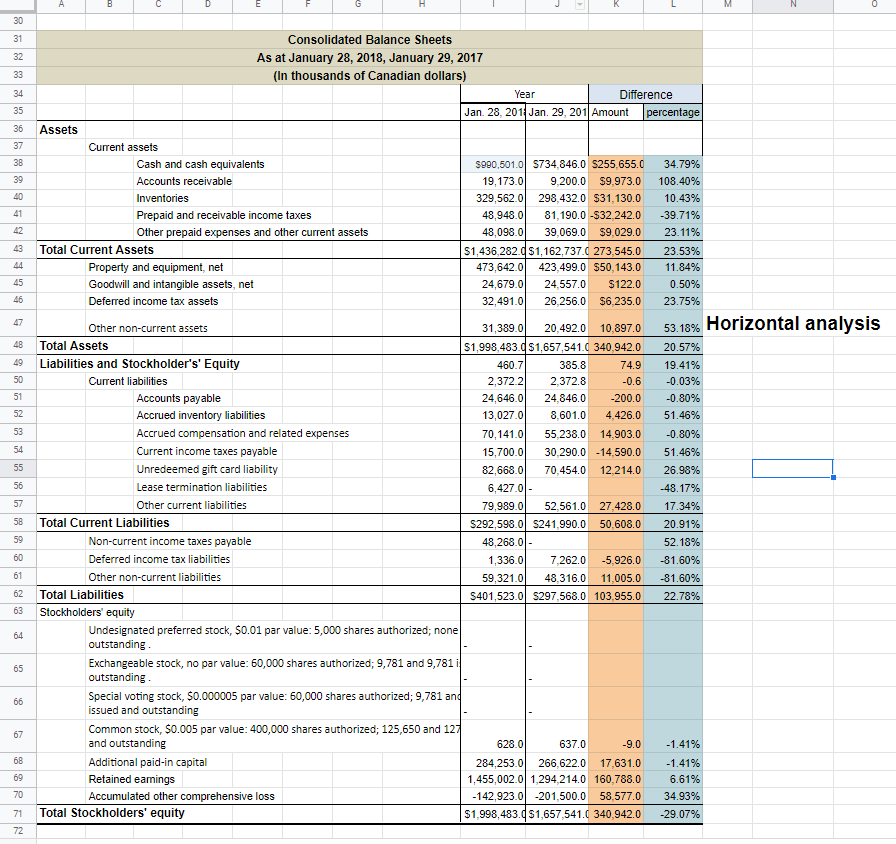

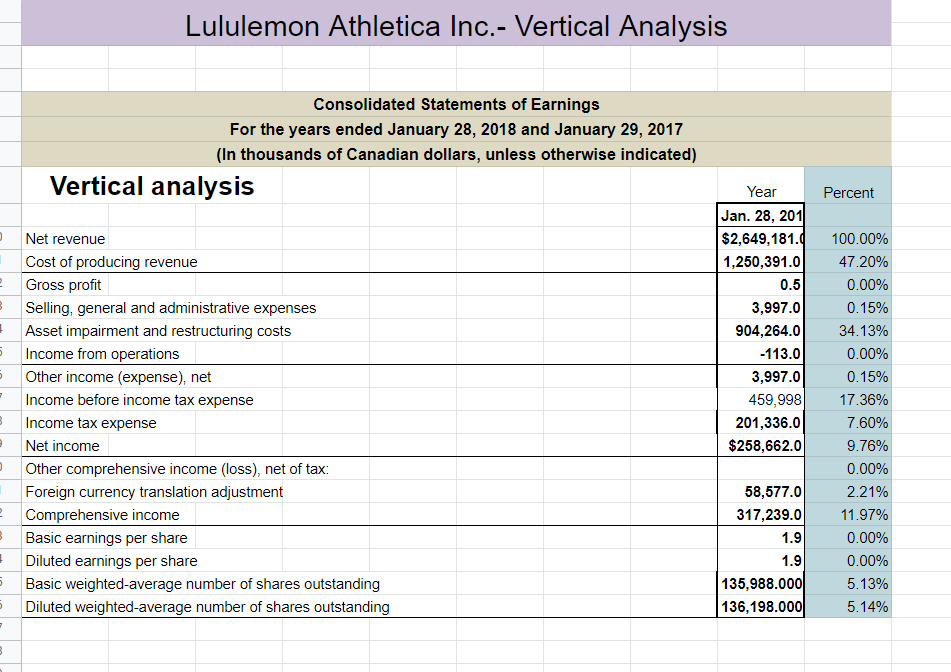

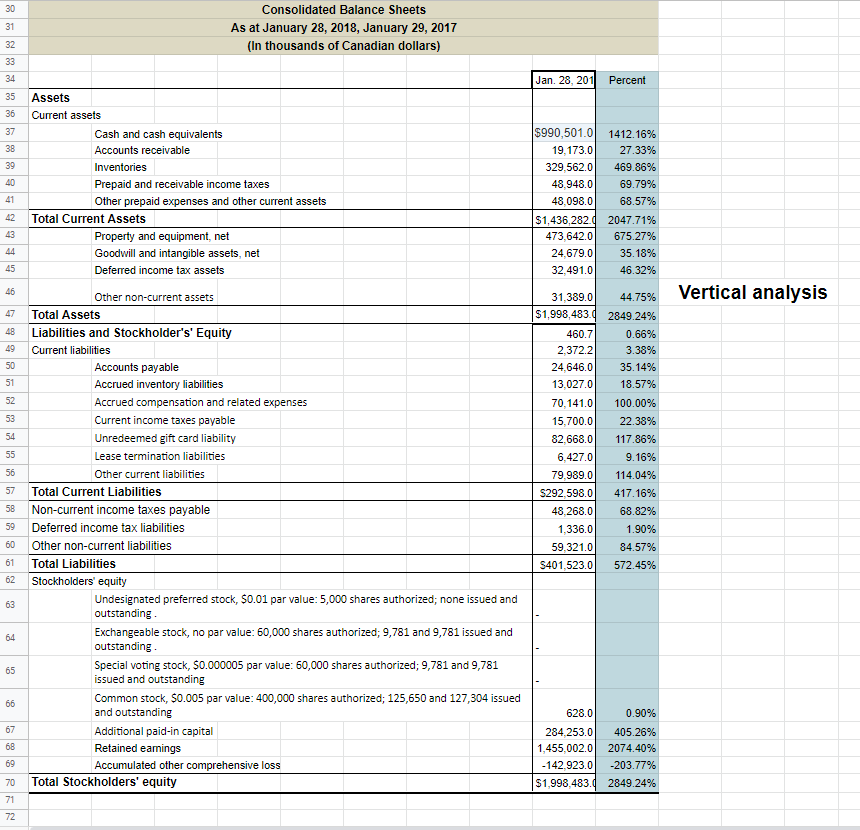

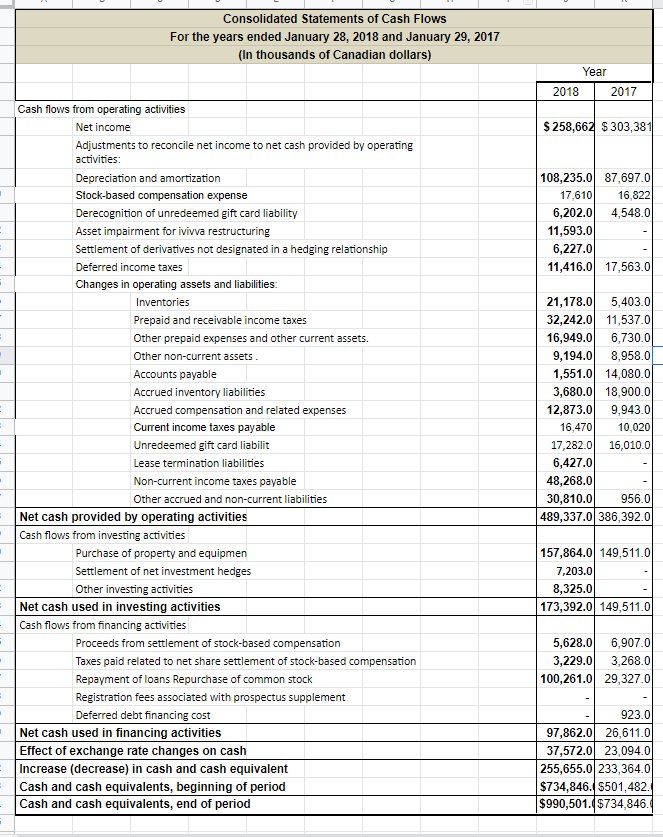

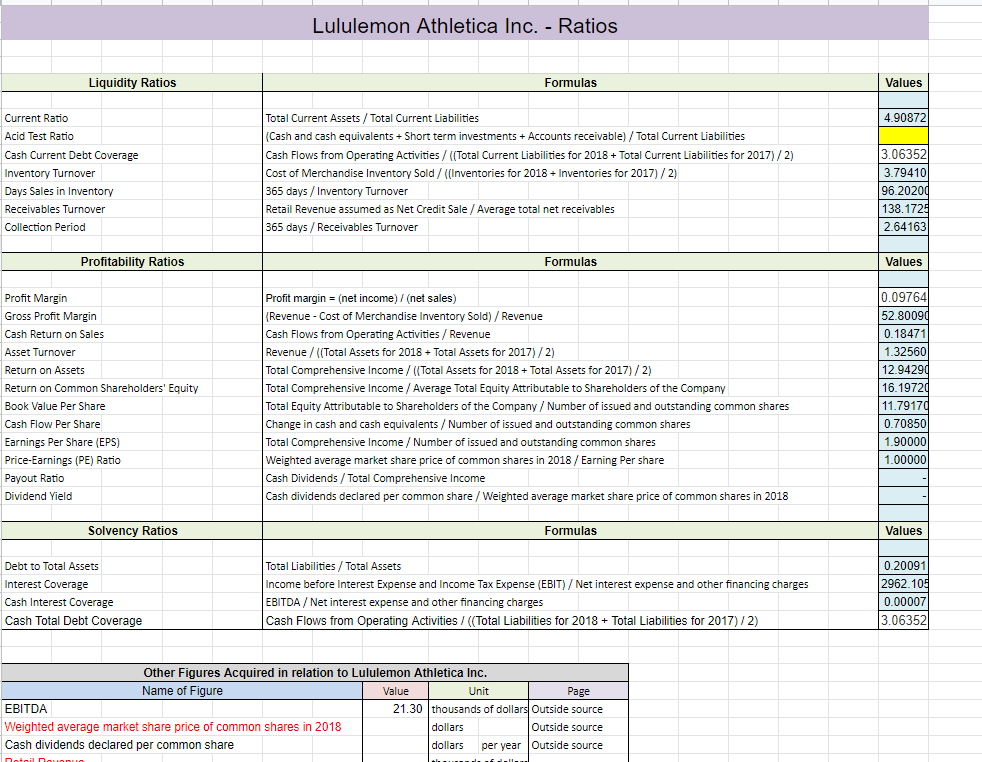

