Hi, pls show the workings for question (i).

The answer given by my teacher is:

current ratio = 1.25 times

book value per ordinary share = RM13.80

A/R Turnover = 6.32

Inventory turnover = 4.4 times

return on ordinary share capital = 18%

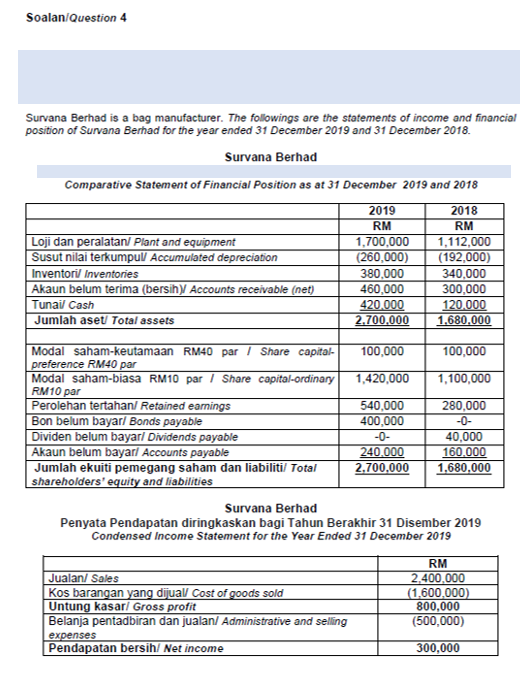

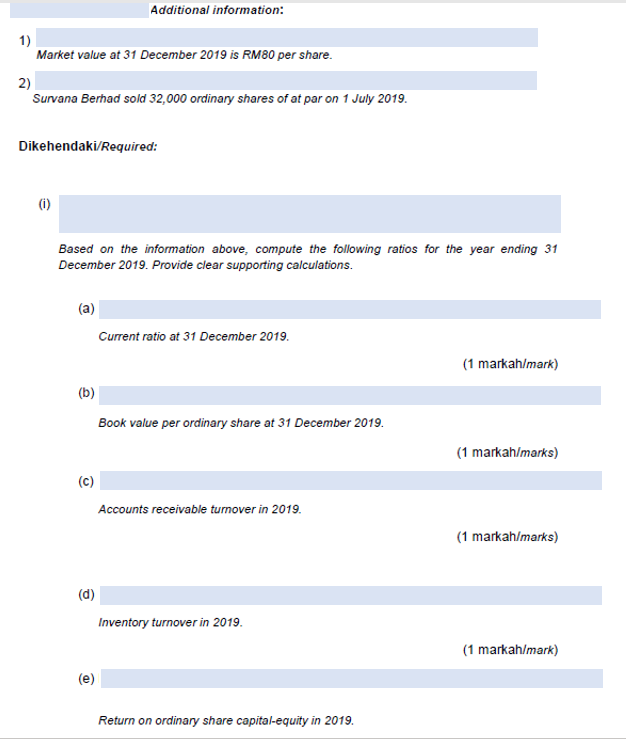

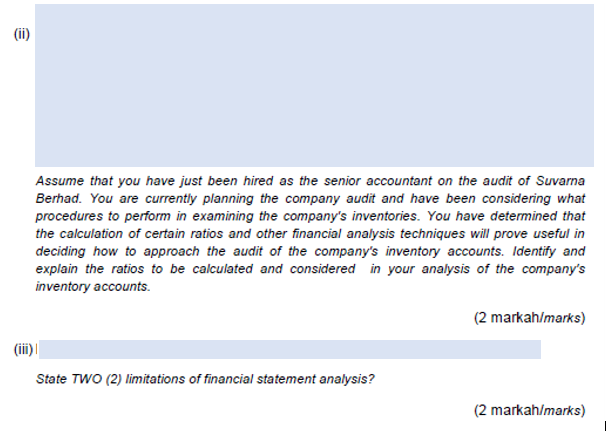

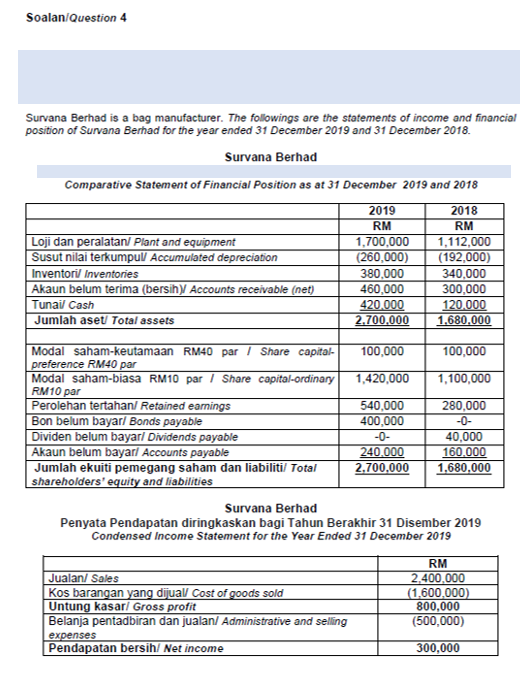

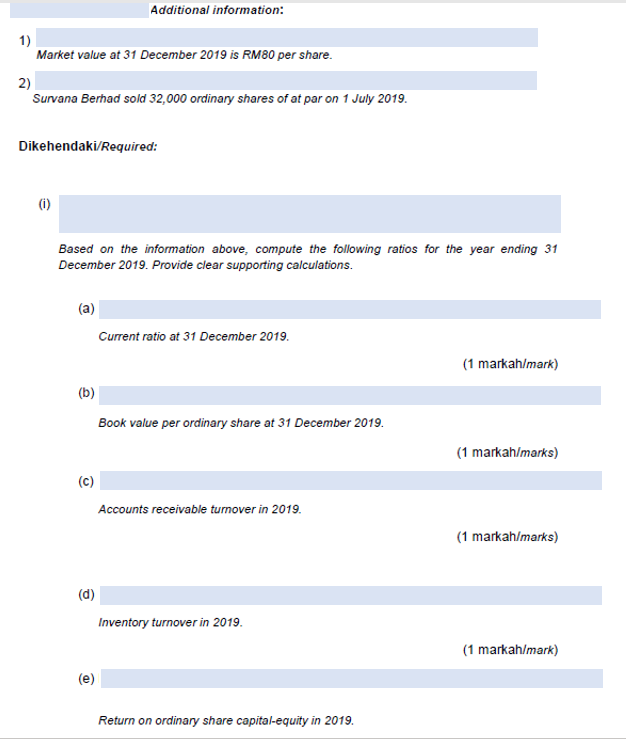

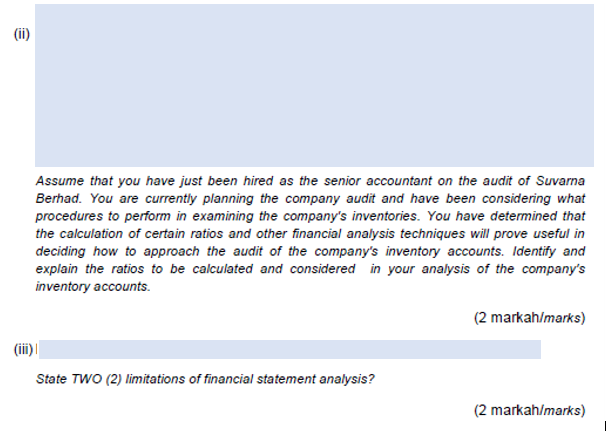

Soalan Question 4 Survana Berhad is a bag manufacturer. The followings are the statements of income and financial position of Survana Berhad for the year ended 31 December 2019 and 31 December 2018. Survana Berhad Comparative Statement of Financial Position as at 31 December 2019 and 2018 Loji dan peralatan/ Plant and equipment Susut nilai terkumpul Accumulated depreciation Inventori Inventories Akaun belum terima (bersih) Accounts receivable (net) Tunail Cash Jumlah aset Total assets 2019 RM 1,700,000 (260,000) 380,000 460,000 420.000 2,700.000 2018 RM 1,112,000 (192,000) 340.000 300,000 120.000 1.680.000 100,000 100,000 1,420,000 1,100,000 Modal saham-keutamaan RM40 par Share capital preference RM40 par Modal saham-biasa RM10 par / Share capital-ordinary RM10 par Perolehan tertahan/ Retained earnings Bon belum bayarl Bonds payable Dividen belum bayarl Dividends payable Akaun belum bayarl Accounts payable Jumlah ekuiti pemegang saham dan liabilitil Total shareholders' equity and liabilities 540,000 400,000 280,000 240.000 2,700,000 40.000 160.000 1,680,000 Survana Berhad Penyata Pendapatan