Hi, please provide the detailed solution of how you get these answers! Please follow the chart to answer the question. Thanks.

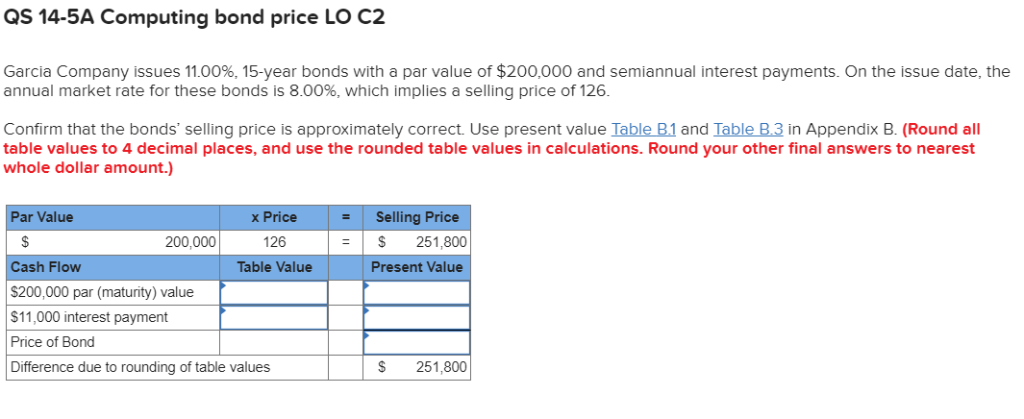

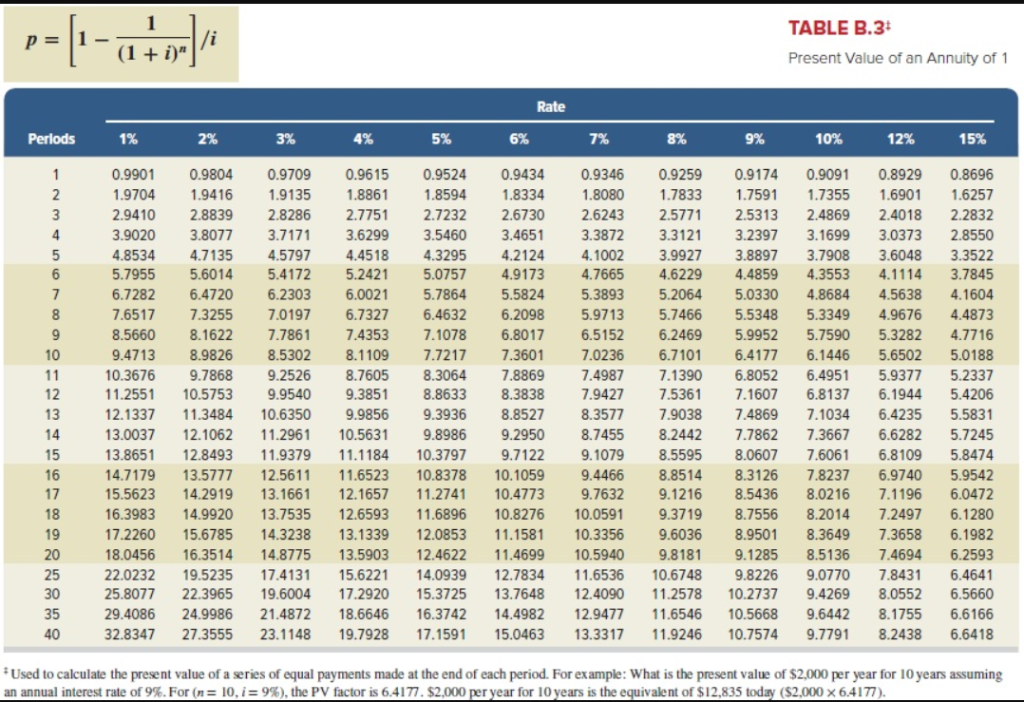

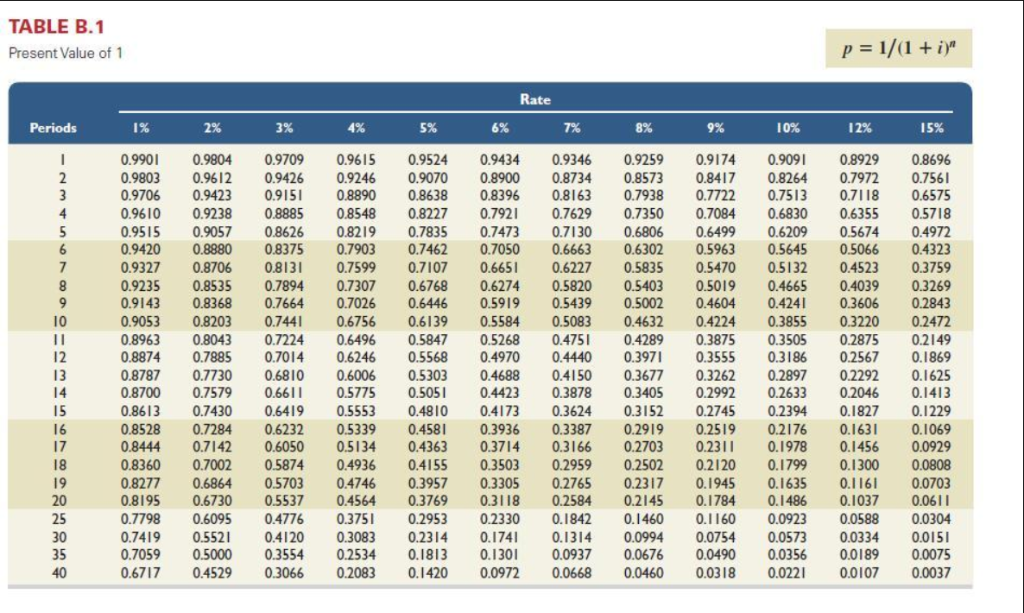

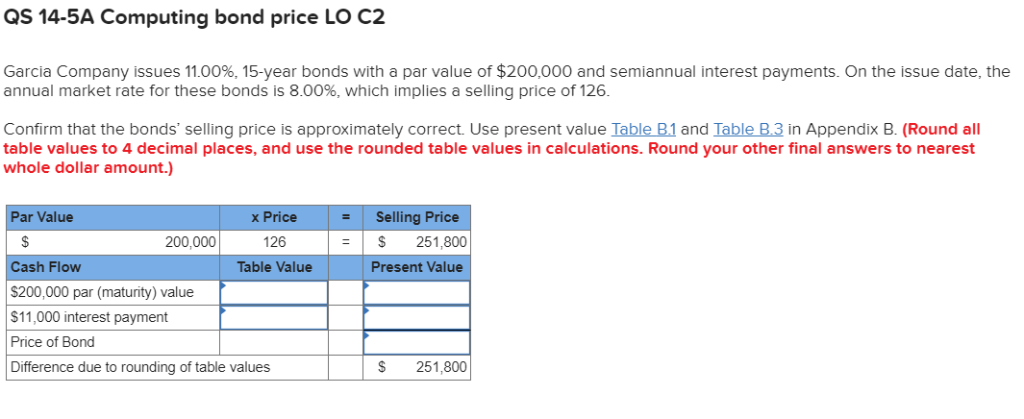

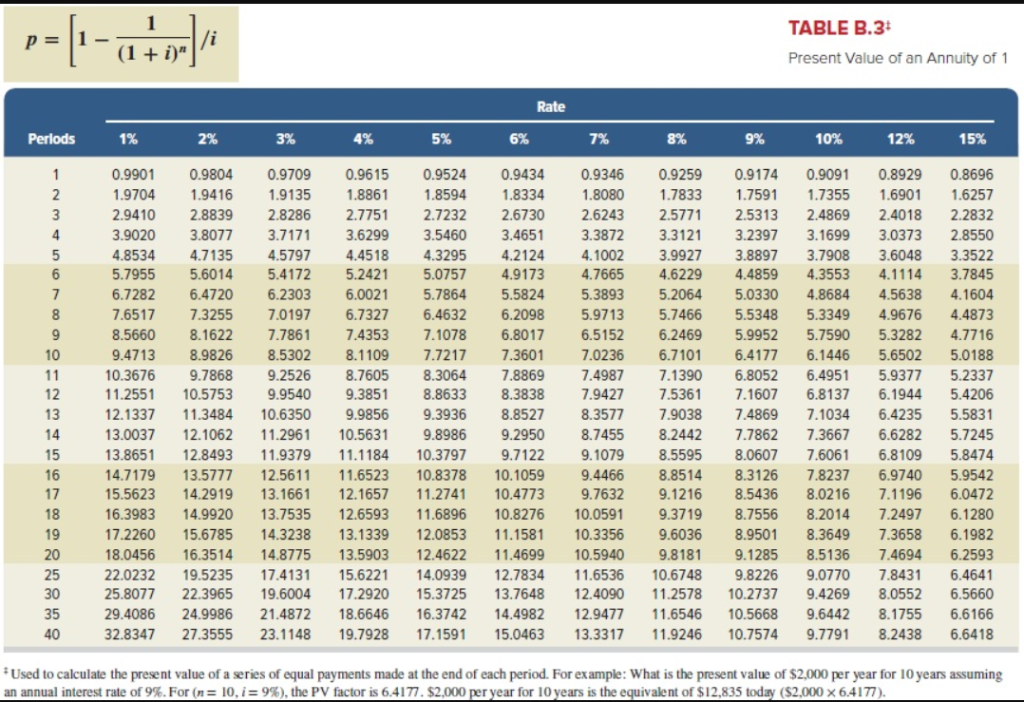

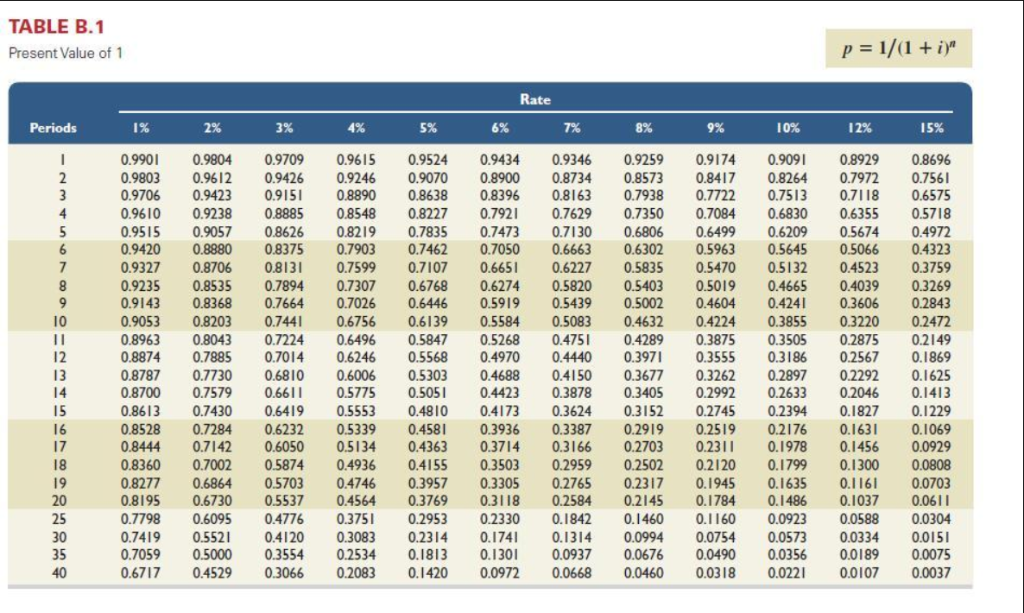

QS 14-5A Computing bond price LO C2 Garcia Company issues 11.00%, 15-year bonds with a par value of $200,000 and semiannual interest paym ents. On the issue date, the annual market rate for these bonds is 8.00%, which implies a selling price of 126. Confirm that the bonds' selling price is approximately correct. Use present value Table B.1 and Table B.3 in Appendix B. (Round all table values to 4 decimal places, and use the rounded table values in calculations. Round your other final answers to nearest whole dollar amount.) Par Value - Selling Price x Price 126 Table Value 200,000 S251,800 Cash Flow $200,000 par (maturity) value $11,000 interest payment Price of Bond Difference due to rounding of table values Present Value 251,800 