hi there, here there is my question and answer. I was wondering can you help me to verify whether answer is correct or not if there are some errors in ky answers please clarify it

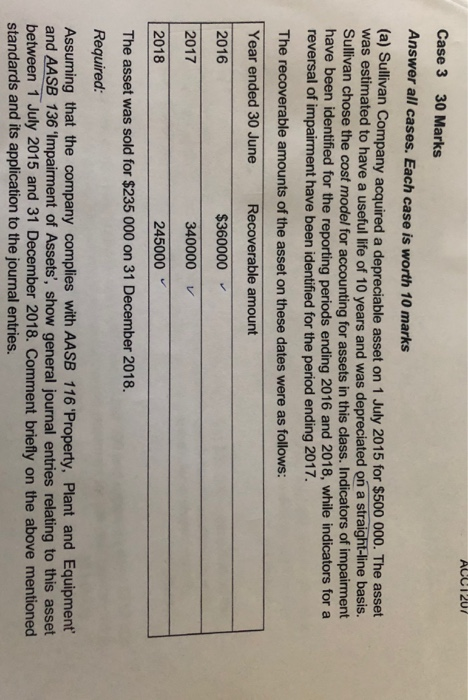

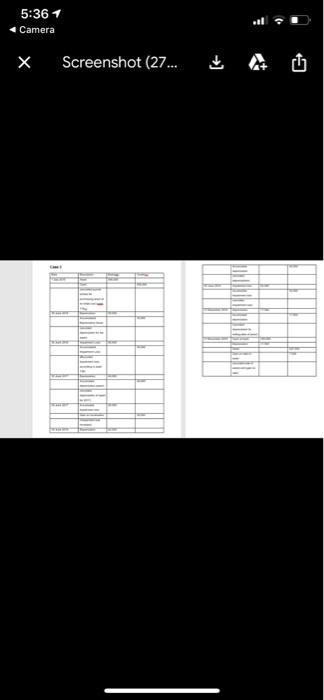

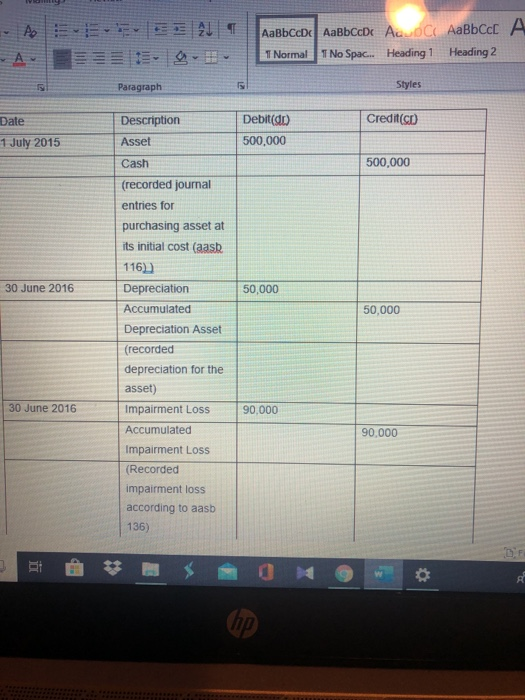

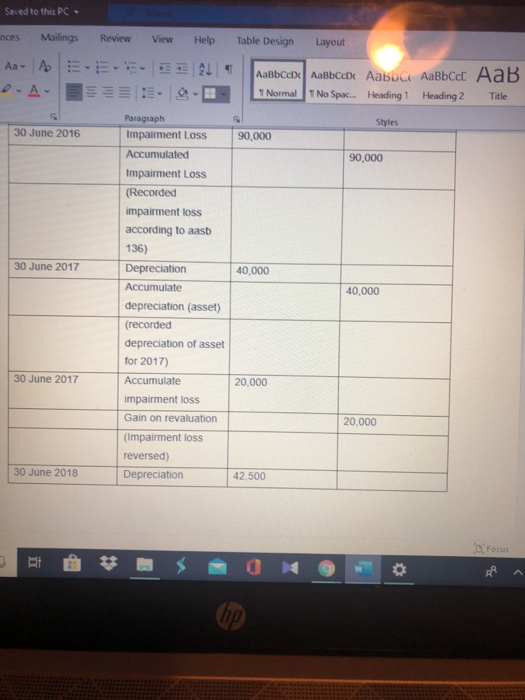

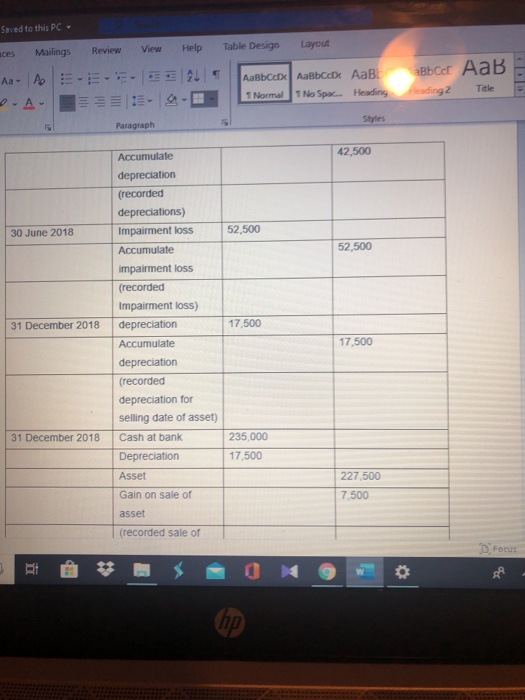

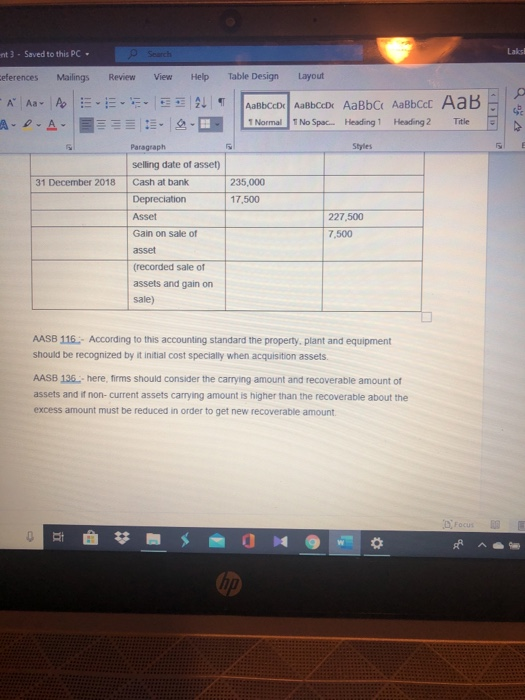

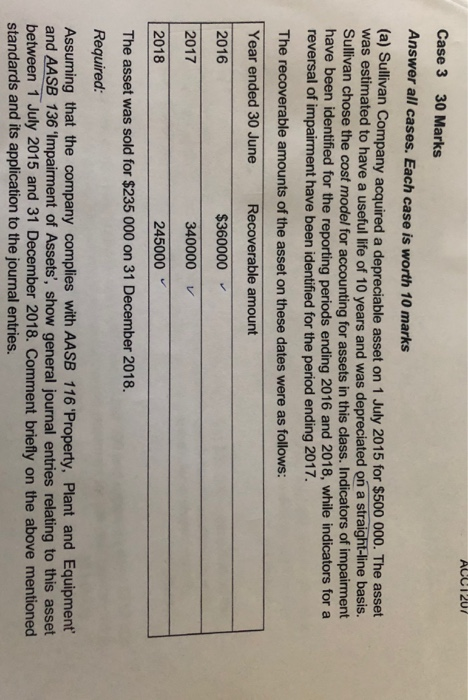

ACC1207 Case 3 30 Marks Answer all cases. Each case is worth 10 marks (a) Sullivan Company acquired a depreciable asset on 1 July 2015 for $500 000. The asset was estimated to have a useful life of 10 years and was depreciated on a straight-line basis. Sullivan chose the cost model for accounting for assets in this class. Indicators of impairment have been identified for the reporting periods ending 2016 and 2018, while indicators for a reversal of impairment have been identified for the period ending 2017. The recoverable amounts of the asset on these dates were as follows: Year ended 30 June Recoverable amount 2016 $360000 2017 340000 V 2018 245000 The asset was sold for $235 000 on 31 December 2018. Required: Assuming that the company complies with AASB 116 'Property, Plant and Equipment' and AASB 136 'Impairment of Assets', show general journal entries relating to this asset between 1 July 2015 and 31 December 2018. Comment briefly on the above mentioned standards and its application to the journal entries. 5:36 1 Camera Screenshot (27... 5 A U A AJ AaBbccdc AabbccDc Acc Aabbcc A T No Spac... Heading 1 Heading 2 1 Normal Paragraph Styles Date Credit() Description Asset Debit(do 500,000 1 July 2015 Cash 500,000 30 June 2016 50,000 50,000 (recorded journal entries for purchasing asset at its initial cost (aash 116) Depreciation Accumulated Depreciation Asset (recorded depreciation for the asset) Impairment Loss