G Gmail X C QUESTION 4 (26 Mark X CHi, Please Check Throux C Question 2 Ubisoft En X PDF 2022 Distance Assignr X File | D:/2022%20Assignments/2022%20Distance%20Assignments%20-%20AFE3691%20-%20Financial%20Accounting%2014.pdf a c I 2 : c + 12 of 25 Q Q + | L Page view | A Read aloud | T Add text | Draw V Highlight Erase A a 19 Question 2 Assignment Ubisoft Entertainment is a partnership of exclusive game distributor who specialise in electronic arts and play stations. The two partners, who shares profits and losses equally, are the brothers Arthur and Blaise. The information below pertains to the business activities of the partnership for the year ended 31 December 2020 Ubisoft Entertainment - Trial Balance as at 31 December 2020 Debit/N$ Credit/N$ 100 000 120 000 4 000 10 000 18 000 6 000 80 000 106 600 4 000 70 000 7 000 Account Capital - Arthur Capital - Blaise Current account - Arthur (1 January 2020) Current account-Blaise (1 January 2020) Drawings - Arthur Drawings-Blaise Long-term loan - Blaise Debtors Control Allowance for credit losses (1 January 2020) Furniture and equipment at cost Accumulated depreciation: Furniture and Bank Inventory (Merchandise (1 January 2020) Sales Bad debts recovered Settlement discount received Purchase returns Purchases Settlement discount granted Advertising cost Administrative expenses Rental expenses Interest expense (long-term loan) Salaries and wages Stationary Insurance 106 810 161 000 663 246 210 2 900 1 700 401 000 4 800 8 818 64 500 4 000 3 600 25 000 1 200 728 989 056 Activate Windows Go to Settings to activate Windows, 989 056 Type here to search II W! 21C Mostly sunny ^) ENG A) 9:02 AM 3/15/2022 oStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started