Answered step by step

Verified Expert Solution

Question

1 Approved Answer

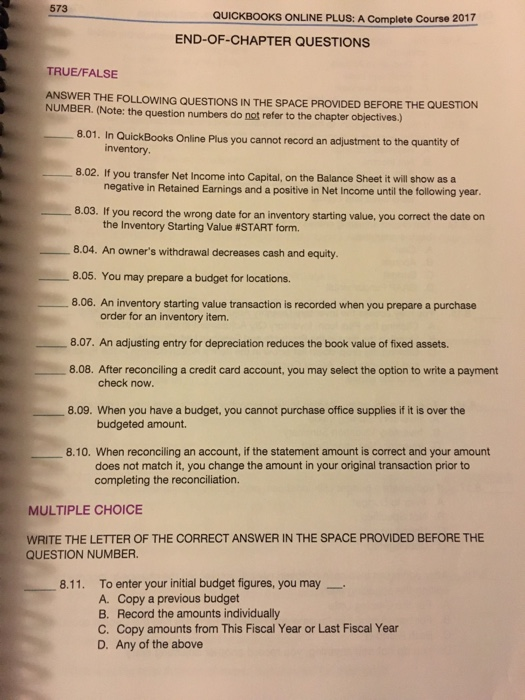

Hi, please help me do these questions on quickbooks online. Thanks! 573 QUICKBOoKS ONLINE PLUS: A Complete Course 2017 END-OF-CHAPTER QUESTIONS TRUE/FALSE ANSWE NUMBER. R

Hi, please help me do these questions on quickbooks online. Thanks!