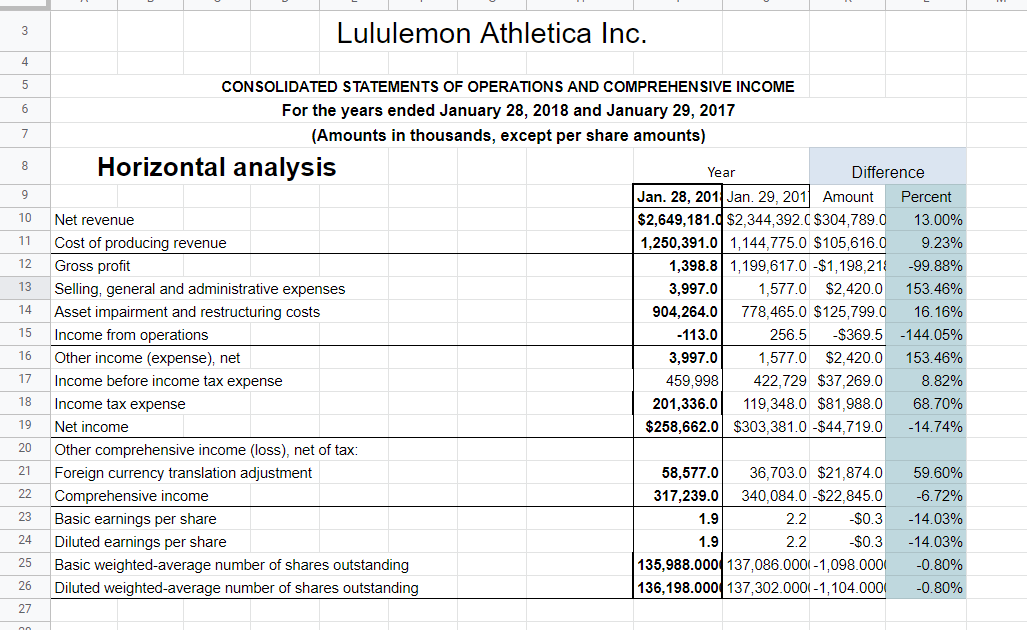

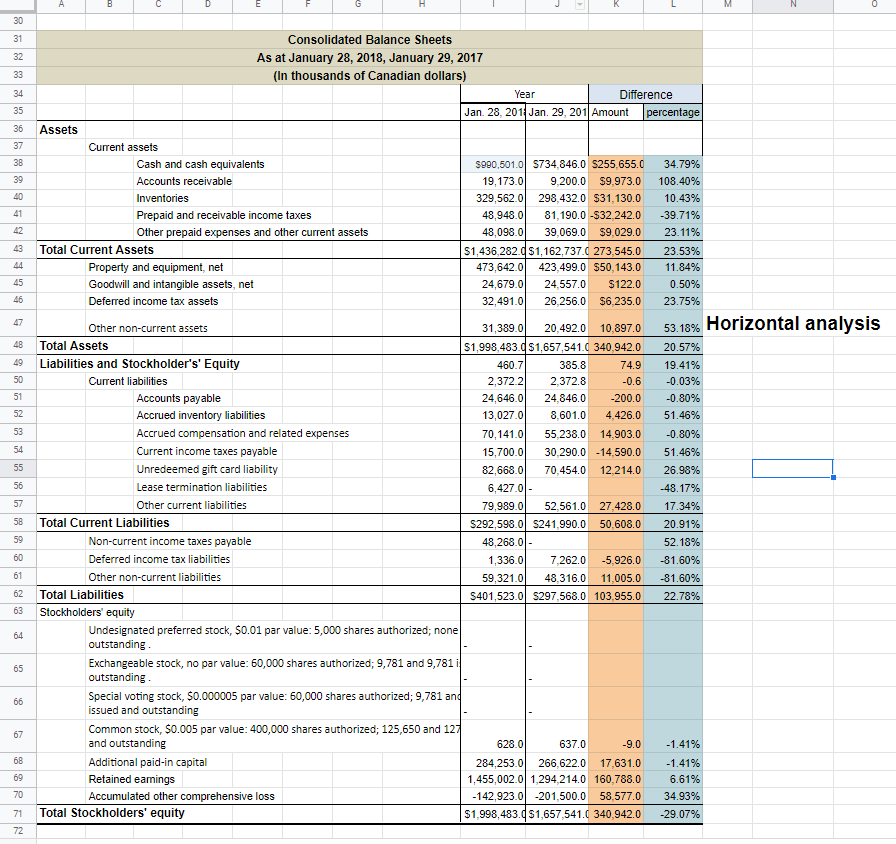

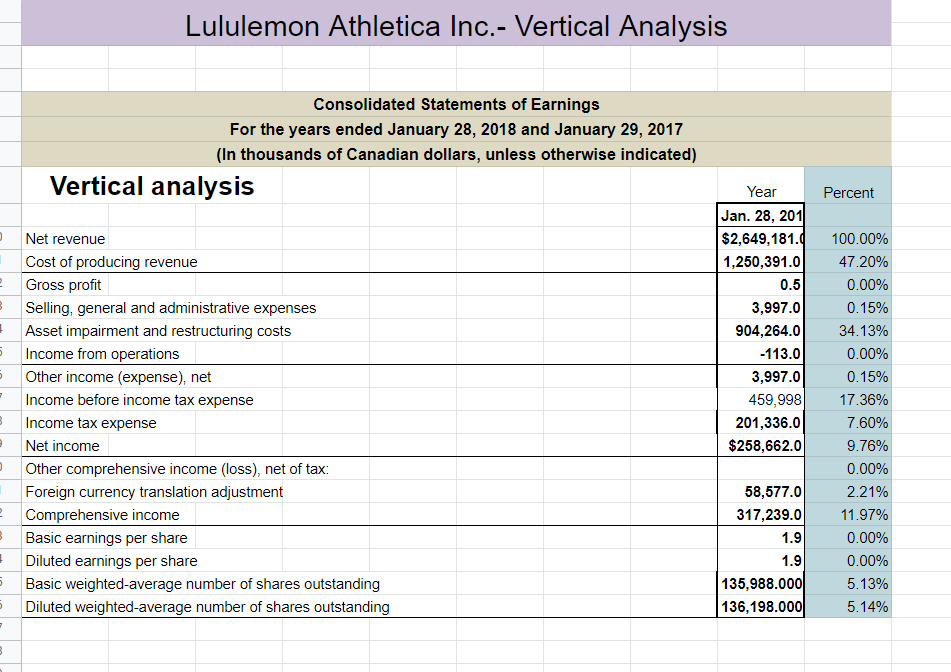

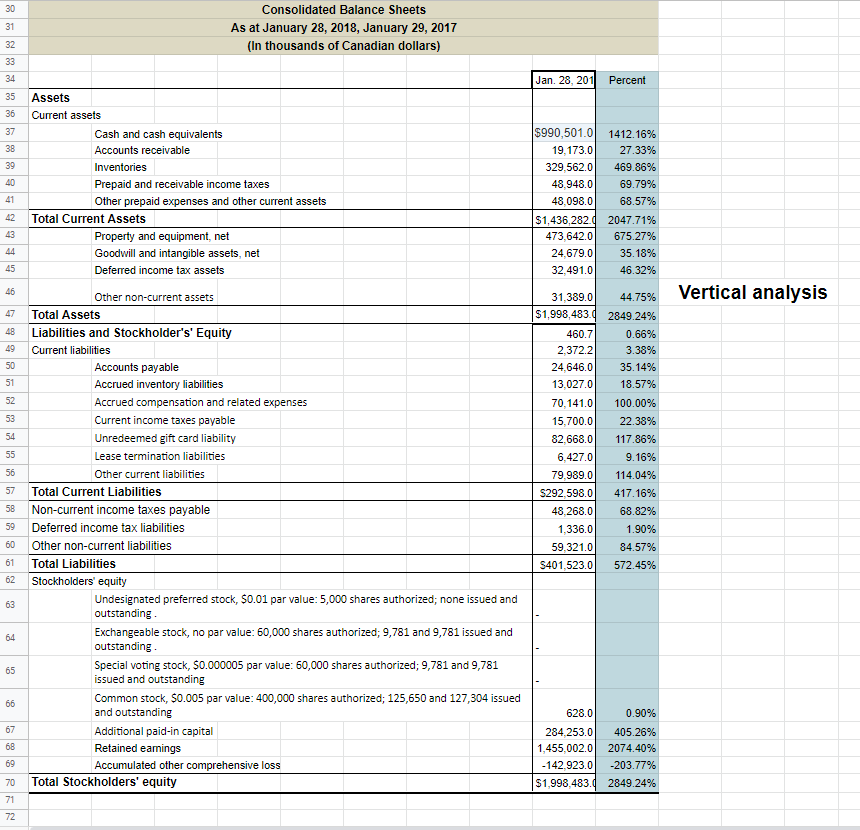

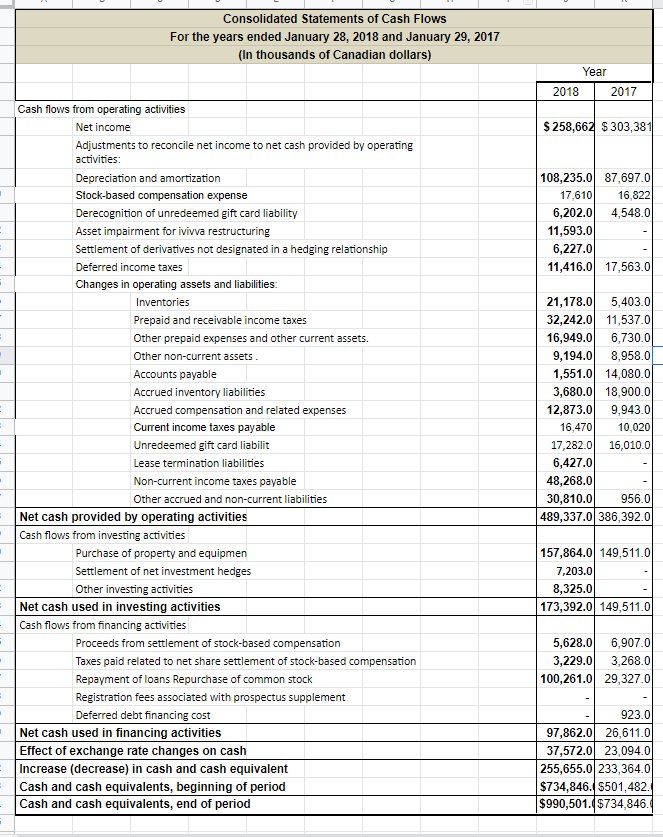

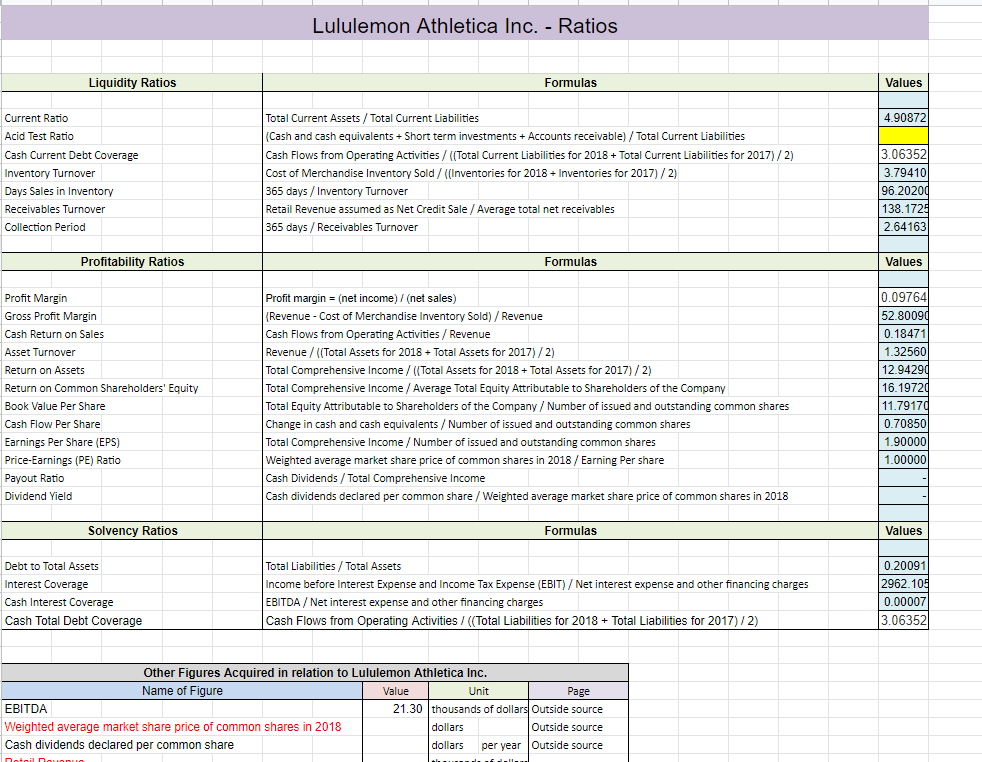

