Hi there

I know i am only allowed 4 mc but i am short on time i need help please. These are the last batch of my questions. Please someone nice help me and i will hit LIKE. Thank you nice person!!

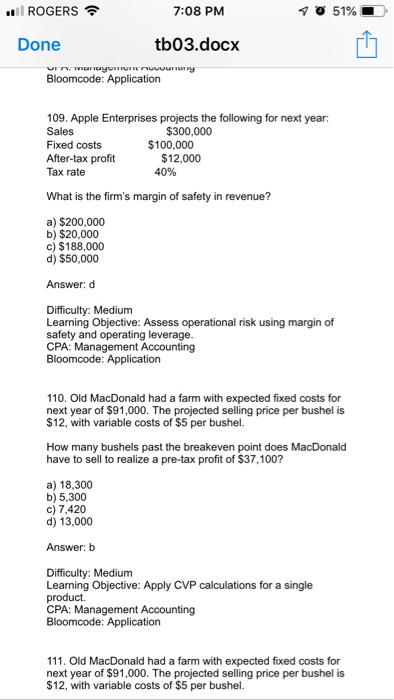

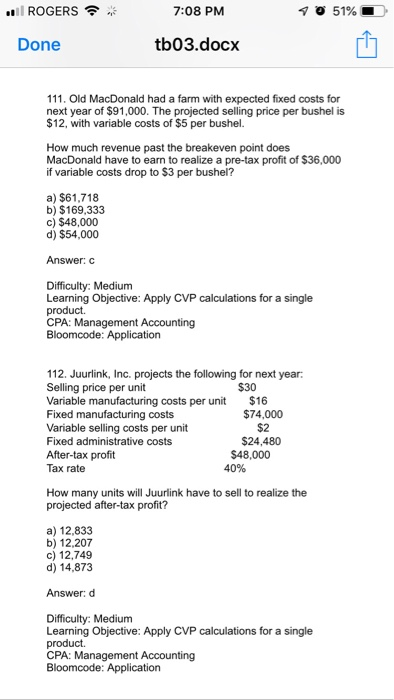

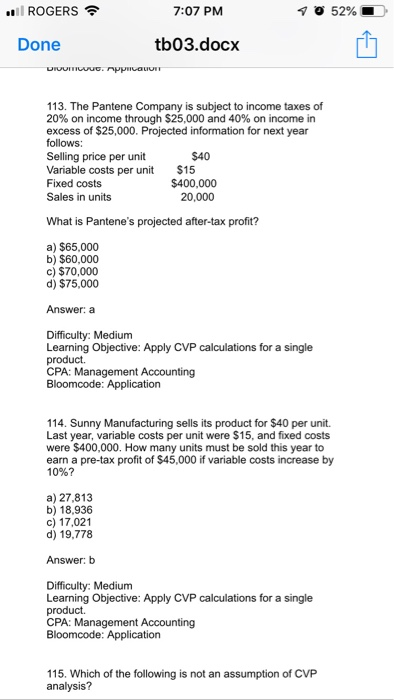

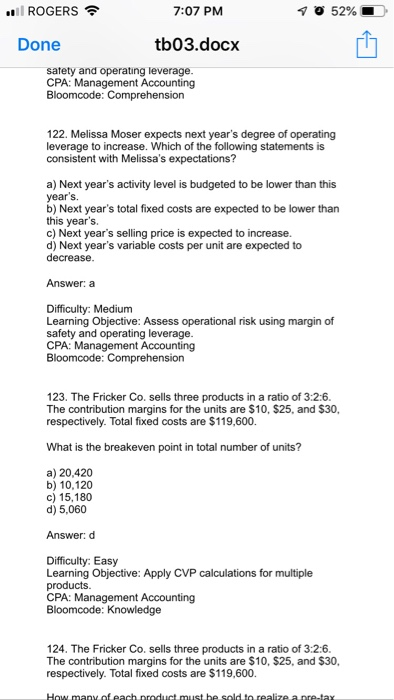

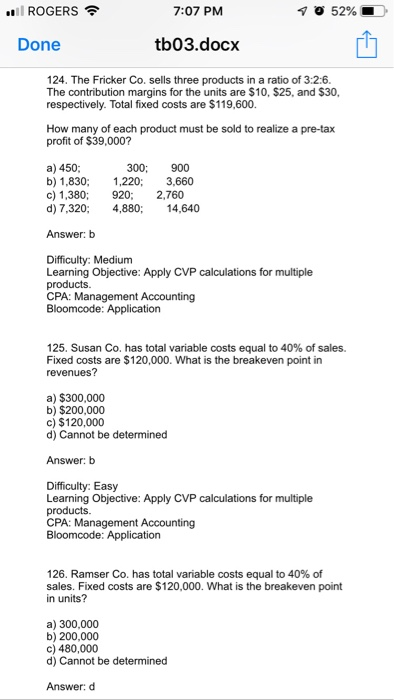

ROGERS 7:08 PM Done tb03.docx 109. Apple Enterprises projects the following for next year: Sales Fixed costs After-tax profit Tax rate $300,000 $100,000 $12,000 40% What is the firm's margin of safety in revenue? a) $200,000 b) $20,000 c) $188,000 d) $50,000 Answer: d Difficulty: Medium Learning Objective: Assess operational risk using margin of safety and operating leverage CPA: Management Accounting 110. Old MacDonald had a farm with expected fixed costs for next year of $91,000. The projected selling price per bushel is $12, with variable costs of $5 per bushel. How many bushels past the breakeven point does MacDonald have to sell to realize a pre-tax profit of $37,100? a) 18,300 b) 5,300 c) 7,420 d) 13,000 Answer: b Difficulty: Medium Learning Objective: Apply CVP calculations for a single product. 111. Old MacDonald had a farm with expected fixed costs for next year of $91,000. The projected selling price per bushel is $12, with variable costs of $5 per bushel. .'Il ROGERS.. 7:08 PM Done tb03.docx 111. Old MacDonald had a farm with expected fixed costs for next year of $91,000. The projected selling price per bushel is $12, with variable costs of $5 per bushel. How much revenue past the breakeven point does MacDonald have to earn to realize a pre-tax profit of $36,000 if variable costs drop to $3 per bushel? a) $61,718 b) $169,333 c) $48,000 d) $54,000 Answer: c Difficulty: Medium Learning Objective: Apply CVP calculations for a single product. CPA: Management Accounting 112. Juurlink, Inc. projects the following for next year Selling price per unit Variable manufacturing costs per unit $16 Fixed manufacturing costs Variable selling costs per unit Fixed administrative costs After-tax profit Tax rate S30 $74,000 $2 $24,480 $48,000 40% How many units will Juurlink have to sell to realize the projected after-tax profit? a) 12,833 b) 12,207 c) 12,749 d) 14,873 Answer: d Difficulty: Medium Learning Objective: Apply CVP calculations for a single product. CPA: Management Accounting ROGERS 7:07 PM Done tb03.docx 113. The Pantene Company is subject to income taxes of 20% on income through $25,000 and 40% on income in excess of $25,000. Projected information for next year follows: Selling price per unit Variable costs per unit $15 Fixed costs Sales in units $40 $400,000 20,000 What is Pantene's projected after-tax