diringkaskan bagi Tahun Berakhir 31 Disember 2019 Condensed Income Statement for the Year Ended 31 December 2019 Jualan/ Sales Kos barangan yang dijual Cost of goods sold Untung kasarl Gross profit Belanja pentadbiran dan jualan/ Administrative and selling expenses Pendapatan bersih/ Net income RM 2.400.000 (1,600,000) 800,000 (500,000) 300,000 Additional information: 1) Market value at 31 December 2019 is RM80 per share. 2) Survana Berhad sold 32,000 ordinary shares of at par on 1 July 2019. Dikehendaki/Required: (i) Based on the information above, compute the following ratios for the year ending 31 December 2019. Provide clear supporting calculations. (a) Current ratio at 31 December 2019. (1 markah/mark) (b) Book value per ordinary share at 31 December 2019. (1 markah/marks) (c) Accounts receivable turnover in 2019. (1 markah/marks) (d) Inventory turnover in 2019. (1 markah/mark) (e) Return on ordinary share capital-equity in 2019. (ii) Assume that you have just been hired as the senior accountant on the audit of Suvarna Berhad. You are currently planning the company audit and have been considering what procedures to perform in examining the company's inventories. You have determined that the calculation of certain ratios and other financial analysis techniques will prove useful in deciding how to approach the audit of the company's inventory accounts. Identify and explain the ratios to be calculated and considered in your analysis of the company's inventory accounts. (2 markah/marks) (iii) State TWO (2) limitations of financial statement analysis? (2 markah/marks)