Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi... The question is complete and it consistis A and B B has I and II In overall the question is about 2 pages that

Hi... The question is complete and it consistis A and B B has I and II

In overall the question is about 2 pages that has been attage.

full answer work in excel is prefered..

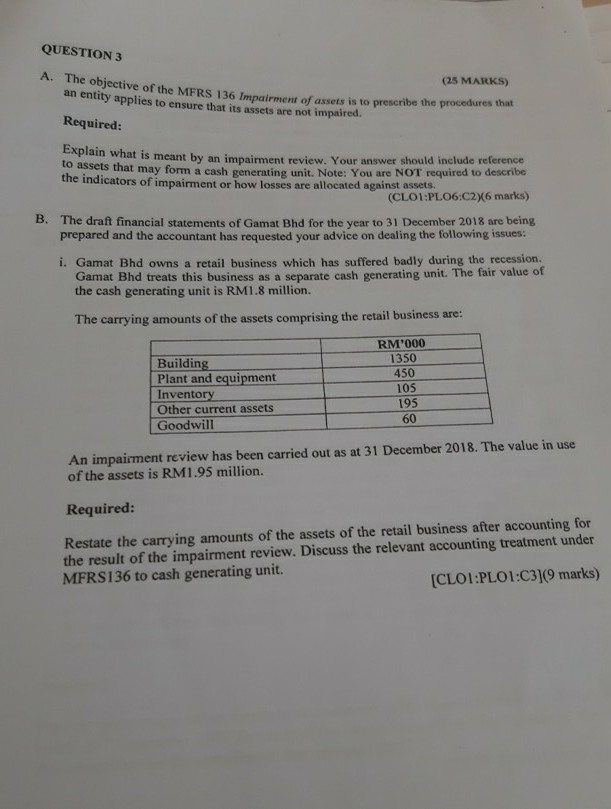

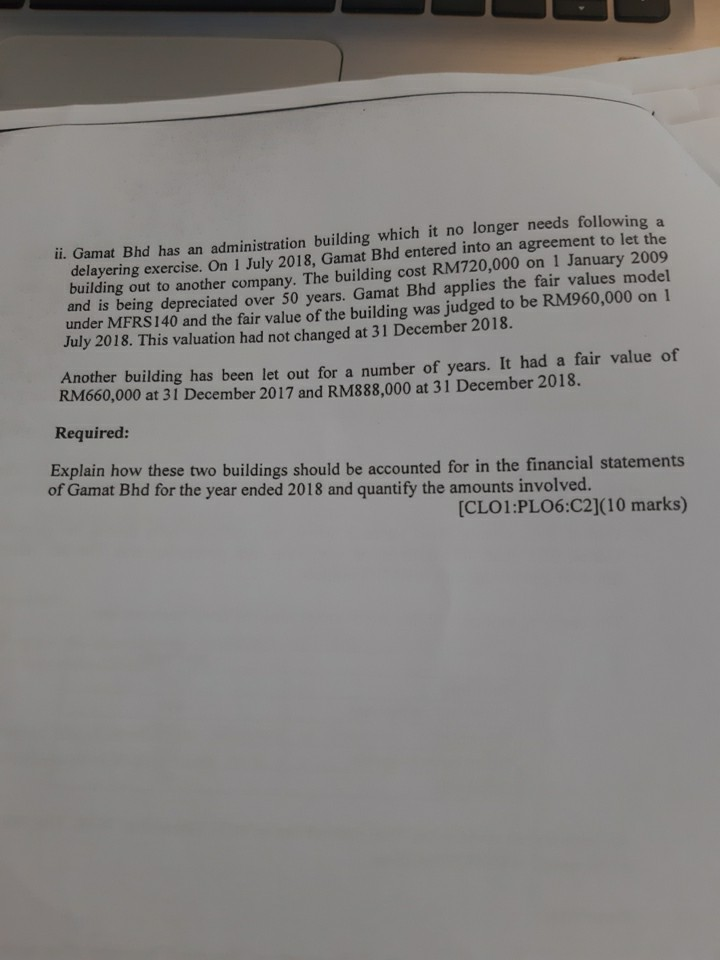

QUESTION 3 (25 MARKS) A. The objective of the MFRS 136 Impairment of assets is to prescribe the procedures that an entity applies to ensure that its assets are not impaired. Required: Explain what is meant by an impairment review. Your answer should include reference to assets that may form a cash generating unit. Note: You are NOT required to describe the indicators of impairment or how losses are allocated against assets. (CLOI:PLO6:C2X6 marks) B. The draft financial statements of Gamat Bhd for the year to 31 December 2018 are being prepared and the accountant has requested your advice on dealing the following issues: i. Gamat Bhd owns a retail business which has suffered badly during the recession. Gamat Bhd treats this business as a separate cash generating unit. The fair value of the cash generating unit is RM1.8 million. The carrying amounts of the assets comprising the retail business are: Building Plant and equipment Inventory Other current assets Goodwill RM"000 1350 450 105 195 60 An impairment review has been carried out as at 31 December 2018. The value in use of the assets is RM1.95 million. Required: Restate the carrying amounts of the assets of the retail business after accounting for the result of the impairment review. Discuss the relevant accounting treatment under MFRS136 to cash generating unit. [CLO1:PLO1:C3](9 marks) ii. Gamat Bhd has an administration building which it no longer needs following a delayering exercise. On 1 July 2018, Gamat Bhd entered into an agreement to let the building out to another company. The building cost RM720,000 on 1 January 2009 and is being depreciated over 50 years. Gamat Bhd applies the fair values model under MFRS 140 and the fair value of the building was judged to be RM960,000 on 1 July 2018. This valuation had not changed at 31 December 2018. Another building has been let out for a number of years. It had a fair value of RM660,000 at 31 December 2017 and RM888,000 at 31 December 2018. Required: Explain how these two buildings should be accounted for in the financial statements of Gamat Bhd for the year ended 2018 and quantify the amounts involved. [CLO1:PLO6:02](10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started