Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi pls help with questions 1-4 1. You would like to buy 1,000 shares of Google at a price of $200. To amplify your retums,

hi pls help with questions 1-4

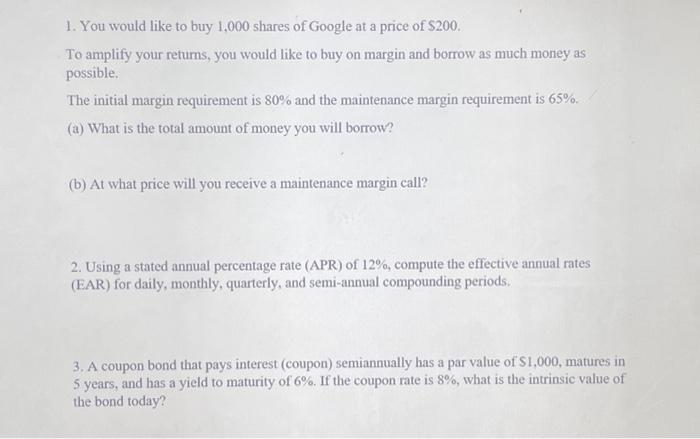

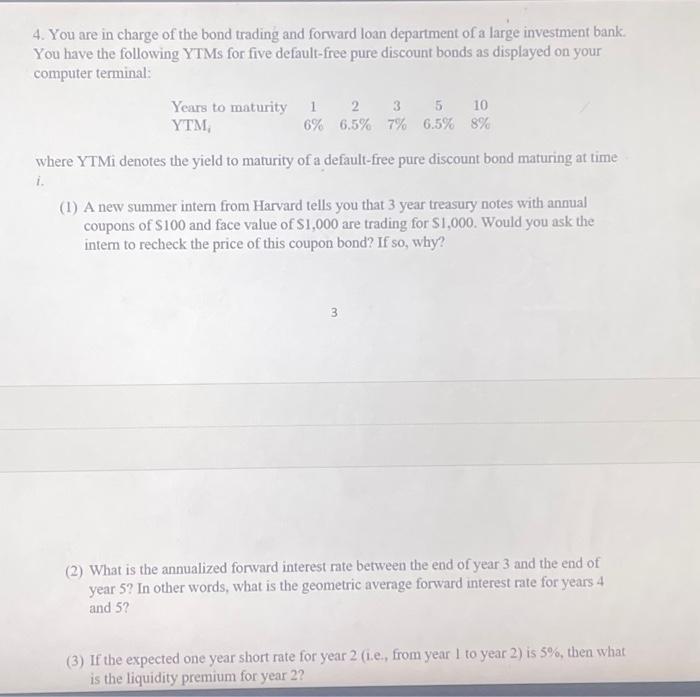

1. You would like to buy 1,000 shares of Google at a price of $200. To amplify your retums, you would like to buy on margin and borrow as much money as possible. The initial margin requirement is 80% and the maintenance margin requirement is 65%. (a) What is the total amount of money you will borrow? (b) At what price will you receive a maintenance margin call? 2. Using a stated annual percentage rate (APR) of 12%, compute the effective annual rates (EAR) for daily, monthly, quarterly, and semi-annual compounding periods. 3. A coupon bond that pays interest (coupon) semiannually has a par value of $1,000, matures in 5 years, and has a yield to maturity of 6%. If the coupon rate is 8%, what is the intrinsic value of the bond today? 4. You are in charge of the bond trading and forward loan department of a large investment bank. You have the following YTMs for five default-free pure discount bonds as displayed on your computer terminal: where YTMi denotes the yield to maturity of a default-free pure discount bond maturing at time i. (1) A new summer intern from Harvard tells you that 3 year treasury notes with annual coupons of $100 and face value of $1,000 are trading for $1,000. Would you ask the intern to recheck the price of this coupon bond? If so, why? 3 (2) What is the annualized forward interest rate between the end of year 3 and the end of year 5 ? In other words, what is the geometric average forward interest rate for years 4 and 5 ? (3) If the expected one year short rate for year 2 (i.e, from year 1 to year 2 ) is 5%, then what is the liquidity premium for year 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started