Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, Please give me the correct answers, this is my third time, uploading the same questions! 152F%252Fnewconnect meducation.com 252Fw/activity0 Chapter 4 Exercises Sivet Help Save

Hi, Please give me the correct answers, this is my third time, uploading the same questions!

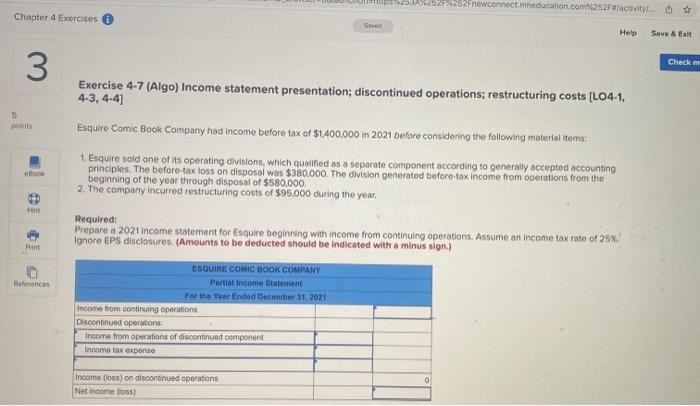

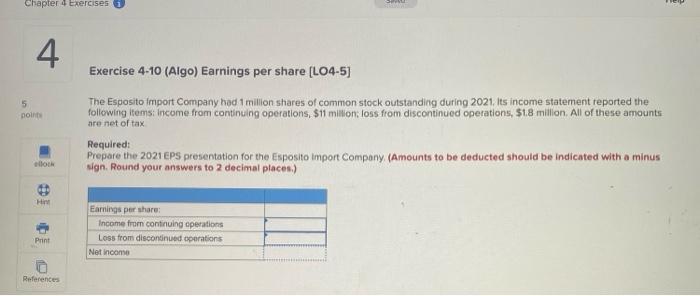

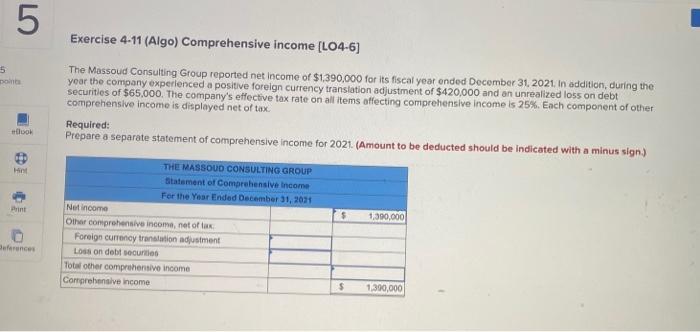

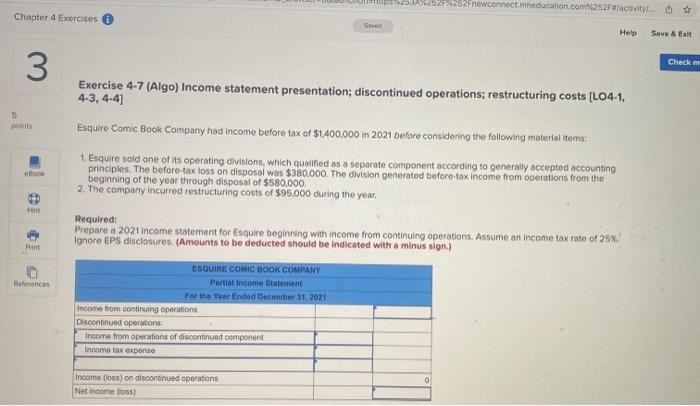

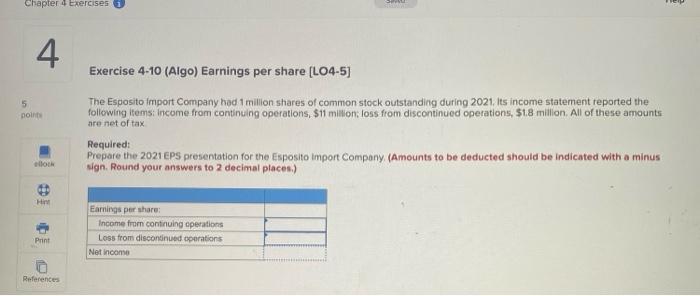

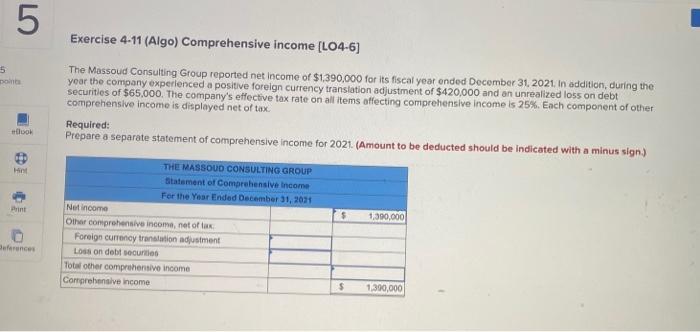

152F%252Fnewconnect meducation.com 252Fw/activity0 Chapter 4 Exercises Sivet Help Save & Exit Checkm 3 Exercise 4-7 (Algo) Income statement presentation; discontinued operations; restructuring costs (L04-1, 4-3, 4.4] Esquire Comic Book Company had income before tax of $1,400,000 in 2021 before considering the following material items 5 point ook 1 Esquire sold one of its operating divisions, which qualified as a separate component according to generally accepted accounting principles. The before-tex loss on disposal was $380.000. The division generated before tax income from operations from the beginning of the year through disposal of $580,000 2. The company incurred restructuring costs of $95.000 during the year. Hint Required: Prepare a 2021 income statement for Esquire beginning with income from continuing operations. Assume an income tax rate of 25% Ignore EPS disclosures. (Amounts to be deducted should be indicated with a minus sign.) Print Beerences ESQUIRE COMIC BOOK COMPANY Partial income Statement For the Year Ended December 31, 2021 Income from continuing operations Discontinued operations Income from operations of discontinued component Income tax expense Income 005) on discontinued operations Nat income oss) 0 Chapter 4 Exercises 4 Exercise 4-10 (Algo) Earnings per share (L04-5] 5 point The Esposito import Company had 1 million shares of common stock outstanding during 2021. Its income statement reported the following items income from continuing operations, $11 milion loss from discontinued operations, 51.8 million. All of these amounts are net of tax Required: Prepare the 2021 EPS presentation for the Esposito import Company (Amounts to be deducted should be indicated with a minus sign. Round your answers to 2 decimal places) Hir Earnings per share Income from continuing operations Loss from discontinued operations Net income Print References 5 Exercise 4-11 (Algo) Comprehensive income [LO4-6] 5 The Massoud Consulting Group reported net income of $1390,000 for its fiscal year ended Decomber 31, 2021. In addition during the year the company experienced a positive foreign currency translation adjustment of $420,000 and an unrealized loss on debt securities of 565,000. The company's effective tax rate on all items affecting comprehensive income is 25%. Each component of other comprehensive income is displayed net of tax Required: ook Prepare a separate statement of comprehensive income for 2021 (Amount to be deducted should be indicated with a minus sign) Print $ THE MASSOUD CONSULTING GROUP Statement of Comprehensive Income For the Year Ended December 31, 2011 Net income Other comprehensive income, netola Foreign currency translation adjustment Loss on debt securities Total other comprehensive income Comprehensive income 1,390,000 frances $ 1,300,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started