TABLE B.3 Present Value of an Annuity of 1 Rate 2% 3% 5% 6% 7% 8% 9% 10% 12% 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.8929 0.8696 .9704 19416 19135 1.8861 18594 183341 2.9410 2.8839 2.8286 2.7751 2.7232 2.6730 .9020 3.8077 3.7171 3.6299 3.5460 3.46513.3872 3.3121 3.2397 3.1699 3.0373 2.8550 4.85344.7135 4.5797 4.45184.3295 4.2124 4.1002 3.9927 3.8897 3.7908 3.6048 3.3522 5.7955 5.6014 5.4172 5.2421 5.0757 4.9173 4.7665 4.6229 4.48594.3553 4.11143.7845 6.7282 6.4720 6.2303 6.0021 5.7864 5.5824 5.3893 5.2064 5.0330 4.8684 4.5638 4.1604 7.65177.3255 7.01976.7327 6.4632 6.2098 5.9713 5.74665.5348 5.3349 4.9676 4.4873 8.5660 8.1622 7.78617.4353 7.1078 6.80176.5152 6.2469 5.9952 5.7590 5.3282 4.7716 9.4713 8.9826 8.5302 8.1109 7.72177.3601 7.0236 6.7101 6.4177 6.14465.65025.0188 10.3676 9.7868 9.2526 8.7605 8.3064 7.8869 7.4987 7.1390 6.8052 6.4951 5.9377 5.2337 1.2551 10.5753 9.9540 9.3851 8.86338.3838 2.1337 11.3484 10.6350 9.9856 9.39368.8527 8.3577 7.9038 7.4869 7.1034 6.4235 5.5831 3.00372.1062 11.2961 10.5631 9.8986 9.2950 8.7455 8.24427.7862 7.3667 6.6282 5.7245 3.8651 12.8493 11.9379 