Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi there, hope all is well, i was wondering if someone can help me to solve this problem. I posted this earlier and someone showed

Hi there, hope all is well, i was wondering if someone can help me to solve this problem. I posted this earlier and someone showed the decison tree without showing the calculation , so i am having a hard time understanding how to do the calcs for it. Can someone please help me to solve this problem by showing the formulas and decision tree please ? Thanks for all the help.

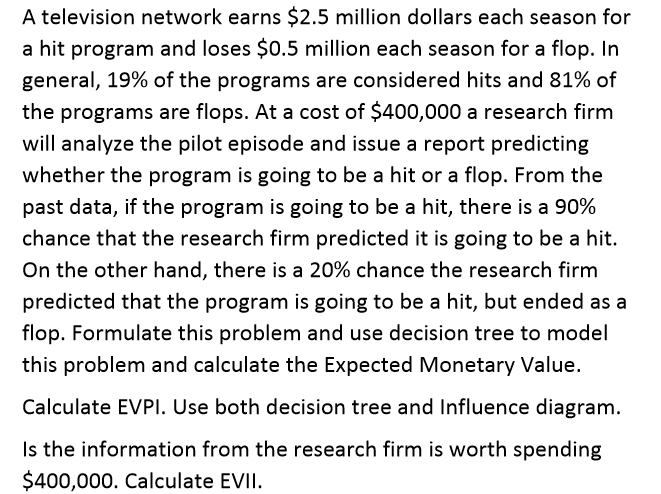

A television network earns $2.5 million dollars each season for a hit program and loses $0.5 million each season for a flop. In general, 19% of the programs are considered hits and 81% of the programs are flops. At a cost of $400,000 a research firm will analyze the pilot episode and issue a report predicting whether the program is going to be a hit or a flop. From the past data, if the program is going to be a hit, there is a 90% chance that the research firm predicted it is going to be a hit. On the other hand, there is a 20% chance the research firm predicted that the program is going to be a hit, but ended asa flop. Formulate this problem and use decision tree to model this problem and calculate the Expected Monetary Value. Calculate EVPI. Use both decision tree and Influence diagram Is the information from the research firm is worth spending 400,000. Calculate EVII

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started