Hi, Please show the working and no excel

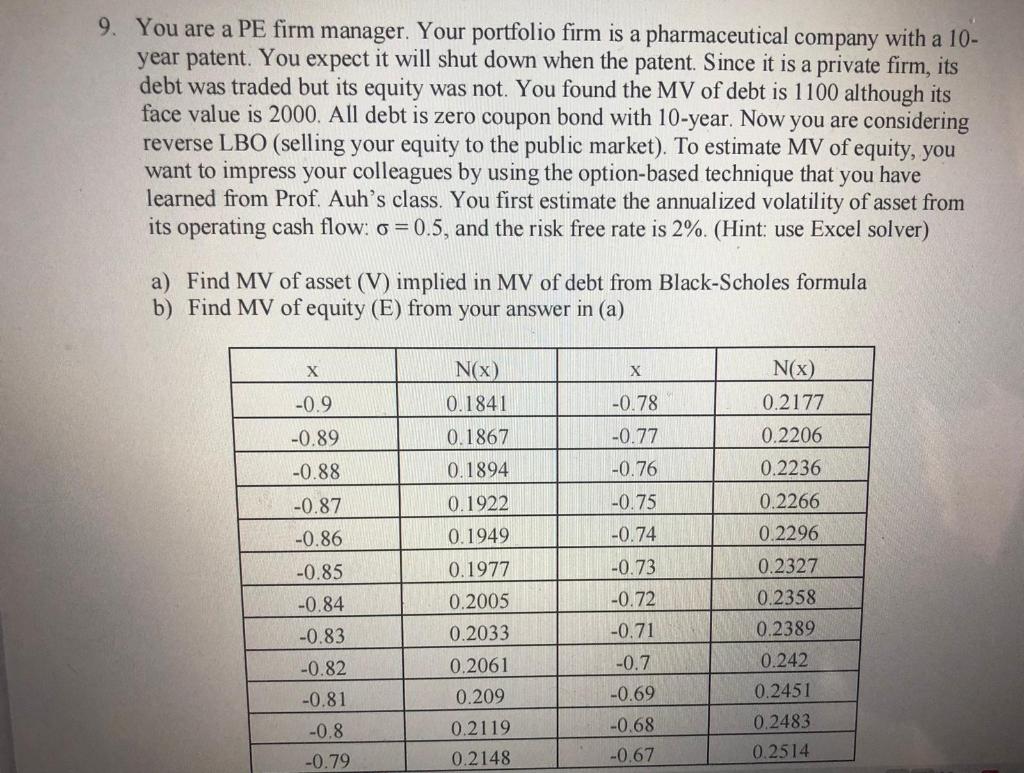

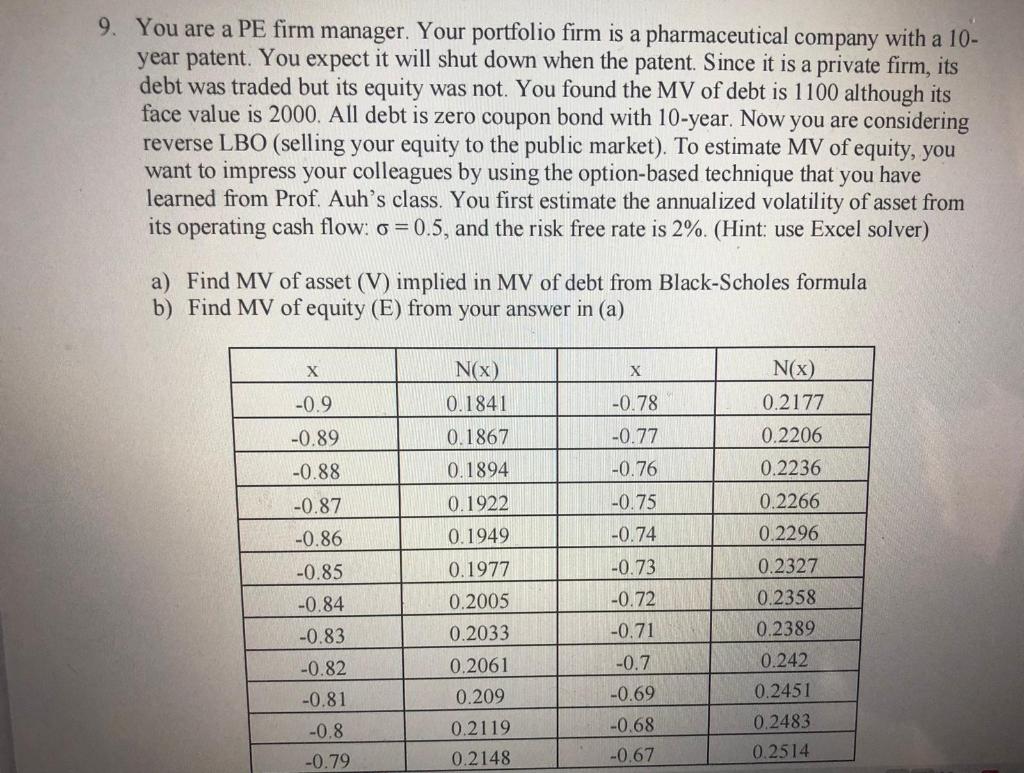

9. You are a PE firm manager. Your portfolio firm is a pharmaceutical company with a 10- year patent. You expect it will shut down when the patent. Since it is a private firm, its debt was traded but its equity was not. You found the MV of debt is 1100 although its face value is 2000. All debt is zero coupon bond with 10-year. Now you are considering reverse LBO (selling your equity to the public market). To estimate MV of equity, you want to impress your colleagues by using the option-based technique that you have learned from Prof. Auh's class. You first estimate the annualized volatility of asset from its operating cash flow: 0 = 0.5, and the risk free rate is 2%. (Hint: use Excel solver) a) Find MV of asset (V) implied in MV of debt from Black-Scholes formula b) Find MV of equity (E) from your answer in (a) X X -0.9 N(X) 0.1841 0.1867 -0.78 -0.89 -0.88 0.1894 0.1922 -0.77 -0.76 -0.75 -0.87 -0.86 0.1949 N(x) 0.2177 0.2206 0.2236 0.2266 0.2296 0.2327 0.2358 0.2389 0.242 0.2451 -0.74 -0.85 0.1977 -0.73 0.2005 -0.72 0.2033 -0.84 -0.83 -0.82 -0.81 -0.8 0.2061 0.209 -0.71 -0.7 -0.69 -0.68 -0.67 0.2119 0.2148 0.2483 0.2514 -0.79 9. You are a PE firm manager. Your portfolio firm is a pharmaceutical company with a 10- year patent. You expect it will shut down when the patent. Since it is a private firm, its debt was traded but its equity was not. You found the MV of debt is 1100 although its face value is 2000. All debt is zero coupon bond with 10-year. Now you are considering reverse LBO (selling your equity to the public market). To estimate MV of equity, you want to impress your colleagues by using the option-based technique that you have learned from Prof. Auh's class. You first estimate the annualized volatility of asset from its operating cash flow: 0 = 0.5, and the risk free rate is 2%. (Hint: use Excel solver) a) Find MV of asset (V) implied in MV of debt from Black-Scholes formula b) Find MV of equity (E) from your answer in (a) X X -0.9 N(X) 0.1841 0.1867 -0.78 -0.89 -0.88 0.1894 0.1922 -0.77 -0.76 -0.75 -0.87 -0.86 0.1949 N(x) 0.2177 0.2206 0.2236 0.2266 0.2296 0.2327 0.2358 0.2389 0.242 0.2451 -0.74 -0.85 0.1977 -0.73 0.2005 -0.72 0.2033 -0.84 -0.83 -0.82 -0.81 -0.8 0.2061 0.209 -0.71 -0.7 -0.69 -0.68 -0.67 0.2119 0.2148 0.2483 0.2514 -0.79