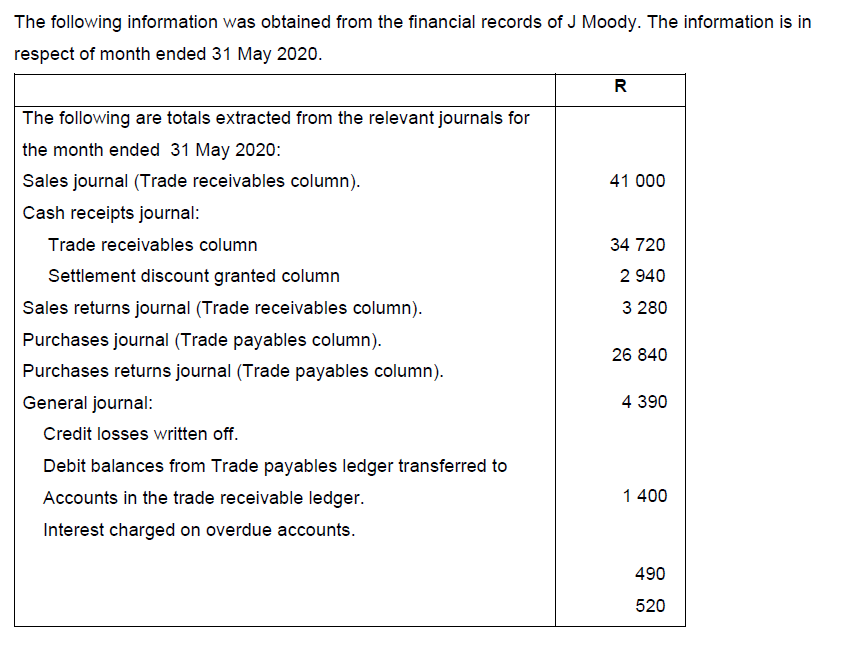

Question

Hi, the solution for the below is available on Chegg but i have some doubts and need some clarification. My workings and assumptions are below:

Hi,

the solution for the below is available on Chegg but i have some doubts and need some clarification. My workings and assumptions are below: Please let me know what I am doing wrong? Also, I can see that there are 5 answers for this question on Chegg but I am only able to view one answer, how do I view others? Or does Chegg only provide one answer per question.

Assumptions I made:

The R34720 already include the discount allowed

Sales overstated by 2000

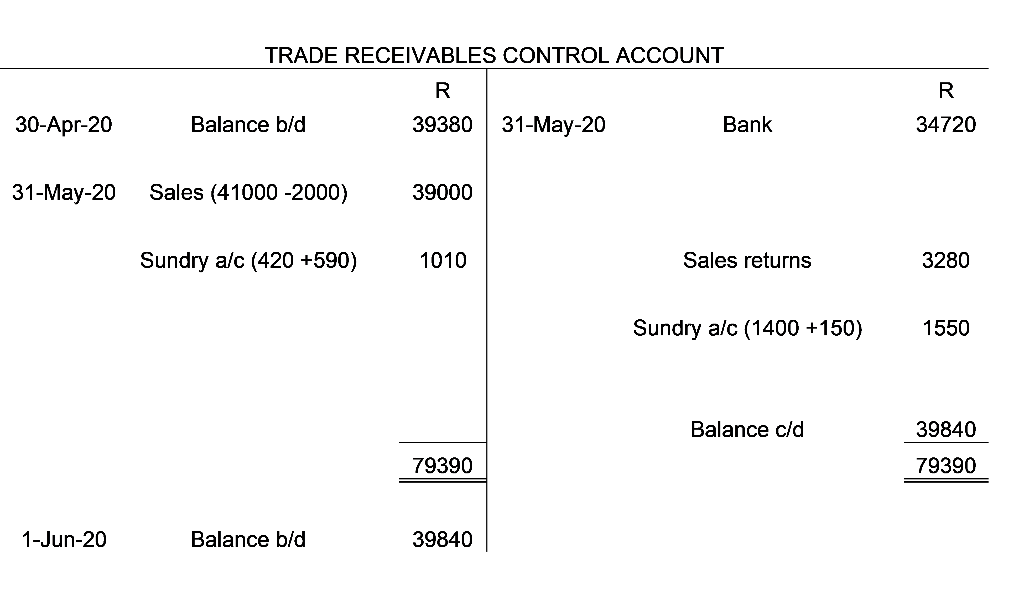

Calculations

Sales = 41000 - 2000 (Point 4 from notes. K Lever - Sales Journal overstated by R2000)

= 39000

Sundry a/c: General journals

Debits:

- Debit balances from Trade payables ledger transferred to accounts in the trade receivable ledger = R490

- Interest charged on overdue accounts = 520

- Sundry a/c Debit = 490 + 520 = 1010

Credits:

- Credit losses written off = 1400

- ( Point 3 from notes ) Amount of R150 received from N Peter in full settlement of his account analyzed as sales in CRJ

- Sundry a/c Credit = 1400 + 150 = 1550

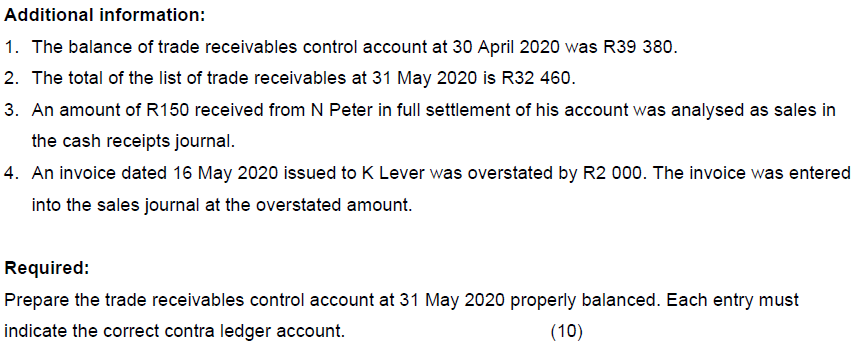

Reconciliation

List of trade receivables as at 31 May 2020 32460

Correction of error N Peter (150)

Balance as per Trade Receivables Control a/c 32310

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started