Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi, please help me complete question 4. QUESTION 4 (15 Marks; 27 Minutes) Ignore value-added tax (VAT). An old university friend, Mike started a business

hi, please help me complete question 4.

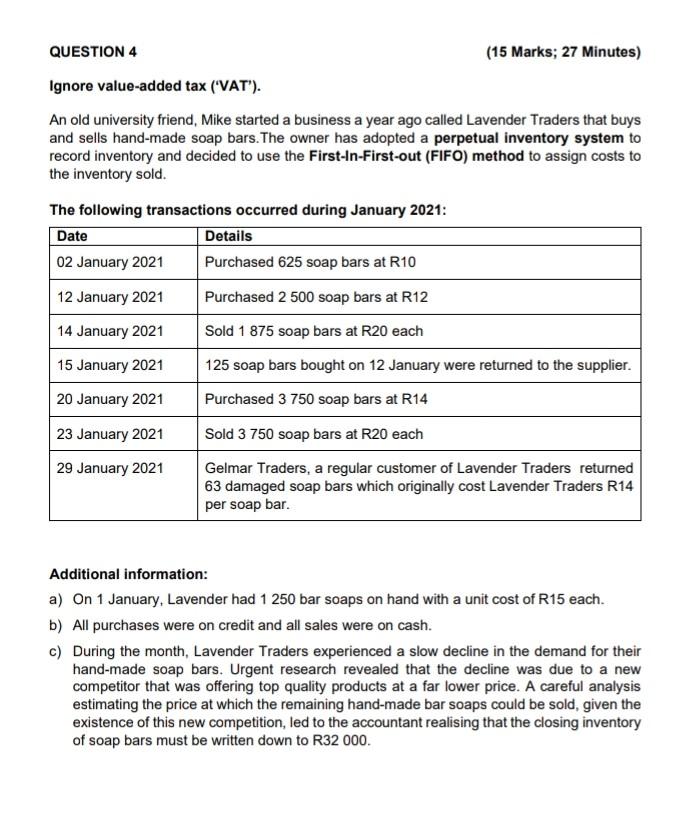

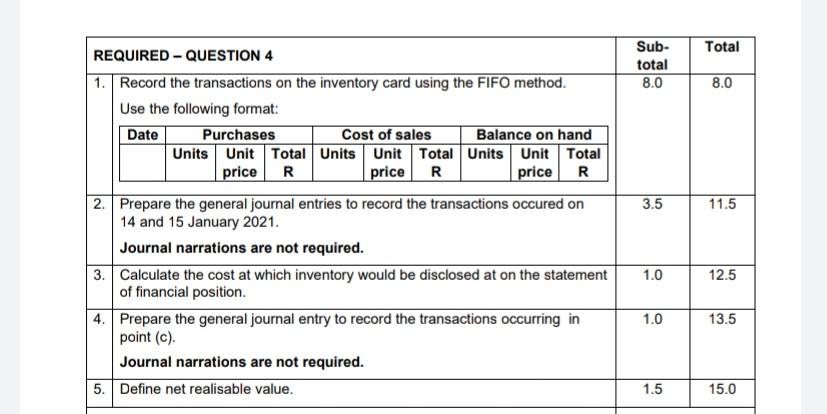

QUESTION 4 (15 Marks; 27 Minutes) Ignore value-added tax ("VAT"). An old university friend, Mike started a business a year ago called Lavender Traders that buys and sells hand-made soap bars. The owner has adopted a perpetual inventory system to record inventory and decided to use the First-In-First-out (FIFO) method to assign costs to the inventory sold. The following transactions occurred during January 2021: Date Details 02 January 2021 Purchased 625 soap bars at R10 12 January 2021 14 January 2021 15 January 2021 20 January 2021 Purchased 2 500 soap bars at R12 Sold 1 875 soap bars at R20 each 125 soap bars bought on 12 January were returned to the supplier. Purchased 3 750 soap bars at R14 Sold 3 750 soap bars at R20 each Gelmar Traders, a regular customer of Lavender Traders returned 63 damaged soap bars which originally cost Lavender Traders R14 per soap bar. 23 January 2021 29 January 2021 Additional information: a) On 1 January, Lavender had 1 250 bar soaps on hand with a unit cost of R15 each. b) All purchases were on credit and all sales were on cash. c) During the month, Lavender Traders experienced a slow decline in the demand for their hand-made soap bars. Urgent research revealed that the decline was due to a new competitor that was offering top quality products at a far lower price. A careful analysis estimating the price at which the remaining hand-made bar soaps could be sold, given the existence of this new competition, led to the accountant realising that the closing inventory of soap bars must be written down to R32 000. Total Sub- total 8.0 8.0 3.5 11.5 REQUIRED - QUESTION 4 1. Record the transactions on the inventory card using the FIFO method. Use the following format: Date Purchases Cost of sales Balance on hand Units Unit Total Units Unit Total Units Unit Total price R price R price R 2. Prepare the general journal entries to record the transactions occured on 14 and 15 January 2021. Journal narrations are not required. 3. Calculate the cost at which inventory would be disclosed at on the statement of financial position. 4. Prepare the general journal entry to record the transactions occurring in point (c). Journal narrations are not required. 5. Define net realisable value. 1.0 12.5 1.0 13.5 1.5 15.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started