Answered step by step

Verified Expert Solution

Question

1 Approved Answer

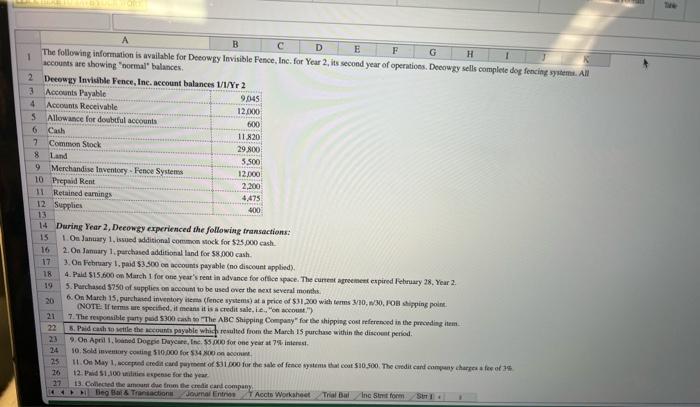

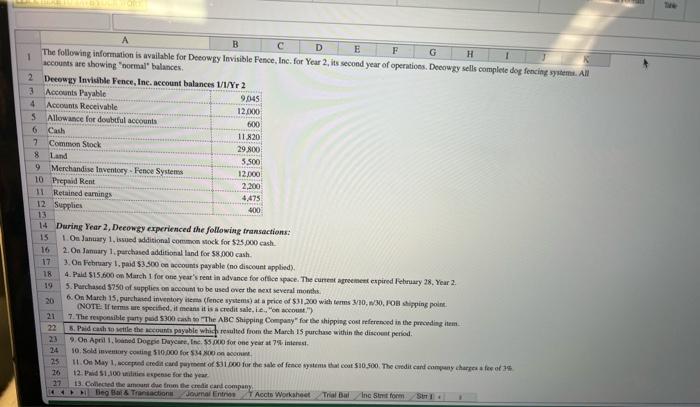

Hi teachers1 if someone could help me complete thus financial statement. thank you! The following inforutation is available for Deeowgy Invisible Fence, Inc. for Year

Hi teachers1 if someone could help me complete thus financial statement. thank you!

