Question

Hi, please use R STUDIO to solve this problem. You can manually show the solution first before integrating it to R studio. Thank you! 1.

Hi, please use R STUDIO to solve this problem. You can manually show the solution first before integrating it to R studio. Thank you!

1. For a given stock assume that you have sold a European put option on a stock that expires in one year. Assume the following information with respect to the stocks current price, the strike price, the stocks volatility, the market portfolios mean drift rate, the risk-free rate, and the stocks beta

= , = , = . , = . , = . , = /.

(a) Use the CAPM model (section 1.3) to find the stocks real world expected rate of return rS.

ABOUT SECTION 1.3:

R = a + RM +

where R is the return from the investment, RM is the return from the market portfolio, a and are constants, and is a random variable equal to the regression error.

1. A component RM, which is a multiple of the return from the market portfolio.

2. A component , which is unrelated to the return from the market portfolio.

(b) Compute the options current price using the Black-Scholes formula.

(c) Compute the option sellers 99% VaR on their real-world payouts in one year.

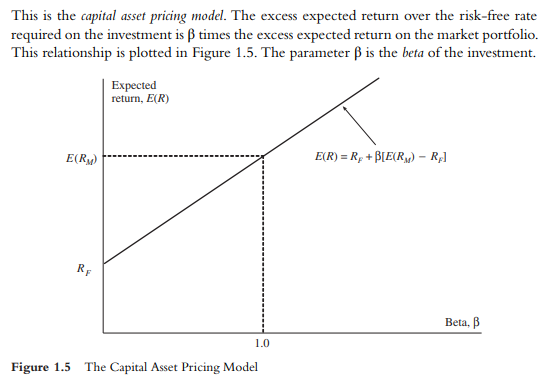

This is the capital asset pricing model. The excess expected return over the risk-free rate required on the investment is times the excess expected return on the market portfolio. This relationship is plotted in Figure 1.5. The parameter is the beta of the investment. Expected return, E(R) E(R) E(R) = R +BLE(R) - R] RE Beta, 1.0 Figure 1.5 The Capital Asset Pricing ModelStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started