Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi, please help record entries in the general journal. QUESTION 3 (20 Marks; 36 Minutes) Assume a value-added tax (VAT) rate of 15%. PrintCo Store

hi, please help record entries in the general journal.

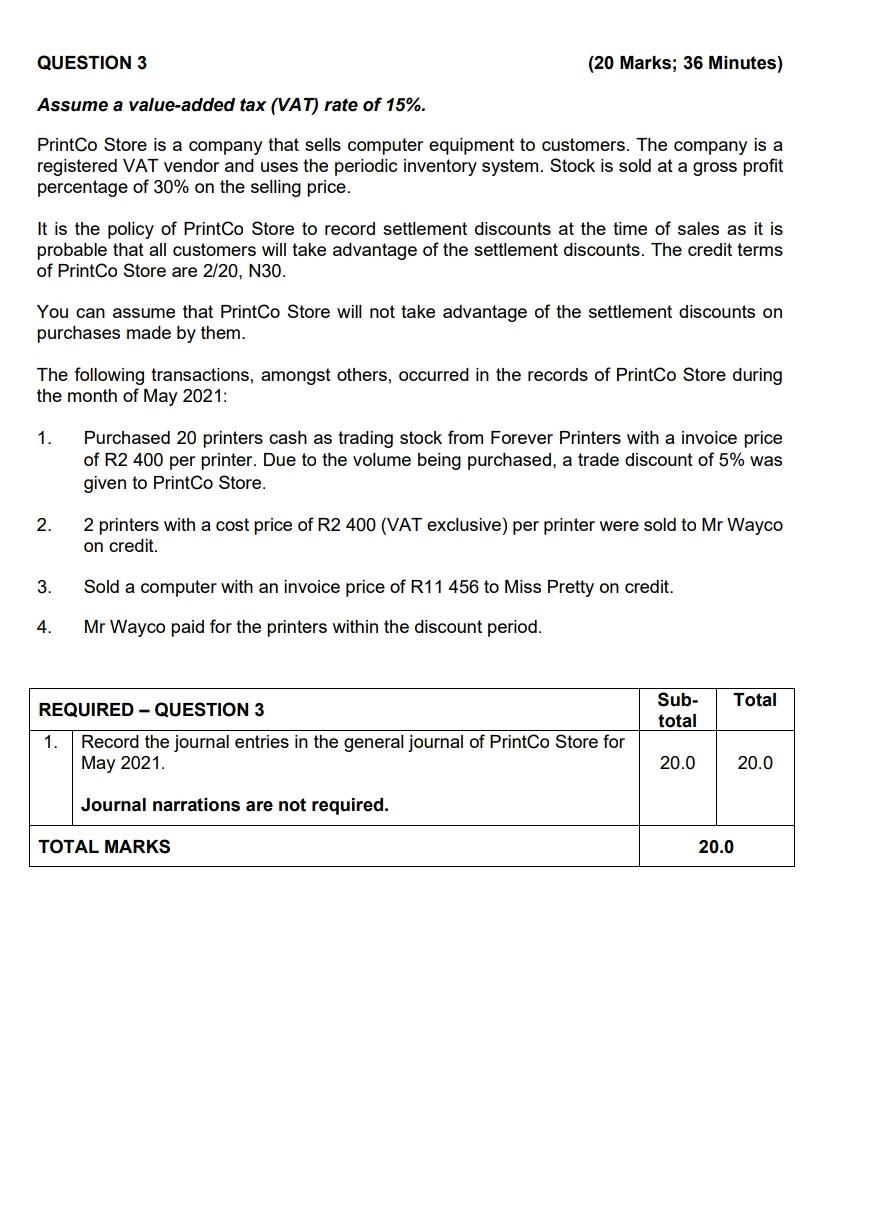

QUESTION 3 (20 Marks; 36 Minutes) Assume a value-added tax (VAT) rate of 15%. PrintCo Store is a company that sells computer equipment to customers. The company is a registered VAT vendor and uses the periodic inventory system. Stock is sold at a gross profit percentage of 30% on the selling price. It is the policy of PrintCo Store to record settlement discounts at the time of sales as it is probable that all customers will take advantage of the settlement discounts. The credit terms of PrintCo Store are 2/20, N30. You can assume that PrintCo Store will not take advantage of the settlement discounts on purchases made by them. The following transactions, amongst others, occurred in the records of PrintCo Store during the month of May 2021: 1. Purchased 20 printers cash as trading stock from Forever Printers with a invoice price of R2 400 per printer. Due to the volume being purchased, a trade discount of 5% was given to PrintCo Store. 2. 2 printers with a cost price of R2 400 (VAT exclusive) per printer were sold to Mr Wayco on credit. 3. Sold a computer with an invoice price of R11 456 to Miss Pretty on credit. Mr Wayco paid for the printers within the discount period. 4. Total Sub- total REQUIRED - QUESTION 3 1. Record the journal entries in the general journal of PrintCo Store for May 2021. 20.0 20.0 Journal narrations are not required. TOTAL MARKS 20.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started