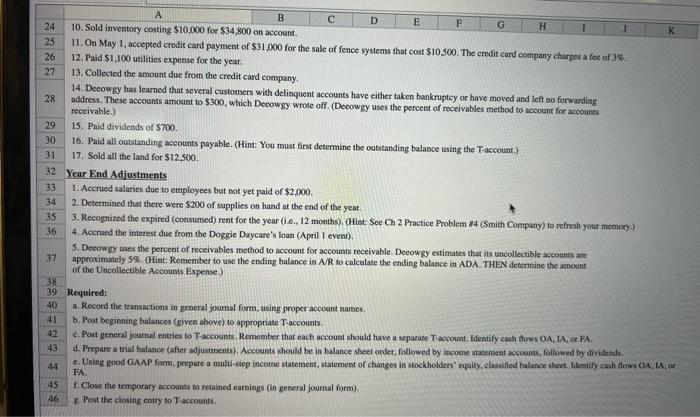

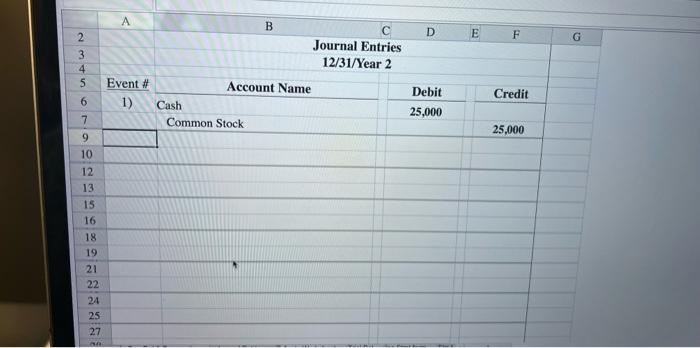

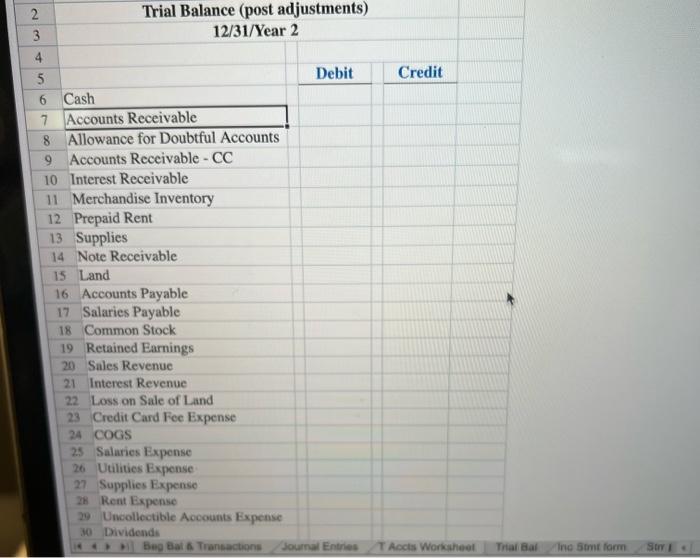

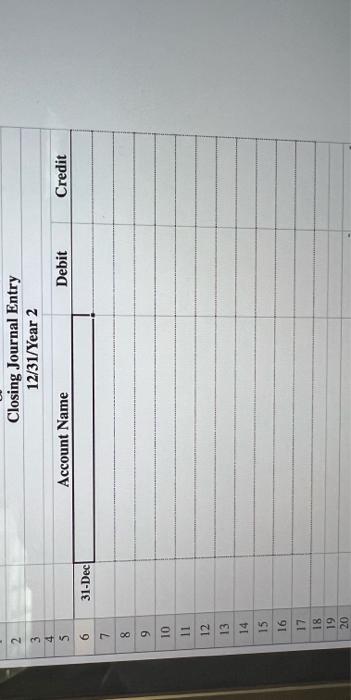

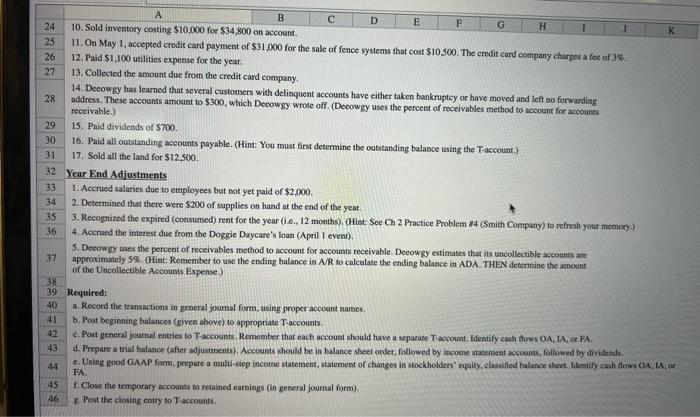

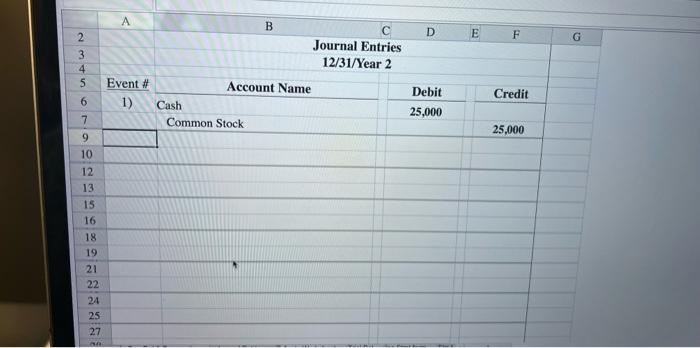

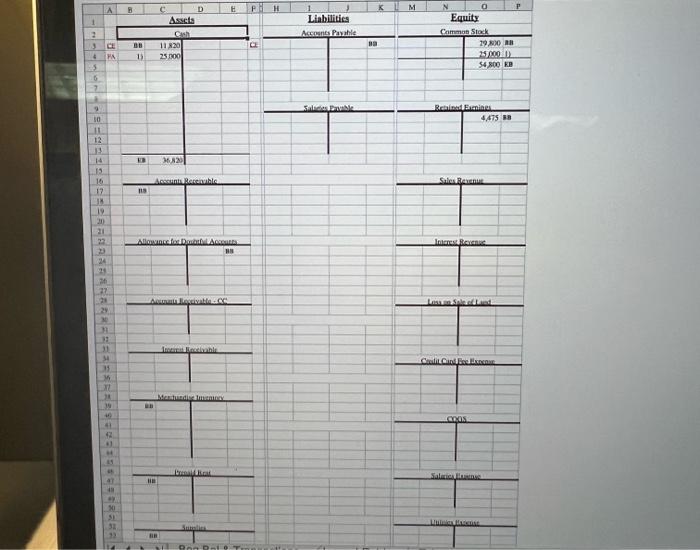

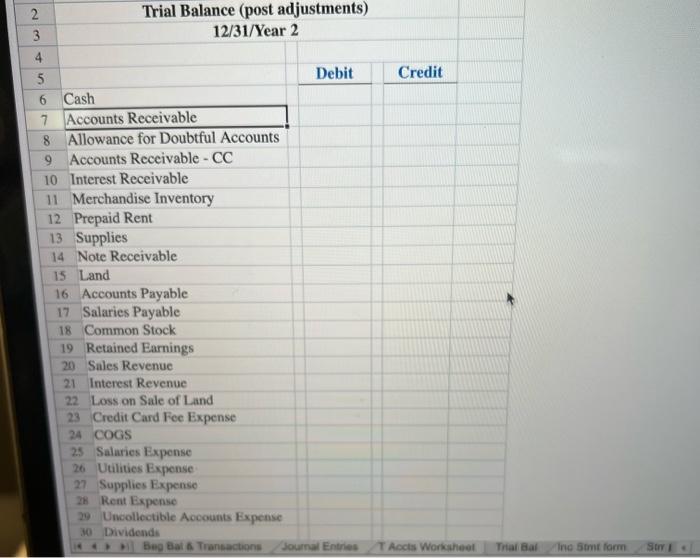

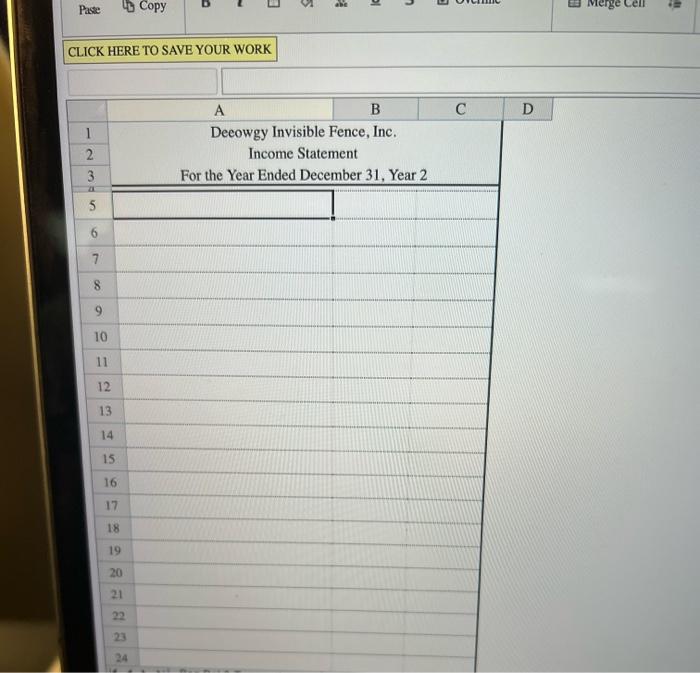

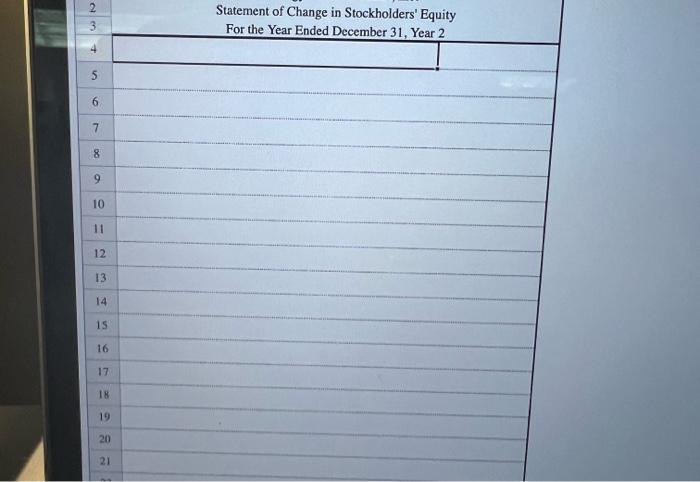

The following inforutation is available for Deeowgy Invisible Fence, Inc. for Year 2, its second year of operatiobs. Decougy sells complete dog fencing syidems. Alil accousts are ahowing "normal" balances. Decow Invisible Fence. Ine. acouunt bek. 1.4 Daring Year 2, Decowgy experienced the following transactions: 15 1. On January 1 , issued additional common sock for $2.5,000 eash. 2. On January 1 , perchased additional land for 580000 cash. 3. On February 1. paid 53.500 ca accounts payable (no disceunt applied). 4. Paia 515.600 on March 1 for one year's rent in advance foe otflee space. The curtet agrecinert expired I ebruary 28 , Year 2. 5. Purchased 5750 of supplies on account io be used ever the dext several months. 6. On Mareh 15, purchaied inventory ilema (fence systems) at a price of $31,200 wich terms 3/20, n/30, 10 alioping point. QNOTte If temes are specified, it meant it is a credit sale, ie, "ce aceouet.7 5. Peid cadh wo retile the aesounti payable whicp resulted from the March is gurchuse within the discoent period. 10, sold inveminy coeting 510,000 for 5.44 Not on accoun. 12. Paid 51.100 atilitios espense foe the yrar. 13. Collected the amcurt due from the credir cant company. 