Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi there, Could you please solve it for me and plz use Excel .. Thanks Consider an option on a stock when the stock price

Hi there,

Could you please solve it for me and plz use Excel ..

Thanks

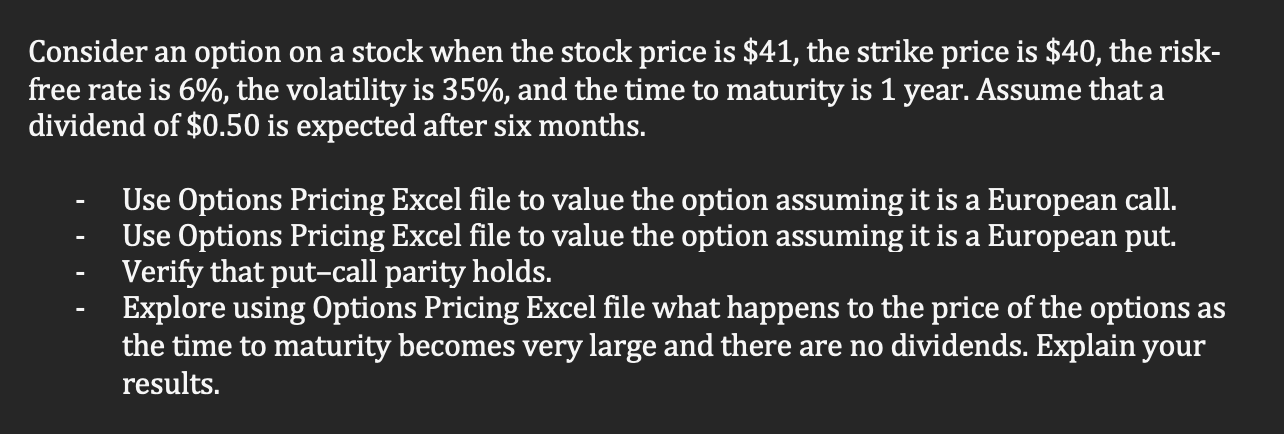

Consider an option on a stock when the stock price is $41, the strike price is $40, the risk- free rate is 6%, the volatility is 35%, and the time to maturity is 1 year. Assume that a dividend of $0.50 is expected after six months. Use Options Pricing Excel file to value the option assuming it is a European call. Use Options Pricing Excel file to value the option assuming it is a European put. Verify that put-call parity holds. Explore using Options Pricing Excel file what happens to the price of the options as the time to maturity becomes very large and there are no dividends. Explain your results. Consider an option on a stock when the stock price is $41, the strike price is $40, the risk- free rate is 6%, the volatility is 35%, and the time to maturity is 1 year. Assume that a dividend of $0.50 is expected after six months. Use Options Pricing Excel file to value the option assuming it is a European call. Use Options Pricing Excel file to value the option assuming it is a European put. Verify that put-call parity holds. Explore using Options Pricing Excel file what happens to the price of the options as the time to maturity becomes very large and there are no dividends. Explain your resultsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started