Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi pls help me with this. Thank you in advance! Mae Inc., which was organized on January 2, 2018, two years ago, has not maintained

Hi pls help me with this. Thank you in advance!

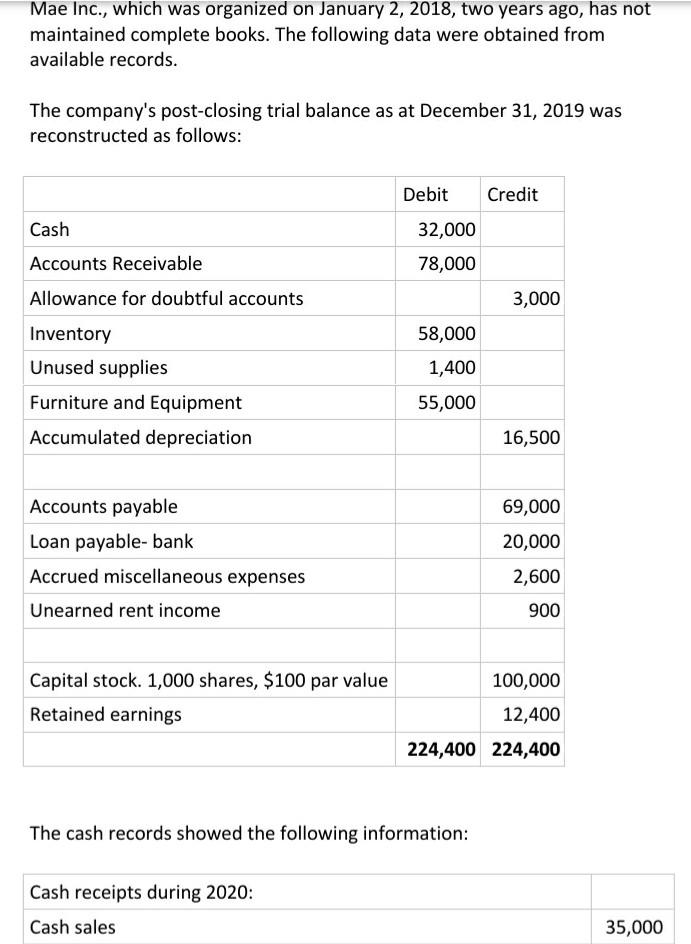

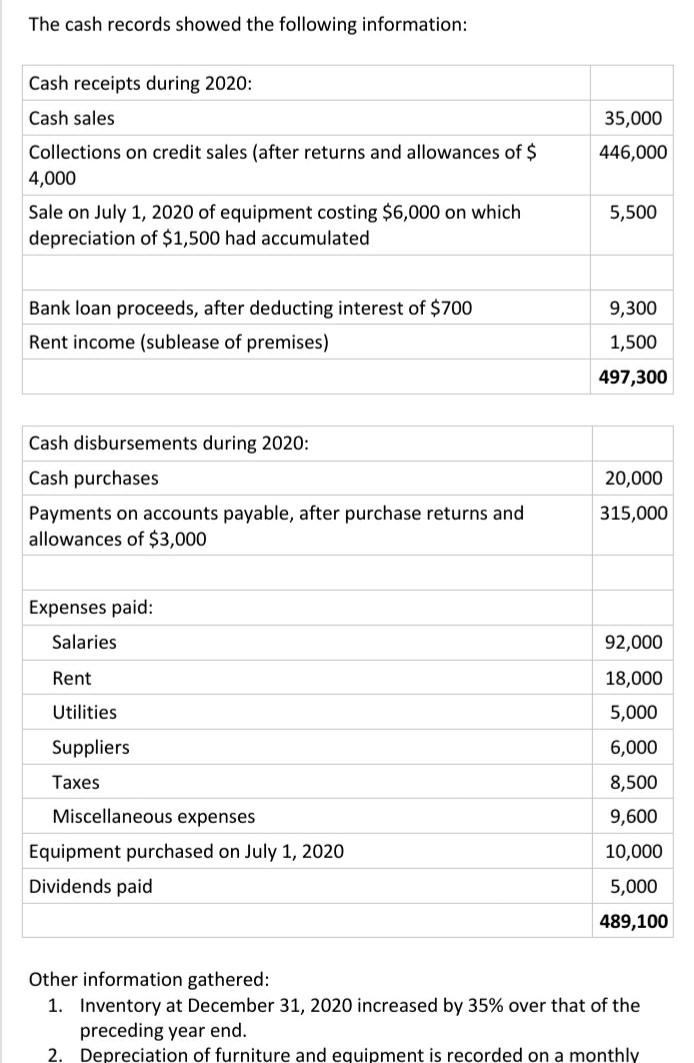

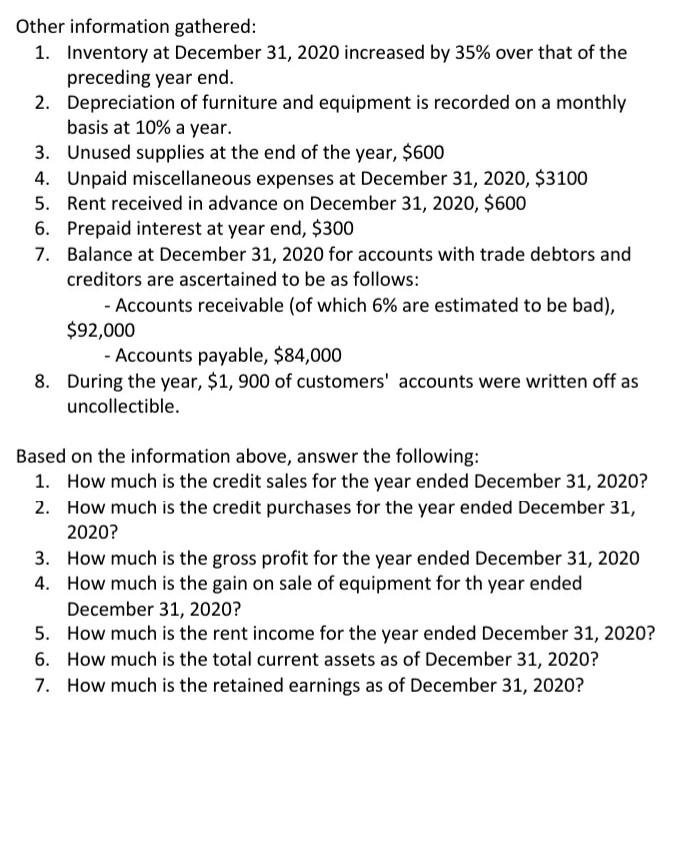

Mae Inc., which was organized on January 2, 2018, two years ago, has not maintained complete books. The following data were obtained from available records. The company's post-closing trial balance as at December 31, 2019 was reconstructed as follows: Debit Credit Cash 32,000 78,000 3,000 Accounts Receivable Allowance for doubtful accounts Inventory Unused supplies Furniture and Equipment Accumulated depreciation 58,000 1,400 55,000 16,500 69,000 20,000 Accounts payable Loan payable-bank Accrued miscellaneous expenses Unearned rent income 2,600 900 Capital stock. 1,000 shares, $100 par value Retained earnings 100,000 12,400 224,400 224,400 The cash records showed the following information: Cash receipts during 2020: Cash sales 35,000 The cash records showed the following information: Cash receipts during 2020: Cash sales Collections on credit sales (after returns and allowances of $ 4,000 Sale on July 1, 2020 of equipment costing $6,000 on which depreciation of $1,500 had accumulated 35,000 446,000 5,500 9,300 Bank loan proceeds, after deducting interest of $700 Rent income (sublease of premises) 1,500 497,300 Cash disbursements during 2020: Cash purchases Payments on accounts payable, after purchase returns and allowances of $3,000 20,000 315,000 Expenses paid: Salaries 