Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, Please, need help with Intermediate Accounting (9th Edition) Chapter 15, Problem 2BYP Thanks a lot!!! ual interest rate of 5%. winn paid a $100,000

Hi,

Hi,

Please, need help with

Intermediate Accounting (9th Edition)

Chapter 15, Problem 2BYP

Thanks a lot!!!

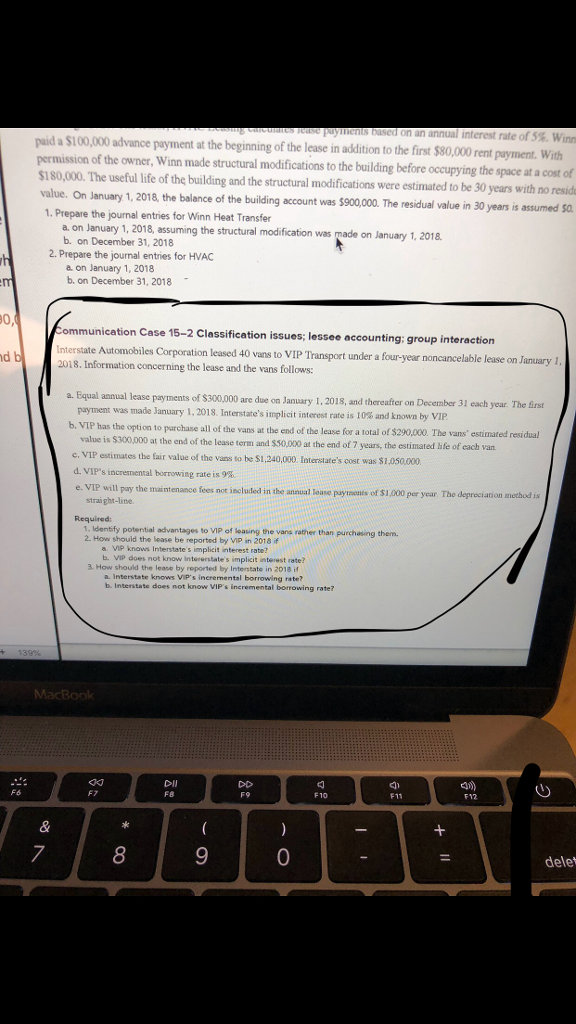

ual interest rate of 5%. winn paid a $100,000 advance payment at the begining of the lease in addition to the first $80,000 rent payment. With of the owner, Winn made structural modifications to the building before occupying the space at a cost of $180,000. The useful life of the building and the structural modifications were estimated to be 30 years with no resid value. On January 1, 2018, the balance of the building account was $900,000. The residual value in 30 years is assumed So 1. Prepare the journal entries for Winn Heat Transfer 1, 2018, assuming the structural modification was made on January 1, 2018 b. on December 31, 2018 2. Prepare the journal entries for HVAC a on January 1, 2018 b. on December 31, 2018 0 ommunication Case 15-2 Classification issues; lessee accounting: group interaction interstate Automobiles Corporation leased 40 vans to VIP Transport under a four-year 2018. Information concerning the lease and the vans follows: d b noncancelable lease on January1 payments of S300,000 are due on January 1, 2018, and thereafter on December 31 each year. The first payment was made January 1, 2018, Interstate's implicit interest rate is 10% and known by VP b. VIP has the option to parchase all of the vans at the end of the lease for a total of $290,000. The vans' estimated resi dual value is $300,000 at the end of the lease term and c. VIP estimates the fair value of the vans to be $1,240,000 Interstate's cost was $1.050,000 d. VIP's incremental borrowing rate is 9%. $50,000 at the end of 7 years, the estimated hife of each van. not included in the annual lease payments of S1,000 per year The degreciarion method is straight-line 1, Identify potential advantages to VIP of leasing the vans rather than purchasing them. 2. How should the lease be reported by VIP in 2018 if VIP knows Interstate s implicit nterest rate? b. VIP does not know Intererstate's implicit interest rate? 3. How should the lease by reported by Interstate in 2018 if a. Interstate knows VIP's incremental borrowing ratel? b. Interstate does not know VIP's incremental borrowing rate? F6 Fa F9 F10 F11 F12 7 8 0 delet ual interest rate of 5%. winn paid a $100,000 advance payment at the begining of the lease in addition to the first $80,000 rent payment. With of the owner, Winn made structural modifications to the building before occupying the space at a cost of $180,000. The useful life of the building and the structural modifications were estimated to be 30 years with no resid value. On January 1, 2018, the balance of the building account was $900,000. The residual value in 30 years is assumed So 1. Prepare the journal entries for Winn Heat Transfer 1, 2018, assuming the structural modification was made on January 1, 2018 b. on December 31, 2018 2. Prepare the journal entries for HVAC a on January 1, 2018 b. on December 31, 2018 0 ommunication Case 15-2 Classification issues; lessee accounting: group interaction interstate Automobiles Corporation leased 40 vans to VIP Transport under a four-year 2018. Information concerning the lease and the vans follows: d b noncancelable lease on January1 payments of S300,000 are due on January 1, 2018, and thereafter on December 31 each year. The first payment was made January 1, 2018, Interstate's implicit interest rate is 10% and known by VP b. VIP has the option to parchase all of the vans at the end of the lease for a total of $290,000. The vans' estimated resi dual value is $300,000 at the end of the lease term and c. VIP estimates the fair value of the vans to be $1,240,000 Interstate's cost was $1.050,000 d. VIP's incremental borrowing rate is 9%. $50,000 at the end of 7 years, the estimated hife of each van. not included in the annual lease payments of S1,000 per year The degreciarion method is straight-line 1, Identify potential advantages to VIP of leasing the vans rather than purchasing them. 2. How should the lease be reported by VIP in 2018 if VIP knows Interstate s implicit nterest rate? b. VIP does not know Intererstate's implicit interest rate? 3. How should the lease by reported by Interstate in 2018 if a. Interstate knows VIP's incremental borrowing ratel? b. Interstate does not know VIP's incremental borrowing rate? F6 Fa F9 F10 F11 F12 7 8 0 deletStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started