11. On May 1, accepecd credit card payment of $31,000 for the sale of fence systems that cost $10.500. The credit eard company charges a fee of 3%. 12. Paid $1,100 utilities expense for the year. 13. Collected the amount due from the credit card company, 14. Decowgy has learned that several customers with delinquent accounts have either taken bankruptcy or bave moved and left ao forwarding address. These accounts amoqant to $300, which Deeowgy wroge off. (Deeowgy uses the percent of receivables method to aceount for accounts. receivable.) 15. Paid dividends of 5700. 16. Paid all outstanding accounts payable. (Hint: You must first determine the outstanding balance using the T-account.) 17. Sold all the land for $12500. 2 Year Find Adjustments 1. Acerued salaries due to ertiployees but not yet paid of $2,000. 2. Determined that there were $200 of supplies on hand at the end of the year. 3. Recognized the expired (coasumed) rent for the year (i.e., 12 months), (Hibt- See Ch 2 Practice Problem 14 (Smith Conpany) to refresh yotr memory.) 4. Accrued the interest due from the Doggie Daycare's loan (April I event). 5. Decowgy ases the percent of receivables method to account for accounts receivable. Deeowgy estimates that its uncollectible accounts are approximstely 5%. (Hint: Remember to use the ending balance in AMR to calcalate the ending balance in ADA. THEN determine the amount of the Uncollectible Acoounts Expense.) Required: a. Recond the transactions in general joumal form. using proper account names. 