92,000 Rent Utilities 18,000 5,000 6,000 Suppliers Taxes 8,500 9,600 Miscellaneous expenses Equipment purchased on July 1, 2020 Dividends paid 10,000 5,000 489,100 Other information gathered: 1. Inventory at December 31, 2020 increased by 35% over that of the preceding year end. 2. Depreciation of furniture and equipment is recorded on a monthly Other information gathered: 1. Inventory at December 31, 2020 increased by 35% over that of the preceding year end. 2. Depreciation of furniture and equipment is recorded on a monthly basis at 10% a year. 3. Unused supplies at the end of the year, $600 4. Unpaid miscellaneous expenses at December 31, 2020, $3100 5. Rent received in advance on December 31, 2020, $600 6. Prepaid interest at year end, $300 7. Balance at December 31, 2020 for accounts with trade debtors and creditors are ascertained to be as follows: - Accounts receivable (of which 6% are estimated to be bad), $92,000 - Accounts payable, $84,000 8. During the year, $1,900 of customers' accounts were written off as uncollectible. Based on the information above, answer the following: 1. How much is the credit sales for the year ended December 31, 2020? 2. How much is the credit purchases for the year ended December 31, 2020? 3. How much is the gross profit for the year ended December 31, 2020 4. How much is the gain on sale of equipment for th year ended December 31, 2020? 5. How much is the rent income for the year ended December 31, 2020? 6. How much is the total current assets as of December 31, 2020? 7. How much is the retained earnings as of December 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started