Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, please help me see how to do this, I have lots of big questions like this and I work best with seeing an example

Hi, please help me see how to do this, I have lots of big questions like this and I work best with seeing an example first. Thank you in advance!

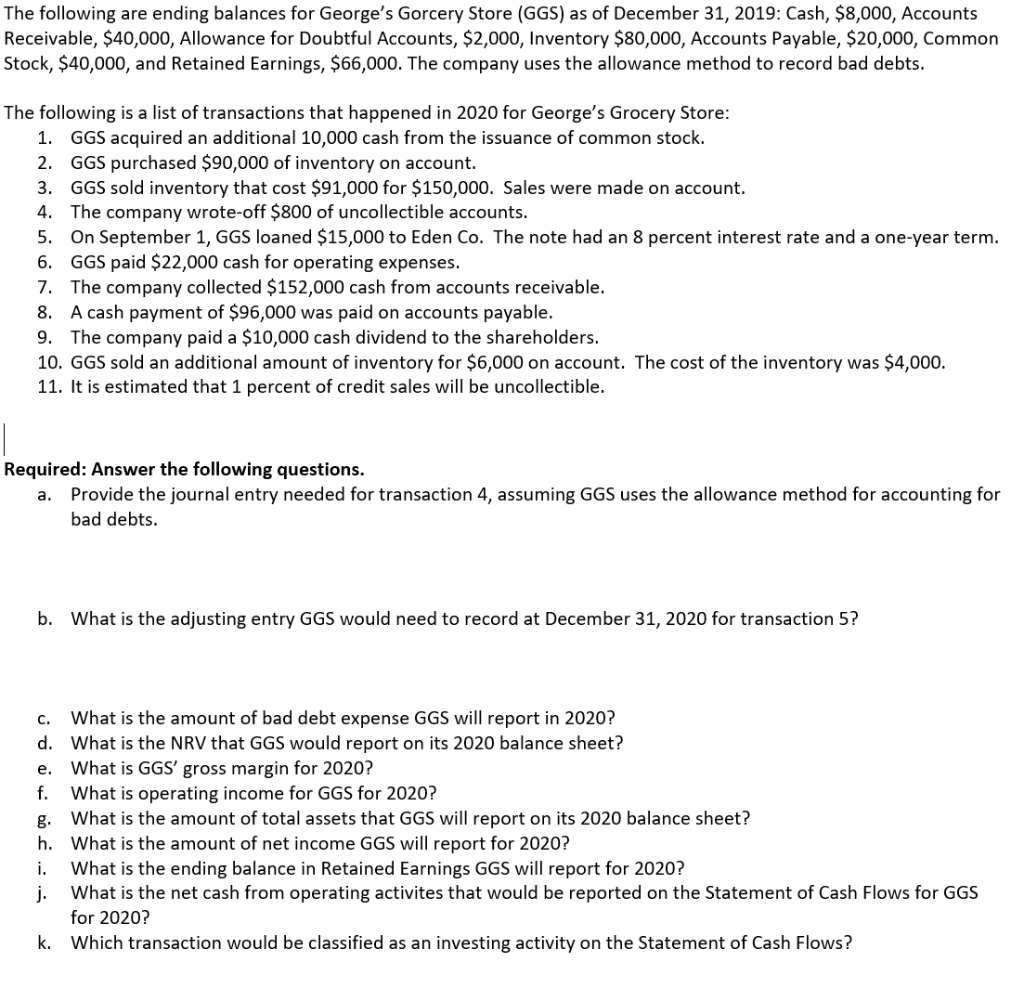

The following are ending balances for George's Gorcery Store (GGS) as of December 31, 2019: Cash, $8,000, Accounts Receivable, $40,000, Allowance for Doubtful Accounts, $2,000, Inventory $80,000, Accounts Payable, $20,000, Common Stock, $40,000, and Retained Earnings, $ 66,000. The company uses the allowance method to record bad debts. The following is a list of transactions that happened in 2020 for George's Grocery Store: 1. GGS acquired an additional 10,000 cash from the issuance of common stock. 2. GGS purchased $90,000 of inventory on account. 3. GGS sold inventory that cost $91,000 for $150,000. Sales were made on account. 4. The company wrote-off $800 of uncollectible accounts. 5. On September 1, GGS loaned $15,000 to Eden Co. The note had an 8 percent interest rate and a one-year term. 6. GGS paid $22,000 cash for operating expenses. 7. The company collected $152,000 cash from accounts receivable. 8. A cash payment of $96,000 was paid on accounts payable. 9. The company paid a $10,000 cash dividend to the shareholders. 10. GGS sold an additional amount of inventory for $6,000 on account. The cost of the inventory was $4,000. 11. It is estimated that 1 percent of credit sales will be uncollectible. Required: Answer the following questions. a. Provide the journal entry needed for transaction 4, assuming GGS uses the allowance method for accounting for bad debts. b. What is the adjusting entry GGS would need to record at December 31, 2020 for transaction 5? c. What is the amount of bad debt expense GGS will report in 2020? d. What is the NRV that GGS would report on its 2020 balance sheet? e. What is GGS' gross margin for 2020? What is operating income for GGS for 2020? g. What is the amount of total assets that GGS will report on its 2020 balance sheet? h. What is the amount of net income GGS will report for 2020? i. What is the ending balance in Retained Earnings GGS will report for 2020? j. What is the net cash from operating activites that would be reported on the Statement of Cash Flows for GGS for 2020? k. Which transaction would be classified as an investing activity on the Statement of Cash Flows? The following are ending balances for George's Gorcery Store (GGS) as of December 31, 2019: Cash, $8,000, Accounts Receivable, $40,000, Allowance for Doubtful Accounts, $2,000, Inventory $80,000, Accounts Payable, $20,000, Common Stock, $40,000, and Retained Earnings, $ 66,000. The company uses the allowance method to record bad debts. The following is a list of transactions that happened in 2020 for George's Grocery Store: 1. GGS acquired an additional 10,000 cash from the issuance of common stock. 2. GGS purchased $90,000 of inventory on account. 3. GGS sold inventory that cost $91,000 for $150,000. Sales were made on account. 4. The company wrote-off $800 of uncollectible accounts. 5. On September 1, GGS loaned $15,000 to Eden Co. The note had an 8 percent interest rate and a one-year term. 6. GGS paid $22,000 cash for operating expenses. 7. The company collected $152,000 cash from accounts receivable. 8. A cash payment of $96,000 was paid on accounts payable. 9. The company paid a $10,000 cash dividend to the shareholders. 10. GGS sold an additional amount of inventory for $6,000 on account. The cost of the inventory was $4,000. 11. It is estimated that 1 percent of credit sales will be uncollectible. Required: Answer the following questions. a. Provide the journal entry needed for transaction 4, assuming GGS uses the allowance method for accounting for bad debts. b. What is the adjusting entry GGS would need to record at December 31, 2020 for transaction 5? c. What is the amount of bad debt expense GGS will report in 2020? d. What is the NRV that GGS would report on its 2020 balance sheet? e. What is GGS' gross margin for 2020? What is operating income for GGS for 2020? g. What is the amount of total assets that GGS will report on its 2020 balance sheet? h. What is the amount of net income GGS will report for 2020? i. What is the ending balance in Retained Earnings GGS will report for 2020? j. What is the net cash from operating activites that would be reported on the Statement of Cash Flows for GGS for 2020? k. Which transaction would be classified as an investing activity on the Statement of Cash FlowsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started