Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, please help me as i'm prepping for my exams, these 4 questions i'm not 100% sure. i think i got it tho. thank you!

Hi, please help me as i'm prepping for my exams, these 4 questions i'm not 100% sure. i think i got it tho.

thank you!

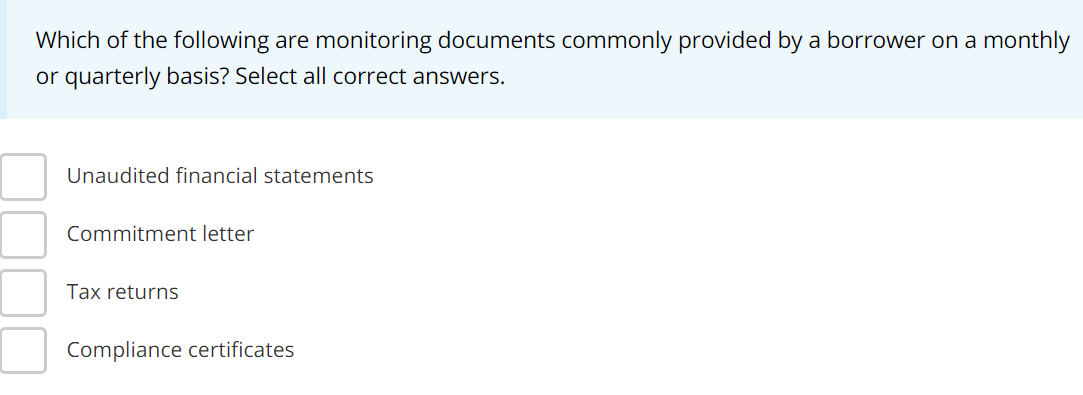

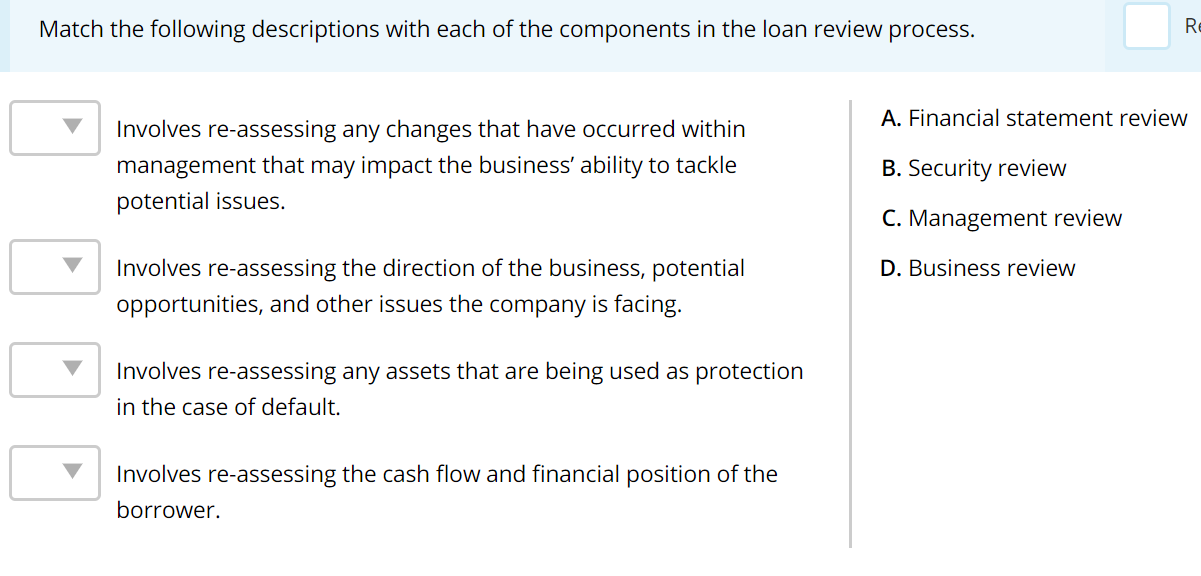

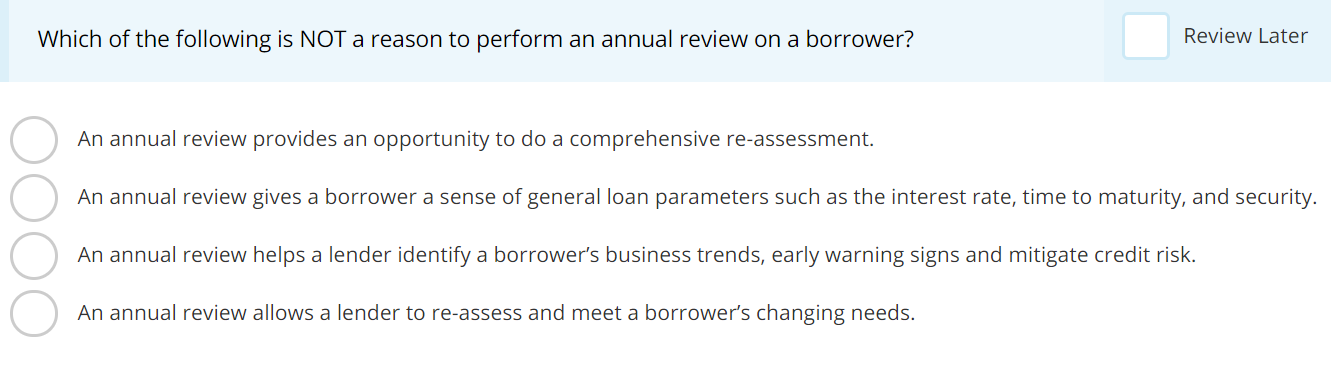

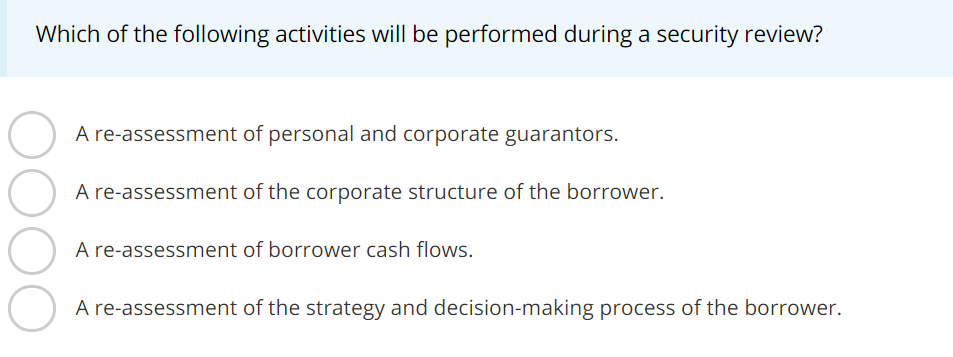

Which of the following are monitoring documents commonly provided by a borrower on a monthly or quarterly basis? Select all correct answers. Unaudited financial statements Commitment letter Tax returns Compliance certificates Match the following descriptions with each of the components in the loan review process. R A. Financial statement review Involves re-assessing any changes that have occurred within management that may impact the business' ability to tackle potential issues. B. Security review C. Management review D. Business review Involves re-assessing the direction of the business, potential opportunities, and other issues the company is facing. Involves re-assessing any assets that are being used as protection in the case of default. Involves re-assessing the cash flow and financial position of the borrower. Which of the following is NOT a reason to perform an annual review on a borrower? Review Later An annual review provides an opportunity to do a comprehensive re-assessment. An annual review gives a borrower a sense of general loan parameters such as the interest rate, time to maturity, and security. An annual review helps a lender identify a borrower's business trends, early warning signs and mitigate credit risk. An annual review allows a lender to re-assess and meet a borrower's changing needs. Which of the following activities will be performed during a security review? A re-assessment of personal and corporate guarantors. A re-assessment of the corporate structure of the borrower. A re-assessment of borrower cash flows. O A re-assessment of the strategy and decision-making process of the borrowerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started