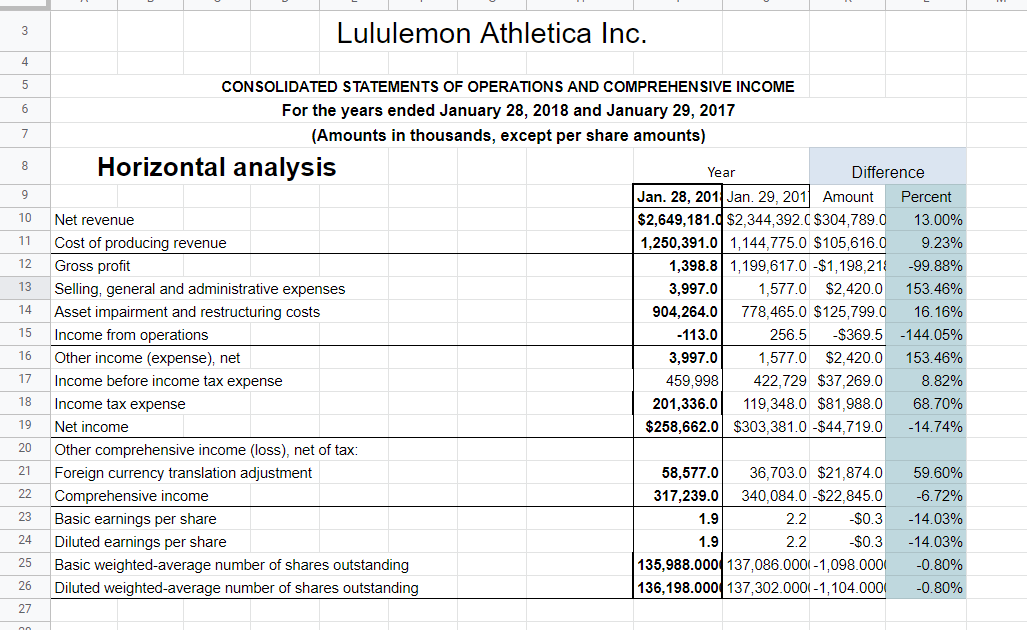

Hi so I was copying a companys financial documents and was asked to find difference and percentages for H.A and V.A.This is very important for me I need somebody to take a quick look at it and see if I made any mistakes (like naming the ratios, Retail Revenue, etc ) If I can get help ASAP I would really be grateful. (don't mind the big H.A., V.A text I know it's not supposed to be there, its just to demonstrate)

Hi so I was copying a companys financial documents and was asked to find difference and percentages for H.A and V.A.This is very important for me I need somebody to take a quick look at it and see if I made any mistakes (like naming the ratios, Retail Revenue, etc ) If I can get help ASAP I would really be grateful. (don't mind the big H.A., V.A text I know it's not supposed to be there, its just to demonstrate)

