Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, please double check the answers and fill in the answers to the ones that are blank. Thank you! Case 10-59 Sports Fanatic Company is

Hi, please double check the answers and fill in the answers to the ones that are blank. Thank you!

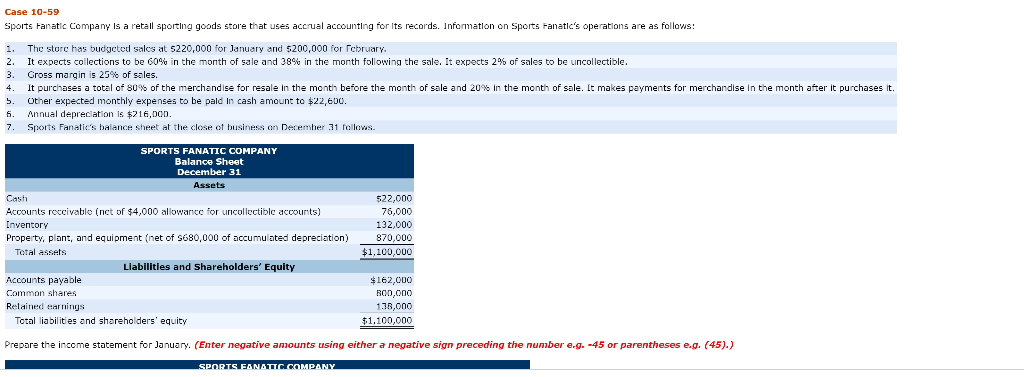

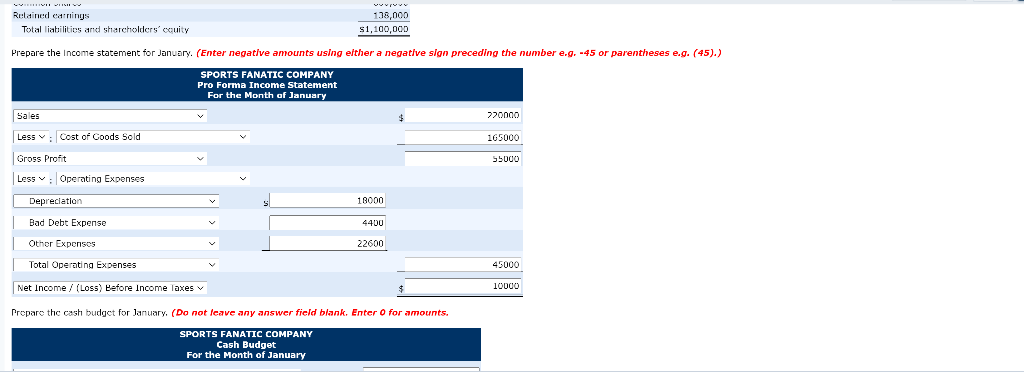

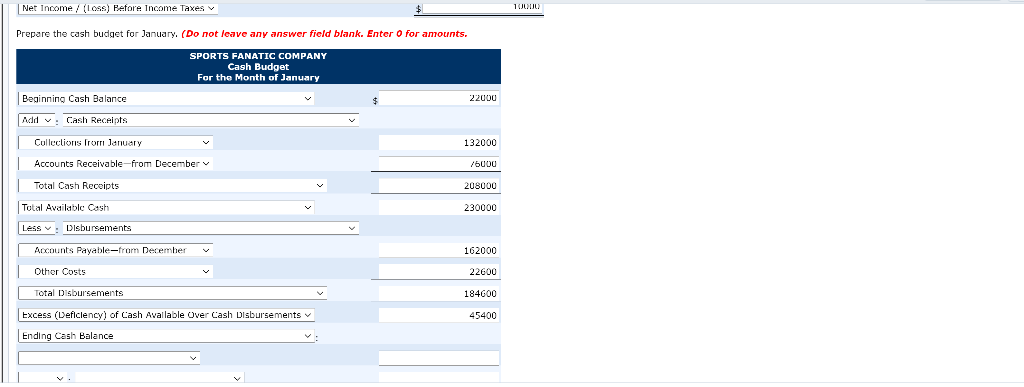

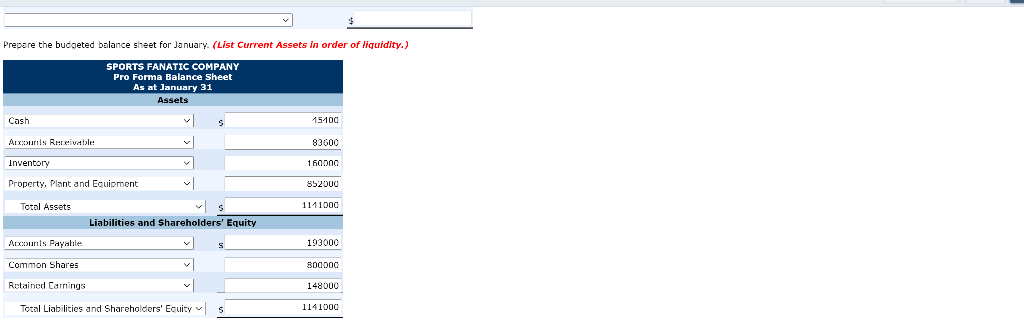

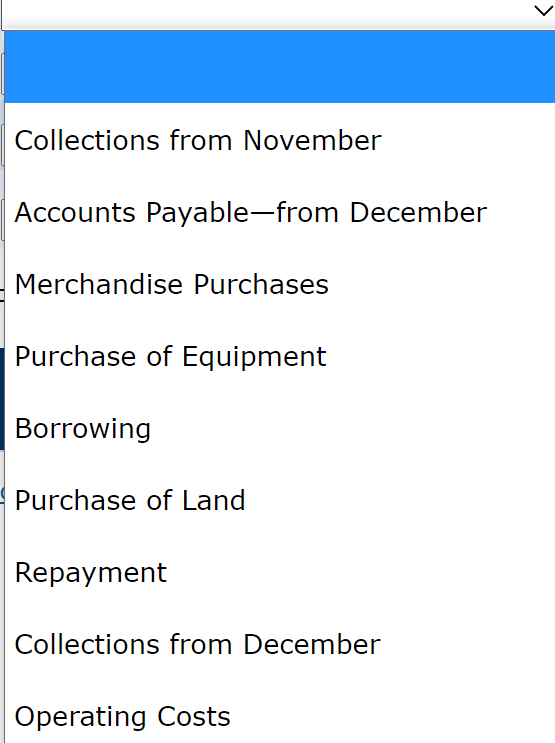

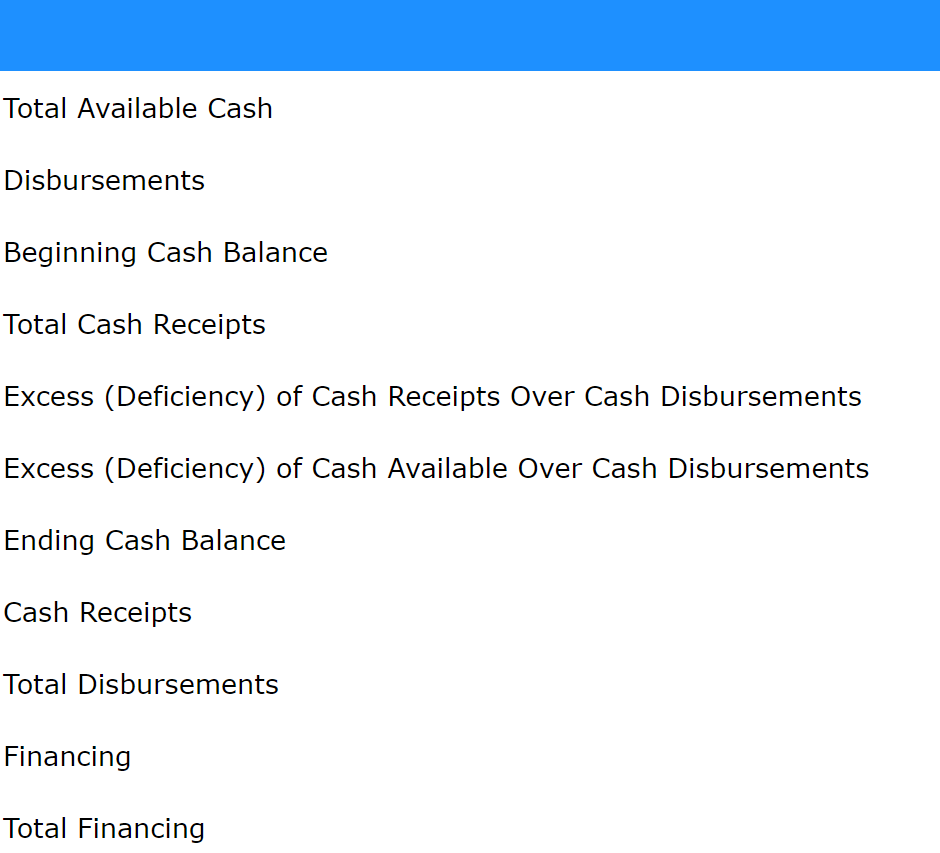

Case 10-59 Sports Fanatic Company is a retail sporting goods store that uses accrual accounting for its records. Information on Sports Fanatic's operations are as follows: 1. The storc has budgcted sales at 5220,000 for January and $200,000 for February. 2 It expects collections to be 60% in the month of sale and 38% in the month following the sale. It expects 2% of sales to be uncollectible. 3. Gross margin is 25% of sales. 4. It purchases a total of 80% of the merchandise for resale in the month before the month of sale and 20% in the month of sale. It makes payments for merchandise in the month after it purchases it. Other expected monthly expenses to be pald In cash amount to $22,600. 6 Annual depreciation is $216,000. Sports Fanatic's balance sheet at the close of business on December 31 follows. 