Accumulated Impairment Loss (Recorded impairment loss according to aasb 136) 30 June 2016 90.000 90.000 OP Saved to this PC- nces Mailings Review View Help Table Design Layout Aa A EL A Normal T No Spac... Heading 1 Heading 2 Title Styles 30 June 2016 90,000 90,000 30 June 2017 40,000 40,000 Paragraph Impairment Loss Accumulated Impairment Loss (Recorded impairment loss according to aasb 136) Depreciation Accumulate depreciation (asset) (recorded depreciation of asset for 2017) Accumulate impairment loss Gain on revaluation (Impairment loss reversed) Depreciation 30 June 2017 20,000 20,000 30 June 2018 42.500 D Focus i # ap Seved to this PC- Mailings View Review Help Layout ces Table Design Aa A - 2 1 Normal No Spac Heading Heading 2 Title D-A- Styles Paragraph 42,500 30 June 2018 52,500 52,500 Accumulate depreciation (recorded depreciations) Impairment loss Accumulate impairment loss (recorded Impairment loss) depreciation Accumulate depreciation (recorded depreciation for selling date of asset) Cash at ba 31 December 2018 17,500 17.500 31 December 2018 235,000 17,500 Depreciation Asset 227.500 7.500 Gain on sale of asset (recorded sale of Focus o A nt 3 - Saved to this PC- Ceferences Mailings Review View Help Table Design Layout -EEEE 2 T - A- Ao A 1 Normal 1 No Spac... Heading 1 Heading 2 Title Styles 31 December 2018 235,000 17,500 Paragraph seling date of asset) Cash at bank Depreciation Asset Gain on sale or asset (recorded sale of assets and gain on sale) 227,500 7,500 AASB 116. According to this accounting standard the property, plant and equipment should be recognized by it initial cost specially when acquisition assets. AASB 136 here, firms should consider the carrying amount and recoverable amount of assets and if non-current assets carrying amount is higher than the recoverable about the excess amount must be reduced in order to get new recoverable amount. D. Focus hp)