Hi Sir please can you help me

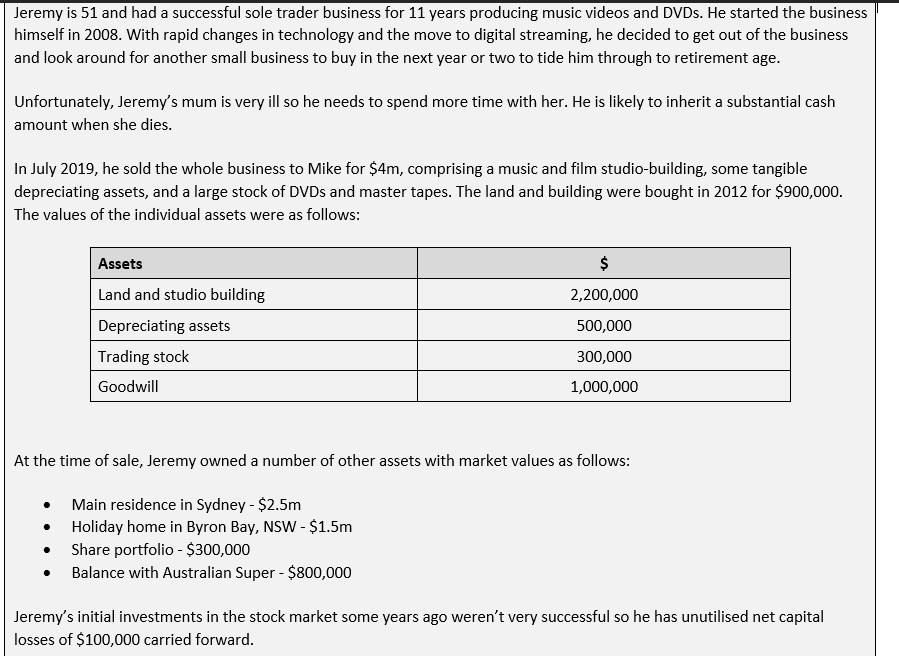

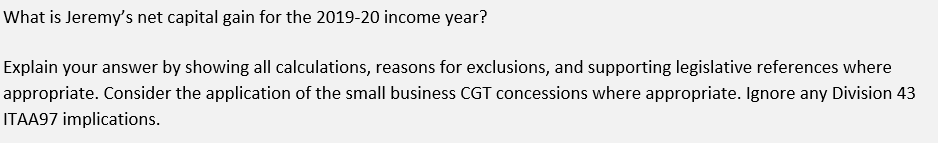

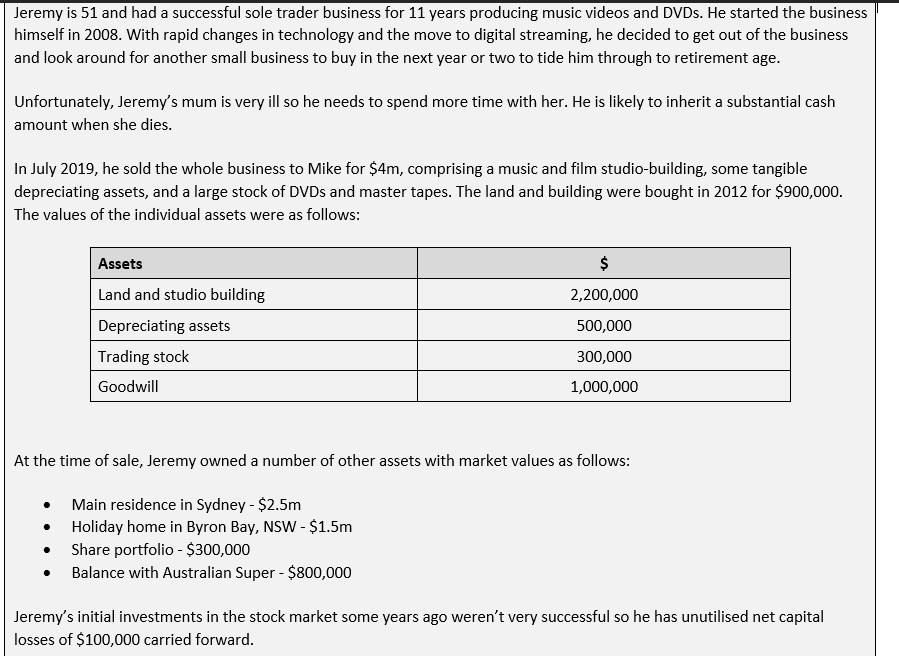

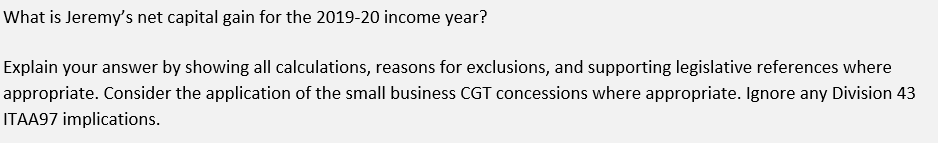

Jeremy is 51 and had a successful sole trader business for 11 years producing music videos and DVDs. He started the business himself in 2008. With rapid changes in technology and the move to digital streaming, he decided to get out of the business and look around for another small business to buy in the next year or two to tide him through to retirement age. Unfortunately, Jeremy's mum is very ill so he needs to spend more time with her. He is likely to inherit a substantial cash amount when she dies. In July 2019, he sold the whole business to Mike for $4m, comprising a music and film studio-building, some tangible depreciating assets, and a large stock of DVDs and master tapes. The land and building were bought in 2012 for $900,000. The values of the individual assets were as follows: $ 2,200,000 Assets Land and studio building Depreciating assets Trading stock Goodwill 500,000 300,000 1,000,000 At the time of sale, Jeremy owned a number of other assets with market values as follows: Main residence in Sydney - $2.5m Holiday home in Byron Bay, NSW - $1.5m Share portfolio - $300,000 Balance with Australian Super - $ 800,000 . Jeremy's initial investments in the stock market some years ago weren't very successful so he has unutilised net capital losses of $100,000 carried forward. What is Jeremy's net capital gain for the 2019-20 income year? Explain your answer by showing all calculations, reasons for exclusions, and supporting legislative references where appropriate. Consider the application