11.118410.3797 9.7122 9.10798.5595 8.0607 7.6061 6.8109 5.8474 4.7179 13.5777 12.5611 11.6523 10.8378 10.1059 9.4466 8.8514 8.3126 7.8237 6.9740 5.9542 15.5623 14.2919 13.1661 12.1657 11.2741 10.4773 9.76329.1216 8.5436 8.0216 7.1196 6.0472 6.3983 14.9920 13.7535 2.6593 11.6896 10.8276 10.0591 9.3719 8.7556 8.2014 7.2497 6.1280 17.2260 15.6785 14.3238 13.1339 12.0853 11.158 10.3356 9.6036 8.9501 8.3649 7.3658 6.1982 8.0456 16.3514 14.877513.5903 12.4622 11.4699 10.5940 9.81819.1285 8.5136 7.4694 6.2593 22.0232 19.5235 17.413115.6221 14.0939 12.7834 11.6536 10.6748 9.8226 9.0770 7.84316.4641 5.8077 22.3965 19.6004 7.2920 15.3725 13.7648 2.4090 11.2578 10.2737 9.4269 8.0552 6.5660 29.4086 24.9986 21.4872 18.6646 16.3742 14.4982 2.9477 11.6546 10.5668 9.6442 8.755 6.6166 2.8347 27.3555 23.1148 19.7928 17.1591 5.0463 13.33171.9246 10.75749.7791 8.2438 6.6418 1.8080 1.7833 1.7591 1.7355 .6901 16257 2.6243 2.5771 2.5313 2.4869 2.4018 2.2832 10 7 .9427 7.5361 7.1607 6.8137 6.1944 5.4206 13 14 17 Used to calculate the present value of a series of equal payments made at the end of each period. For example: What