7. SPORTS FANATIC COMPANY Balance Sheet December 31 Assets 522,000 76,000 132,000 870,000 $1,100,000 Accounts roccivable (nct of $4,000 allowance for uncollectible accounts) Inventory Property, plant, and equipment (net of S680,000 of accumulated depreciation) Total assets Liabilities and Shareholders' Equity Accounts payable Common shares Retained earnings Total liabilities and shareholders' equity $162,000 B00,000 138.000 $1,100,000 Prepare the income statement for January. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) SPORTS FANATIC.COMPANY Retained earnings Total liabilities and shareholders' cquity 138,000 S1,100.00 Prepare the income statement for January. (Enter negative amounts using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45).) SPORTS FANATIC COMPANY Pro Forma Income Statement For the Month of January Sales 220000 Less Cost of Goods Sold 165000 Gross Profit 55000 Less v Operating Expenses Depreciation 18000 Bad Debt Expense 4400 22600 Other Expenses Total Operating Expenses 45000 Net Income / (Loss) Before Income Taxes 10000 Prepare the cash budget for January. (Do not leave any answer field blank. Enter o for amounts. SPORTS FANATIC COMPANY Cash Budget For the Month of January Net Income / (Loss) Refore Income Taxes v 10010 Prepare the cash budget for January. (Do not leave any answer field blank. Enter o for amounts. SPORTS FANATIC