of the small business CGT concessions where appropriate. Ignore any Division 43 ITAA97 implications. Jeremy is 51 and had a successful sole trader business for 11 years producing music videos and DVDs. He started the business himself in 2008. With rapid changes in technology and the move to digital streaming, he decided to get out of the business and look around for another small business to buy in the next year or two to tide him through to retirement age. Unfortunately, Jeremy's mum is very ill so he needs to spend more time with her. He is likely to inherit a substantial cash amount when she dies. In July 2019, he sold the whole business to Mike for $4m, comprising a music and film studio-building, some tangible depreciating assets, and a large stock of DVDs and master tapes. The land and building were bought in 2012 for $900,000. The values of the individual assets were as follows: $ 2,200,000 Assets Land and studio building Depreciating assets Trading stock Goodwill 500,000 300,000 1,000,000 At the time of sale, Jeremy owned a number of other assets with market values as follows: Main residence in Sydney - $2.5m Holiday home in Byron Bay, NSW - $1.5m Share portfolio - $300,000 Balance with Australian Super - $ 800,000 . Jeremy's initial investments in the stock market some years ago weren't very successful so he has unutilised net capital losses of $100,000 carried forward. What is Jeremy's net capital gain for the 2019-20 income year? Explain your answer by showing all calculations, reasons for exclusions, and supporting legislative references where appropriate. Consider the application of the small business CGT concessions where appropriate. Ignore any Division 43 ITAA97 implications