Question

Hi there, Case study (Accounting questions) solution required for questions e, i and j only regarding Chicago Corpration Case at chapter 17, the case no

Hi there,

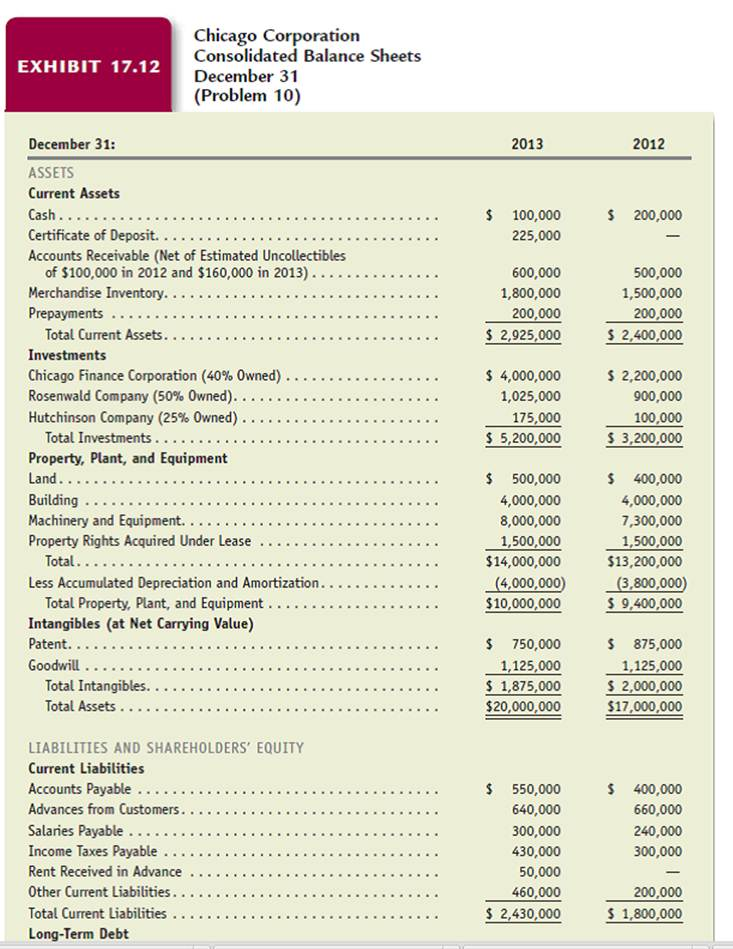

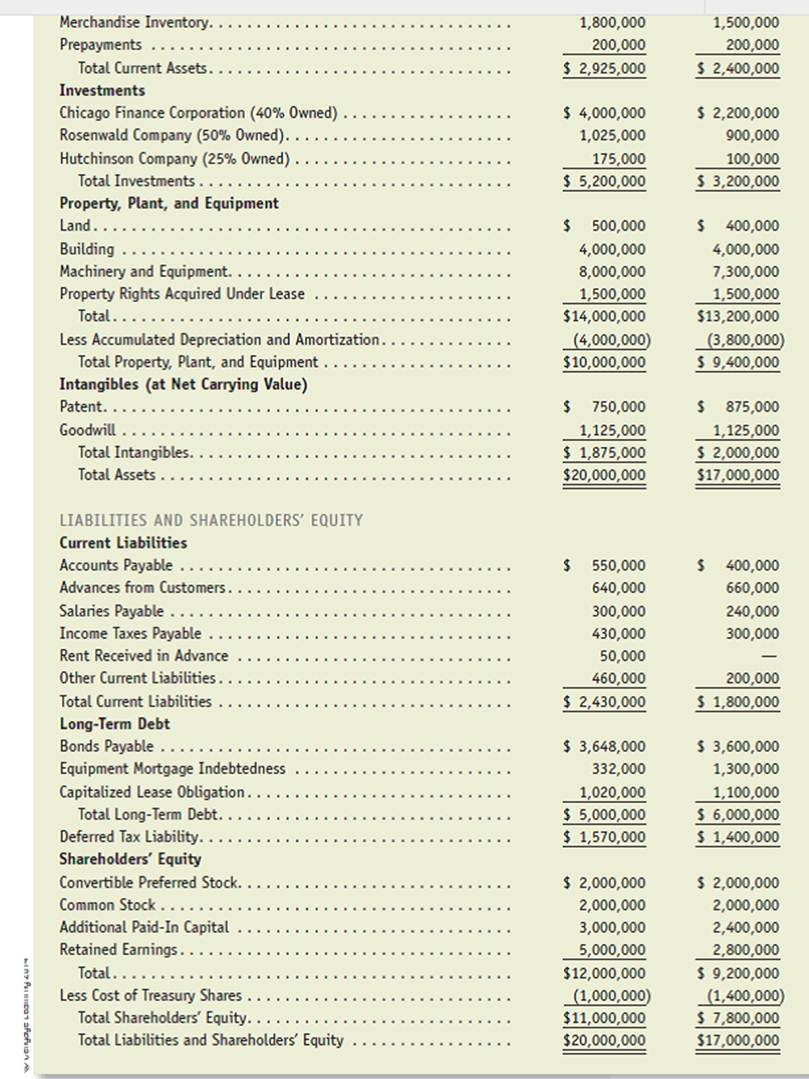

Case study (Accounting questions) solution required for questions e, i and j only regarding Chicago Corpration Case at chapter 17, the case no is 10p in (Financial Accounting Book (14th Edition). i was able to find the case but there is no answers! I have attached the financials as PDF also here is the link to the case, it includes all financial statements you need, your help is highly appreciated.

here is the link to the case in Chegg websit

http://www.chegg.com/homework-help/comprehensive-review-problem-exhibits-1711-1712-present-part-chapter-17-problem-10p-solution-9781111823450-exc

