Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi someone can help me to get solutions E 11-4B and E 11-13B Please E11-4B: The stockholders' equity section of Baylor Corporation's balance sheet at

Hi someone can help me to get solutions E 11-4B and E 11-13B Please

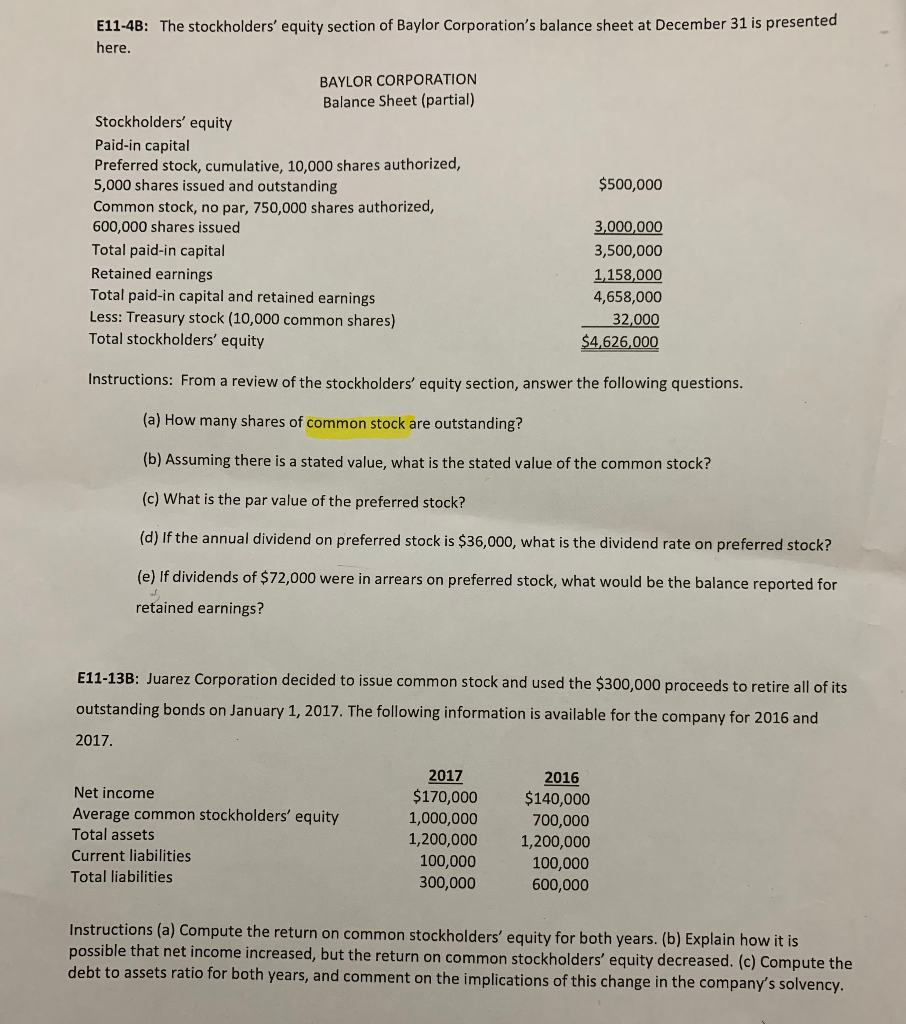

E11-4B: The stockholders' equity section of Baylor Corporation's balance sheet at December 31 is presented here BAYLOR CORPORATION Balance Sheet (partial) Stockholders' equity Paid-in capital Preferred stock, cumulative, 10,000 shares authorized, 5,000 shares issued and outstanding Common stock, no par, 750,000 shares authorized, 600,000 shares issued Total paid-in capital Retained earnings Total paid-in capital and retained earnings Less: Treasury stock (10,000 common shares) Total stockholders' equity $500,000 3,000,000 3,500,000 1158,000 4,658,000 32,000 4.626,000 Instructions: From a review of the stockholders' equity section, answer the following questions. (a) How many shares of common stock are outstanding? (b) Assuming there is a stated value, what is the stated value of the common stock? (c) What is the par value of the preferred stock? (d) If the annual dividend on preferred stock is $36,000, what is the dividend rate on preferred stock? (e) If dividends of $72,000 were in arrears on preferred stock, what would be the balance reported for retained earnings? E11-138: Juarez Corporation decided to issue common stock and used the $300,000 proceeds to retire all of its outstanding bonds on January 1, 2017. The following information is available for the company for 2016 and 2017 2017 2016 Net income Average common stockholders' equity Total assets Current liabilities Total liabilities $170,000 $140,000 700,000 1,200,000 1,200,000 100,000 600,000 1,000,000 100,000 300,000 Instructions (a) Compute the return on common stockholders' equity for both years. (b) Explain how it is possible that net income increased, but the return on common stockholders' equity decreased. (c) Compute the debt to assets ratio for both years, and comment on the implications of this change in the company's solvencyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started