Consolidated Balance Sheets As at January 28, 2018, January 29, 2017 (In thousands of Canadian dollars) Lululemon Athletica Inc.- Vertical Analysis Consolidated Statements of Earnings For the years ended January 28, 2018 and January 29, 2017 (In thousands of Canadian dollars, unless otherwise indicated) Vertical analysis Net revenue Cost of producing revenue Gross profit Selling, general and administrative expenses Asset impairment and restructuring costs Income from operations Other income (expense), net Income before income tax expense Income tax expense Net income Other comprehensive income (loss), net of tax: Foreign currency translation adjustment Comprehensive income Basic earnings per share Diluted earnings per share Basic weighted-average number of shares outstanding Diluted weighted-average number of shares outstanding \begin{tabular}{|r|r|} \multicolumn{1}{c|}{ Year } & Percent \\ \hline Jan. 28, 201 & \\ \hline $2,649,181. & 100.00% \\ \hline 1,250,391.0 & 47.20% \\ \hline 0.5 & 0.00% \\ \hline 3,997.0 & 0.15% \\ 904,264.0 & 34.13% \\ 113.0 & 0.00% \\ \hline 3,997.0 & 0.15% \\ \hline 459,998 & 17.36% \\ \hline 201,336.0 & 7.60% \\ $258,662.0 & 9.76% \\ \hline & 0.00% \\ \hline 58,577.0 & 2.21% \\ 317,239.0 & 11.97% \\ \hline 1.9 & 0.00% \\ \hline 1.9 & 0.00% \\ \hline 135,988.000 & 5.13% \\ \hline 136,198.000 & 5.14% \\ \hline \end{tabular} Consolidated Balance Sheets As at January 28, 2018, January 29, 2017 (In thousands of Canadian dollars) Consolidated Statements of Cash Flows For the years ended January 28, 2018 and January 29, 2017 (In thousands of Canadian dollars) Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization Stock-based compensation expense Derecognition of unredeemed gift card liability Asset impairment for ivivva restructuring Settlement of derivatives not designated in a hedging relationship Deferred income taxes Changes in operating assets and liabilities: Inventories Prepaid and receivable income taxes Other prepaid expenses and other current assets. Other non-current assets . Accounts payable Accrued inventory liabilities Accrued compensation and related expenses Current income taxes payable Unredeemed gift card liabilit Lease termination liabilities Non-current income taxes payable Other accrued and non-current liabilities \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Year } \\ \hline 2018 & 2017 \\ \hline & \\ $258,662 & $303,381 \\ \hline \end{tabular} Net cash provided by operating activities Cash flows from investing activities Purchase of property and equipmen Settlement of net investment hedges Other investing activities Net cash used in investing activities Cash flows from financing activities Proceeds from settlement of stock-based compensation Taxes paid related to net share settlement of stock-based compensation Repayment of loans Repurchase of common stock Registration fees associated with prospectus supplement Deferred debt financing cost \begin{tabular}{r|r|} 108,235.0 & 87,697.0 \\ 17,610 & 16,822 \\ 6,202.0 & 4,548.0 \\ \hline 11,593.0 & \\ \hline 6,227.0 & \\ \hline 11,416.0 & 17,563.0 \\ \hline \end{tabular} Lululemon Athletica Inc. - Ratios Lululemon Athletica Inc. Consolidated Balance Sheets As at January 28, 2018, January 29, 2017 (In thousands of Canadian dollars) Lululemon Athletica Inc.