the case from this book (Financial Accounting Book (14th Edition)

here is the link to the book the case from:

http://www.chegg.com/textbooks/financial-accounting-14th-edition-9781111823450-1111823456?trackid=51e6b63a&strackid=29013c2d&ii=1

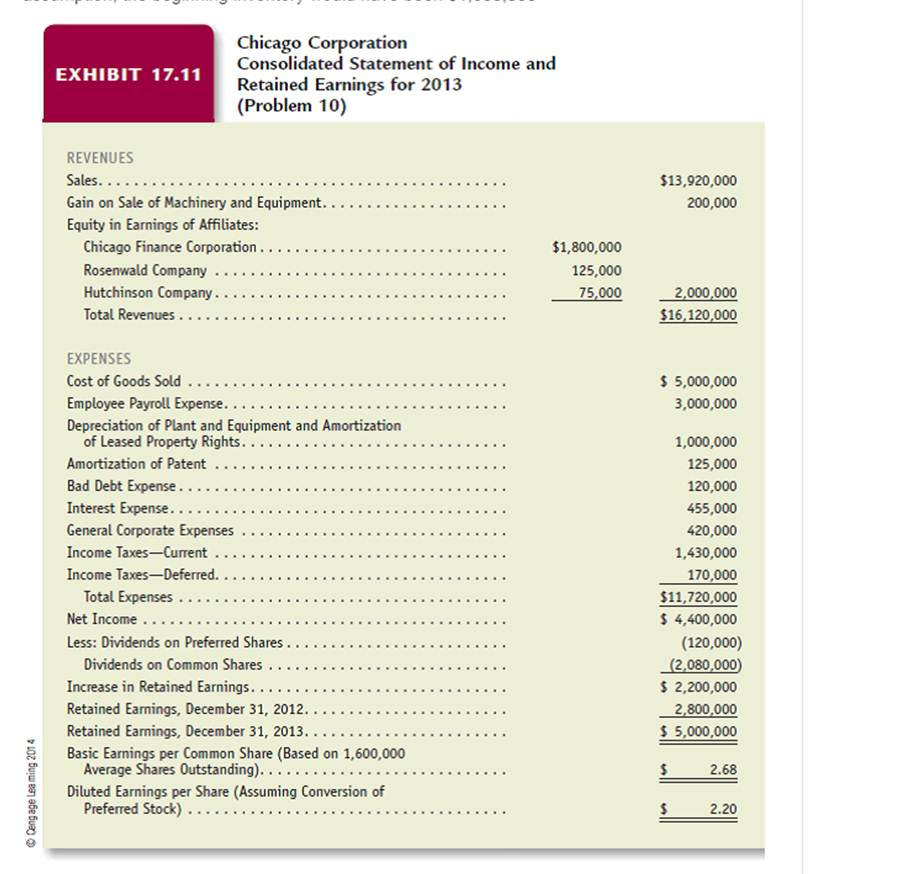

Dividend declared by Chicago Finance Corporation in 2013 is $1,800,000.

Dividend declared by Rosenwald Company in 2013 is $125,000.

Dividend declared by Hutchinson Company in 2013 is $75,000.

The dividends declared by these companies are recorded in Consolidated statement of income as Revenue from Equity in earnings of affiliates. So, we knew from this amount of dividend declared by each company.

all financial statements are available below along with the questions:

:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started