6. Post beginning balances (given above) to appropriate Taccounts. c. Post general joomal entries to T-accounts. Remember that each account should have a separate Taccount, Identify cash Alows OA, MA, of FA. d. Prepare a trial balance (afier adjustments). Accounts should be in balance sheet order, followed by incoene statement accounts, folloned by divileads. e. Using good GAAP form, prepare a multi-itep income slatement, staiement of changes in stockholders" equity, classified balance sheet. Identify cash flows OA, UA, o FA. f. Close the temporary accoupts to retained earnings (in general joumal form). 8. Post the closing eotry to T-accounts. 2 Trial Balance (post adjustments) 12/31/Year 2 CLICK HERE TO SAVE YOUR WORK \begin{tabular}{|c|c|c|} \hline & A & B \\ \hline 1 & Deeowgy Invisible Fence, Inc. \\ \hline 2 & Income Statement \\ \hline 3 & For the Year Ended December 31, Year 2 \\ \hline 4 & \\ \hline 6 & \\ \hline 7 & \\ \hline 8 & \\ \hline 9 & \\ \hline 10 & \\ \hline 11 & \\ \hline 12 & 13 \\ \hline 14 \\ \hline 15 \\ \hline 16 \\ \hline 17 & \\ \hline 18 \\ \hline 19 \\ \hline 20 \\ \hline 21 \\ \hline 22 \\ \hline 23 \\ \hline 24 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline 2 & \multicolumn{1}{|c|}{ Closing Journal Entry } \\ \hline 3 & \multicolumn{12}{|c|}{12/31/Year2} & \\ \hline 4 & & Account Name & \\ \hline 5 & & & \\ \hline 6 & 31-Dec & & \\ \hline 7 & & & \\ \hline 8 & & & \\ \hline 9 & & & \\ \hline 10 & & & \\ \hline 11 & & & \\ \hline 12 & & & \\ \hline 13 & & & \\ \hline 14 & & & \\ \hline 15 & & & \\ \hline 16 & & & \\ \hline 17 & & & \\ \hline 18 & & & \\ \hline 19 & & & \\ \hline 20 & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started