is the present value of $2,000 per year for 10 years assuming an annual interest rate of 9%. For (n = IO, 1 9%), te PV factor is 6.4177. S2.000 per year for 10 years is the equivalent of $12,835 today ($2,000 6.4177) TABLE B.1 Present Value of 1 Perieds 2% 3% 5% 98 7% 8% 9% 0.9901 0.9804 0.9709 0.9615 0.95240.9434 0.9346 0.9259 0.9174 0.9091 08929 08696 0.9803 0.9612 0.9426 0.9246 0.9070 0.8900 0.8734 0.8573 0.8417 0.3264 0.7972 7551 0.9706 0.9423 091 08890 0.8638 0.8396 0.8163 0.7938 0.7722 0.7513 0.7118 0.6575 0.96100.9238 08885 0.8548 0.8227 0.7921 0.76290.7350 0.7084 0.6830 0.6355 0.5718 0.9515 0.9057 0.8626 0.8219 0.7835 0.7473 0.7130 0.6806 0.6499 0.6209 05674 0.4972 0.9420 0.8880 0.8375 0.7903 0.7462 0.7050 0.66630.63020.5963 0.5645 0.5066 0.4323 0.9327 0.8706 0.8131 0.7599 0.7107 0.6651 0.6227 0.5835 0.5470 0.5122 0.4523 0.3759 0.9235 0.8535 0.7894 0.7307 0.6768 0.6274 0.5820 0.5403 0.5019 0.4665 0.4039 0.3269 0.91430.8368 0.7664 0.7026 0.6446 0.5919 0.54390.50020.4604 0.4241 0.3606 0.2843 09053 08203 07441 0.6756 0.6139 0.5584 0.5083 0.4632 0.4224 0.3855 0.3220 0.2472 0.89630.8043 07224 