profit? a) $65,000 b) $60,000 c) $70,000 d) $75,000 Answer: a Difficulty: Medium Learning Objective: Apply CVP calculations for a single product. CPA: Management Accounting 114. Sunny Manufacturing sells its product for $40 per unit. Last year, variable costs per unit were $15, and fixed costs were $400,000. How many units must be sold this year to earn a pre-tax profit of $45,000 if variable costs increase by 10%? a) 27,813 b) 18,936 c) 17,021 d) 19,778 Answer: b Difficulty: Medium Learning Objective: Apply CVP calculations for a single product. CPA: Management Accounting 115. Which of the following is not an assumption of CVP analysis? ROGERS 7:07 PM Done tb03.docx satety and operating leverage 122. Melissa Moser expects next year's degree of operating leverage to increase. Which of the following statements is consistent with Melissa's expectations? a) Next year's activity level is budgeted to be lower than this year's. b) Next year's total fixed costs are expected to be lower than this year's. c) Next year's selling price is expected to increase. d) Next year's variable costs per unit are expected to decrease Answer: a Difficulty: Medium Learning Objective: Assess operational risk using margin of safety and operating leverage CPA: Management Accounting 123. The Fricker Co. sells three products in a ratio of 3:2:6 The contribution margins for the units are $10, $25, and $30, respectively. Total fixed costs are $119,600. What is the breakeven point in total number of units? a) 20,420 b) 10,120 c) 15,180 d) 5,060 Answer: d Difficulty: Easy Learning Objective: Apply CVP calculations for multiple products. 124. The Fricker Co. sells three products in a ratio of 3:2:6 The contribution margins for the units are $10, $25, and $30, respectively. Total fixed costs are $119,600. ROGERS 7:07 PM Done tb03.docx 124. The Fricker Co. sells three products in a ratio of 3:2:6 The contribution margins for the units are $10, $25, and $30, respectively. Total fixed costs are $119,600. How many of each product must be sold to realize a pre-tax profit of $39,000? a) 450: b) 1,830; 1,220; 3,660 c) 1,380 920 2,760 d) 7,320; 4,880 14,640 300: 900 Answer: b Difficulty: Medium Learning Objective: Apply CVP calculations for multiple products. CPA: Management Accounting 125. Susan Co. has total variable costs equal to 40% of sales. Fixed costs are $120,000. What is the breakeven point in revenues? a) $300,000 b) $200,000 c) $120,000 d) Cannot be determined Answer: b Difficulty: Easy Learning Objective: Apply CVP calculations for multiple CPA: Management Accounting 126, Ramser Co. has total variable costs equal to 40% of sales. Fixed costs are $120,000. What is the breakeven point in units? a) 300,000 b) 200,000 c) 480,000 d) Cannot be determined Answer: d