Answered step by step

Verified Expert Solution

Question

1 Approved Answer

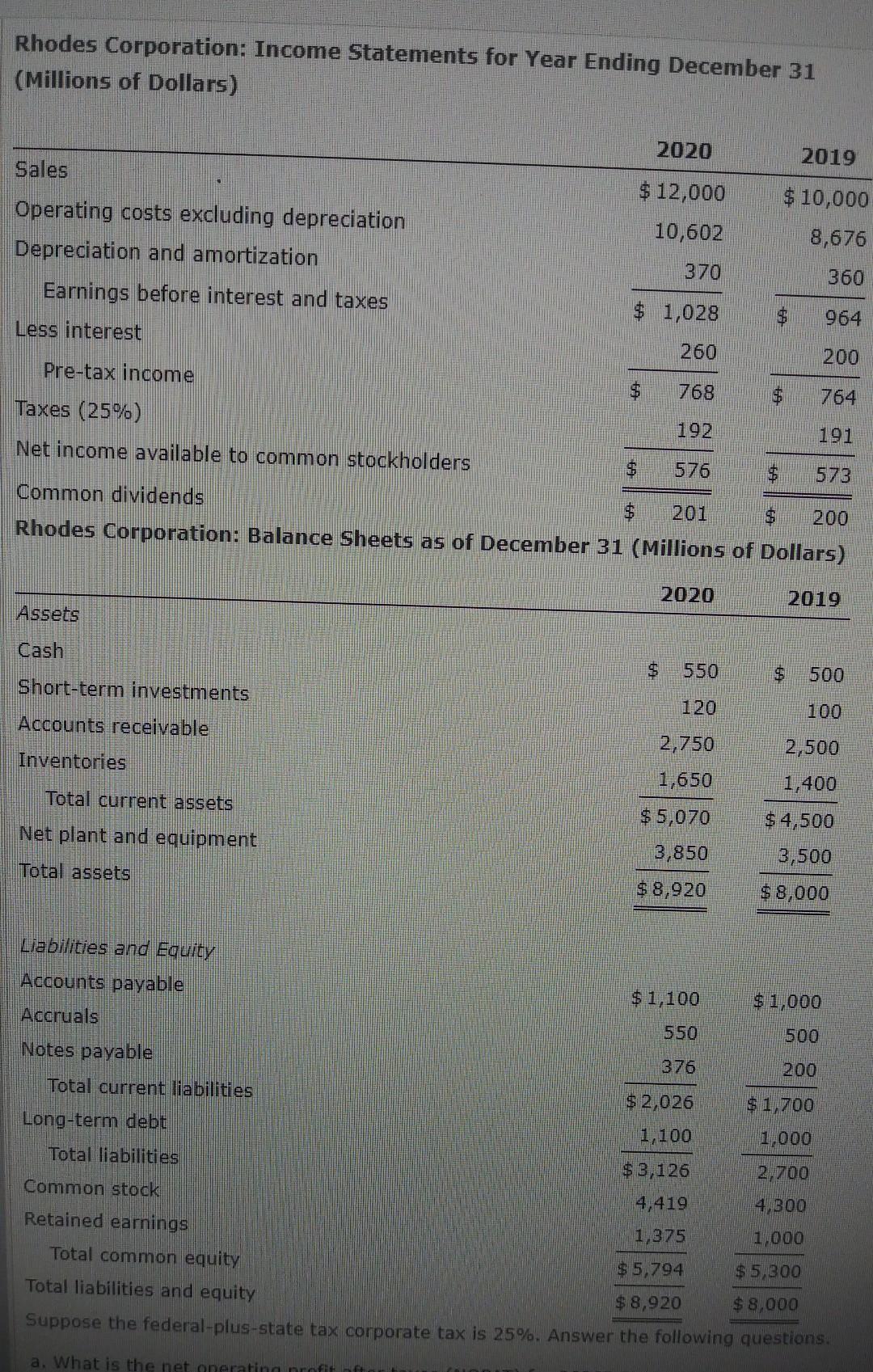

Hi, please help me with the above questions. Thanks. Rhodes Corporation: Income Statements for Year Ending December 31 (Millions of Dollars) 2020 2019 Sales $

Hi, please help me with the above questions. Thanks.

Rhodes Corporation: Income Statements for Year Ending December 31 (Millions of Dollars) 2020 2019 Sales $ 12,000 $ 10,000 Operating costs excluding depreciation 10,602 8,676 Depreciation and amortization 370 360 Earnings before interest and taxes $ 1,028 964 Less interest 260 200 Pre-tax income 768 764 Taxes (25%) 192 191 Net income available to common stockholders $ 576 573 Common dividends $ 200 Rhodes Corporation: Balance Sheets as of December 31 (Millions of Dollars) 2020 2019 Assets Cash 550 500 Short-term investments 120 Accounts receivable 2.750 2,500 Inventories 1,650 1,400 Total current assets $ 5,070 Net plant and equipment 3,850 $ 4,500 3,500 $ 8,000 Total assets $ 8,920 Liabilities and Equity Accounts payable $ 1,100 $1,000 Accruals 550 500 Notes payable 376 200 Total current liabilities $ 2 026 $ 1,700 Long-term debt 1.100 1 000 Total liabilities $ 3,126 2,700 Common stock 4,419 4 300 Retained earnings 1,375 1,000 Total common equity $5,794 $5,300 Total liabilities and equity $ 8,920 $8,000 Suppose the federal-plus-state tax corporate tax is 25%. Answer the following questions. a. What is the net onerating profit oft be indicated by a m e. What is the ROIC for 2020? Round your answer to two decimal places. % f. How much of the FCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of short-term investments? negative.) Enter your answers in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answers to the nearest whole number. After-tax interest payment $ million Reduction (increase) in debt million Payment of dividends 8 8 8 8 8 S million Repurchase (Issue) stock million Purchase (Sale) of short-term investments S million Hide Feedback Partially Correct 0= Icon Key Problem 2-18 (Free Cash Flows) Save SubStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started