0.6496 0.5847 0.5268 0.475 04289 0.3875 0.3505 0.2875 0.2149 08874 07885 07014 0.6246 0.5568 0.4970 0.4440 0.3971 0.3555 0.3186 0.2567 0.1969 0.87870.77300.6810 0.6006 0.5303 0.4688 0.4150 0.36770.3262 0.2897 0.2292 0.1625 0.870007579 0.66 0.5775 0.505 0.4423 0.3878 0.3405 0.2992 0.2633 0.2046 0.1413 0.8613 0.7430 0.6419 0.5553 0.4810 0.4173 0.3624 0.3152 0.2745 0.2394 0.1827 0.1229 0.8528 0.7284 0.6232 0.5339 0.458 0.3936 0.3387 0.2919 0.2519 0.2176 0.1631 0.1069 0.8444 0.7142 0.6050 0.5134 0.4363 0.3714 0.3166 0.2703 0.231 0.1978 0.1456 0.0929 0.8360 0.7002 05874 0.4936 0.4155 0.3503 0.29590.2502 0.2120 0.1799 0.1300 0.0808 0.8277 0.6864 0.5703 0.4746 0.3957 0.3305 0.2765 0.2317 0.1945 0.1635 0.116 0.0703 0.8195 0.6730 05537 0.4564 0.3769 0.3118 0.2584 0.2145 0.1784 0.1486 0.1037 00611 0.77980.6095 0.4776 0.3751 0.2953 0.2330 0.1842 0.1460 0.60 0.0923 00588 00304 0.7419 0.552 0.4120 0.3083 0.2314 0.174 0.1314 0.0994 0.0754 0.0573 0.0334 0.015 0.70590.5000 0.3554 0.2534 0.1813 0.130 0.0937 0.0676 0.0490 0.0356 0.0189 0.0075 0.6717 04529 0.3066 0.2083 0420 0.0972 0.0668 0.0460 0.0318 0.022 00107 0.0037 0