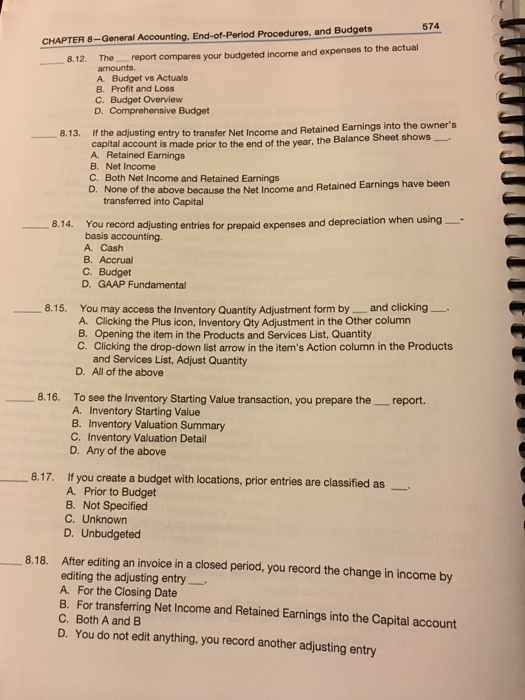

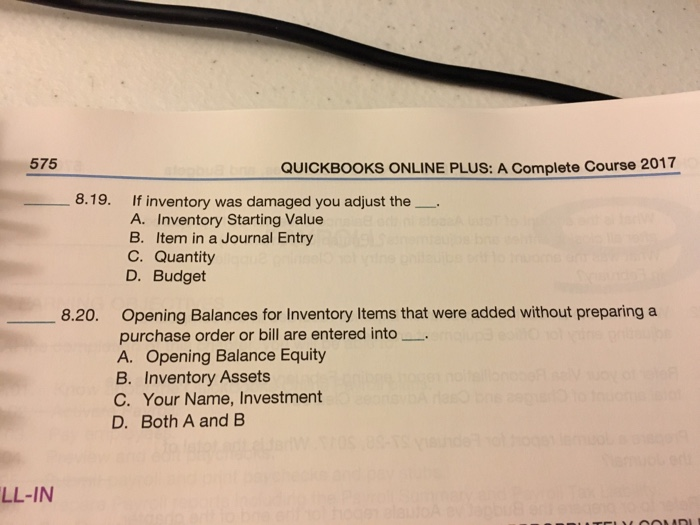

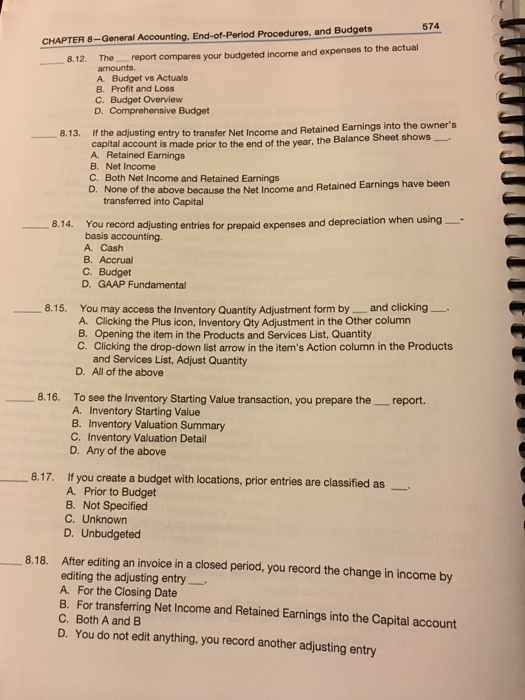

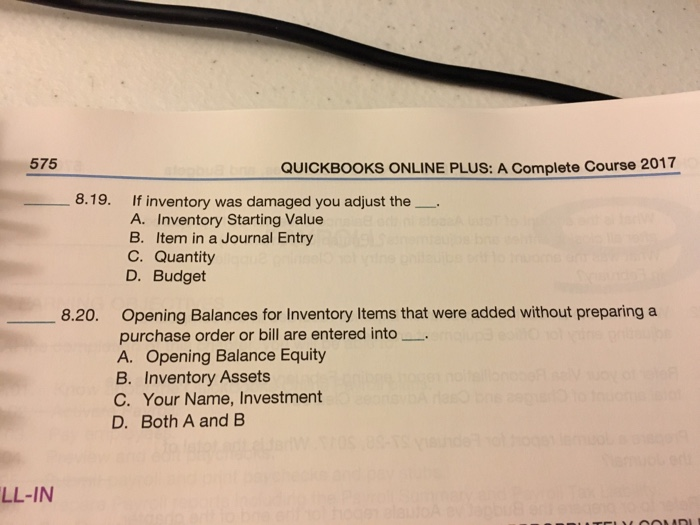

573 QUICKBOoKS ONLINE PLUS: A Complete Course 2017 END-OF-CHAPTER QUESTIONS TRUE/FALSE ANSWE NUMBER. R THE FOLLOWING QUESTIONS IN THE SPACE PROVIDED BEFORE THE QUESTION (Note: the question numbers do not refer to the chapter objectives.) 8.01. In QuickBooks Online Plus you cannot record an adjustment to the quantity of 8.02. If you transfer Net Income into Capital, on the Balance Sheet it will show as a inventory negative in Retained Earnings and a positive in Net Income until the following year. 8.03. If you record the wrong date for an inventory starting value, you correct the date on 8.04. An owner's withdrawal decreases cash and equity. 8.05. You may prepare a budget for locations. 8.06. An inventory starting value transaction is recorded when you prepare a purchase 8.07. An adjusting entry for depreciation reduces the book value of fixed assets. the Inventory Starting Value #START form. order for an inventory item 8.08. After reconciling a credit card account, you may select the option to write a payment check now 8.09. When you have a budget, you cannot purchase office supplies if it is over the budgeted amount. 8.10. When reconciling an account, if the statement amount is correct and your amount does not match it, you change the amount in your original transaction prior to completing the reconciliation. MULTIPLE CHOICE WRITE THE LETTER OF THE CORRECT ANSWER IN THE SPACE PROVIDED BEFORE THE QUESTION NUMBER 8.11. To enter your initial budget figures, you may A. Copy a previous budget B. Record the amounts individually C. Copy amounts from This Fiscal Year or Last Fiscal Year D. Any of the above CHAPTER 8-General Accounting. End-of-Period Procedures, and Budgets674 8.12. The report compares your budgeted income and expenses to the actual amounts. A. Budget vs Actuals B. Profit and Loss C. Budget Overview D. Comprehensive Budget owner's If the the adjusting entry to transfer Net Income and Retained Earnings into the 8.13. capital A. Retained Earnings B. Net Income C. Both Net Income and Retained Earnings D. None account is made prior to the end of the year, the Balance Sheet shows of the above because the Net Income and Retained Earnings have been transferred into Capital 8.14. You record adjusting entries for prepaid expenses and depreciation when using- basis accounting. A. Cash B. Accrual C. Budget D. GAAP Fundamental 8.15. You may access the Inventory Quantity Adjustment form by _ and clicking_ A Clicking the Plus icon, Inventory Qty Adjustment in the Other column B. Opening the item in the Products and Services List, Quantity C. Clicking the drop-down list arrow in the item's Action column in the Products and Services List, Adjust Quantity D. All of the above 8.16. To see the Inventory Starting Value transaction, you prepare the report. A. Inventory Starting Value B. Inventory Valuation Summary C. Inventory Valuation Detail D. Any of the above 8.17. If you create a budget with locations, prior entries are classified as A. Prior to Budget B. Not Specified C. Unknown D. Unbudgeted After editing an invoice in a closed period, you record the change in income by editing the adjusting entry A. For the Closing Date B. For transferring Net Income and Retained Earnings into the Capital account C. Both A and B D. You do not edit anything, you record another adjusting entry 8.18. 575 QUICKBOOKS ONLINE PLUS: A Complete Course 2017 8.19. If inventory was damaged you adjust the A. Inventory Starting Value B. Item in a Journal Entry C. Quantity D. Budget Opening Balances for Inventory Items that were added without preparing a purchase order or bill are entered into A. Opening Balance Equity B. Inventory Assets C. Your Name, Investment 8.20. D. Both A and B LL-IN

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started