Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, please teach me how to solve this problem step by step with the formula. Please be as understandable as possible, since I'm new to

Hi, please teach me how to solve this problem step by step with the formula. Please be as understandable as possible, since I'm new to this. Thank you!

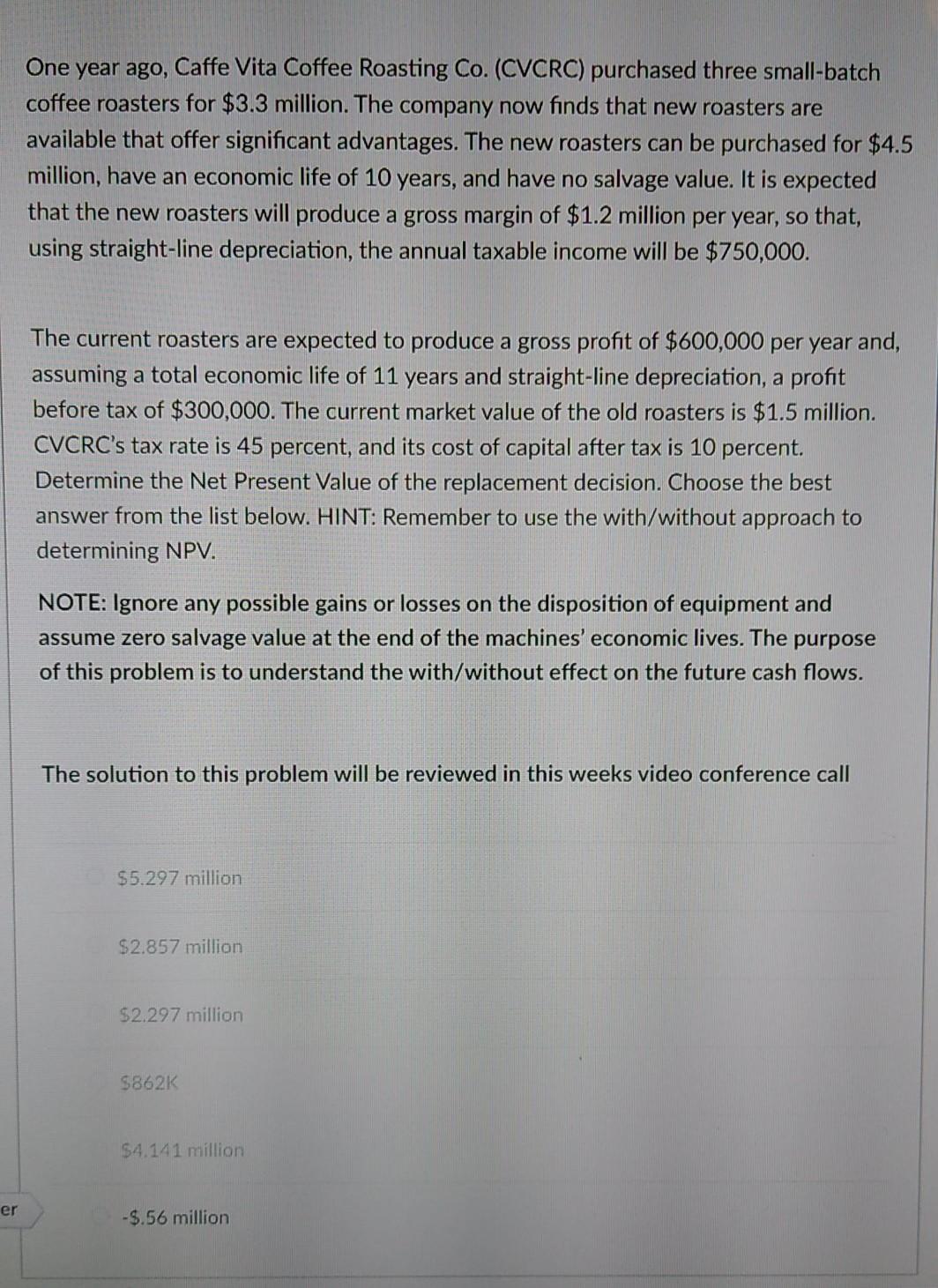

One year ago, Caffe Vita Coffee Roasting Co. (CVCRC) purchased three small-batch coffee roasters for $3.3 million. The company now finds that new roasters are available that offer significant advantages. The new roasters can be purchased for $4.5 million, have an economic life of 10 years, and have no salvage value. It is expected that the new roasters will produce a gross margin of $1.2 million per year, so that, using straight-line depreciation, the annual taxable income will be $750,000. The current roasters are expected to produce a gross profit of $600,000 per year and, assuming a total economic life of 11 years and straight-line depreciation, a profit before tax of $300,000. The current market value of the old roasters is $1.5 million. CVCRC's tax rate is 45 percent, and its cost of capital after tax is 10 percent. Determine the Net Present Value of the replacement decision. Choose the best answer from the list below. HINT: Remember to use the with/without approach to determining NPV. NOTE: Ignore any possible gains or losses on the disposition of equipment and assume zero salvage value at the end of the machines' economic lives. The purpose of this problem is to understand the with/without effect on the future cash flows. The solution to this problem will be reviewed in this weeks video conference call $5.297 million $2.857 million $2.297 million $862K $4.141 million er -$.56 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started