- Vertical Analysis Consolidated Statements of Earnings For the years ended January 28, 2018 and January 29, 2017 (In thousands of Canadian dollars, unless otherwise indicated) Vertical analysis Net revenue Cost of producing revenue Gross profit Selling, general and administrative expenses Asset impairment and restructuring costs Income from operations Other income (expense), net Income before income tax expense Income tax expense Net income Other comprehensive income (loss), net of tax: Foreign currency translation adjustment Comprehensive income Basic earnings per share Diluted earnings per share Basic weighted-average number of shares outstanding Diluted weighted-average number of shares outstanding \begin{tabular}{|r|r|} \multicolumn{1}{c|}{ Year } & Percent \\ \hline Jan. 28, 201 & \\ \hline $2,649,181. & 100.00% \\ \hline 1,250,391.0 & 47.20% \\ \hline 0.5 & 0.00% \\ \hline 3,997.0 & 0.15% \\ 904,264.0 & 34.13% \\ 113.0 & 0.00% \\ \hline 3,997.0 & 0.15% \\ \hline 459,998 & 17.36% \\ \hline 201,336.0 & 7.60% \\ $258,662.0 & 9.76% \\ \hline & 0.00% \\ \hline 58,577.0 & 2.21% \\ 317,239.0 & 11.97% \\ \hline 1.9 & 0.00% \\ \hline 1.9 & 0.00% \\ \hline 135,988.000 & 5.13% \\ \hline 136,198.000 & 5.14% \\ \hline \end{tabular} Consolidated Balance Sheets As at January 28, 2018, January 29, 2017 (In thousands of Canadian dollars) Consolidated Statements of Cash Flows For the years ended January 28, 2018 and January 29, 2017 (In thousands of Canadian dollars) Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization Stock-based compensation expense Derecognition of unredeemed gift card liability Asset impairment for ivivva restructuring Settlement of derivatives not designated in a hedging relationship Deferred income taxes Changes in operating assets and liabilities: Inventories Prepaid and receivable income taxes Other prepaid expenses and other current assets. Other non-current assets . Accounts payable Accrued inventory liabilities Accrued compensation and related expenses Current income taxes payable Unredeemed gift card liabilit Lease termination liabilities Non-current income taxes payable Other accrued and non-current liabilities \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Year } \\ \hline 2018 & 2017 \\ \hline & \\ $258,662 & $303,381 \\ \hline \end{tabular} Net cash provided by operating activities Cash flows from investing activities Purchase of property and equipmen Settlement of net investment hedges Other investing activities Net cash used in investing activities Cash flows from financing activities Proceeds from settlement of stock-based compensation Taxes paid related to net share settlement of stock-based compensation Repayment of loans Repurchase of common stock Registration fees associated with prospectus supplement Deferred debt financing cost \begin{tabular}{r|r|} 108,235.0 & 87,697.0 \\ 17,610 & 16,822 \\ 6,202.0 & 4,548.0 \\ \hline 11,593.0 & \\ \hline 6,227.0 & \\ \hline 11,416.0 & 17,563.0 \\ \hline \end{tabular} Lululemon Athletica Inc. - Ratios Lululemon Athletica Inc

Hi so I was copying a companys financial documents and was asked to find difference and percentages for H.A and V.A.This is very important for me I need somebody to take a quick look at it and see if I made any mistakes (like naming the ratios, Retail Revenue, etc ) If I can get help ASAP I would really be grateful. (don't mind the big H.A., V.A text I know it's not supposed to be there, its just to demonstrate)

Hi so I was copying a companys financial documents and was asked to find difference and percentages for H.A and V.A.This is very important for me I need somebody to take a quick look at it and see if I made any mistakes (like naming the ratios, Retail Revenue, etc ) If I can get help ASAP I would really be grateful. (don't mind the big H.A., V.A text I know it's not supposed to be there, its just to demonstrate)