COMPANY Cash Budget For the Month of January Beginning Cash Balance 22000 Add v Cash Receipts Collections from January 132000 Accounts Receivable from December /5000 Total Cash Receipts 208000 Total Available Cash 230000 Less Disbursements Accounts Payable-from December 162000 Other Costs 22600 Total Disbursements 184600 Excess (Deficiency) of Cash Available Over Cash Disbursements 45400 Ending Cash Balance Prepare the budgeted balance sheet for January (List Current Assets in order of liquidity.) SPORTS FANATIC COMPANY Pro Forma Balance Sheet As at January 31 Assets Cash s 15100 Auxurl Rivable 83600 Inventory 160000 Property, plant and Equipment 852000 Total Assets 1111000 Liabilities and Shareholders' Equity Arxcounts Payable 193000 Common Shares 800000 Retained Carnings 148000 Total Liabilities and Shareholders' Equity 1141000 > Collections from November Accounts Payable-from December Merchandise Purchases Purchase of Equipment Borrowing Purchase of Land Repayment Collections from December Operating Costs Total Available Cash Disbursements Beginning Cash Balance Total Cash Receipts Excess (Deficiency) of Cash Receipts Over Cash Disbursements Excess (Deficiency) of Cash Available Over Cash Disbursements Ending Cash Balance Cash Receipts Total Disbursements Financing Total FinancingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started