Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi there, can you please answer these parts in a neat format please, it will be much appreciated. Will give upvote. Thanks :D {NO EXCEL}

Hi there, can you please answer these parts in a neat format please, it will be much appreciated. Will give upvote. Thanks :D {NO EXCEL}

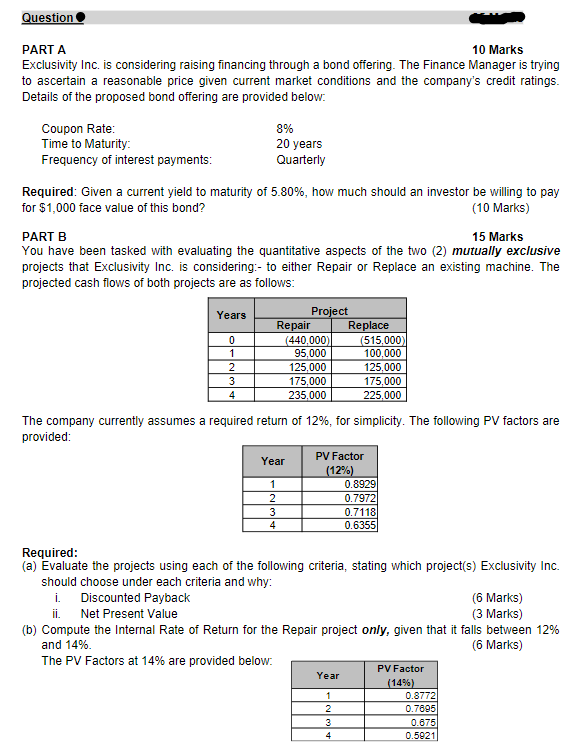

PART A 10 Marks Exclusivity Inc. is considering raising financing through a bond offering. The Finance Manager is trying to ascertain a reasonable price given current market conditions and the company's credit ratings. Details of the proposed bond offering are provided below: Required: Given a current yield to maturity of 5.80%, how much should an investor be willing to pay for $1,000 face value of this bond? (10 Marks) PART B 15 Marks You have been tasked with evaluating the quantitative aspects of the two (2) mutually exclusive projects that Exclusivity Inc. is considering:- to either Repair or Replace an existing machine. The projected cash flows of both projects are as follows: The company currently assumes a required return of 12%, for simplicity. The following PV factors are provided: Required: (a) Evaluate the projects using each of the following criteria, stating which project(s) Exclusivity Inc. should choose under each criteria and why: i. Discounted Payback (6 Marks) ii. Net Present Value (3 Marks) (b) Compute the Internal Rate of Return for the Repair project only, given that it falls between 12% and 14%. (6 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started