Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HI THERE. I NEED A HELP TO SOLVE Q1 a i, ii , iii and iv ? i am stucked pls help me guys !!!

HI THERE. I NEED A HELP TO SOLVE Q1 a i, ii , iii and iv ? i am stucked pls help me guys !!! emergency !! will be grateful if anyone could help me

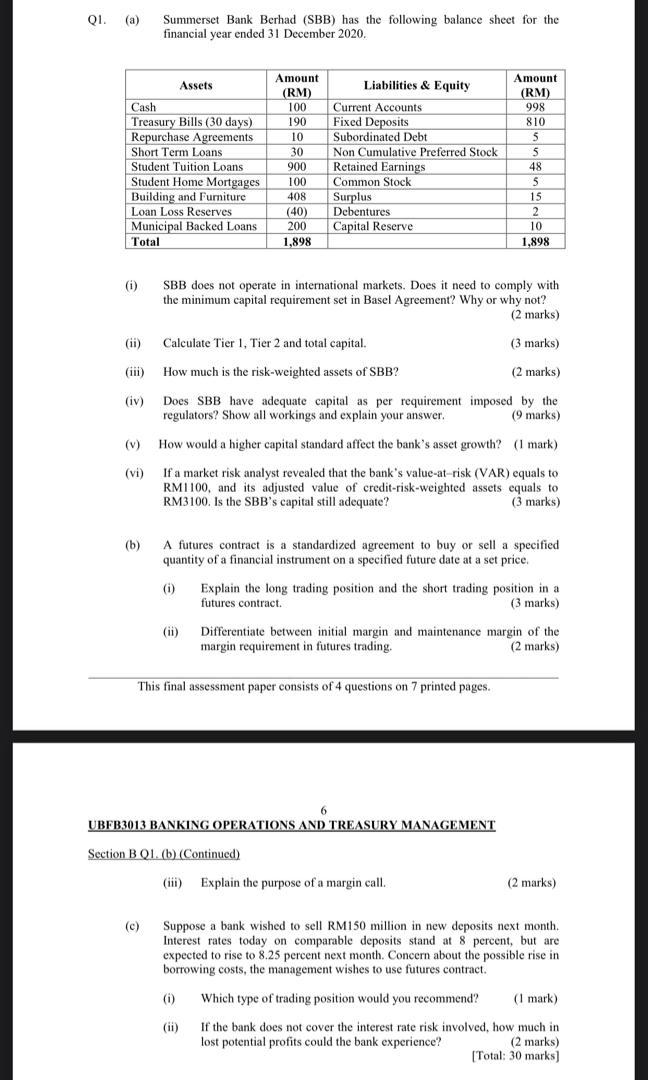

QI. (a) Summerset Bank Berhad (SBB) has the following balance sheet for the financial year ended 31 December 2020. Assets Cash Treasury Bills (30 days) Repurchase Agreements Short Term Loans Student Tuition Loans Student Home Mortgages Building and Furniture Loan Loss Reserves Municipal Backed Loans Total Amount (RM) 100 190 10 30 900 100 408 (40) 200 1,898 Liabilities & Equity Current Accounts Fixed Deposits Subordinated Debt Non Cumulative Preferred Stock Retained Earnings Common Stock Surplus Debentures Capital Reserve Amount (RM) 998 810 5 5 48 5 15 2 10 1,898 (i) SBB does not operate in international markets. Does it need to comply with the minimum capital requirement set in Basel Agreement? Why or why not? (2 marks) (ii) Calculate Tier 1, Tier 2 and total capital. ( (3 marks) (111) How much is the risk-weighted assets of SBB? (2 marks) (iv) Does SBB have adequate capital as per requirement imposed by the regulators? Show all workings and explain your answer. (9 marks) (V) How would a higher capital standard affect the bank's asset growth? (1 mark) (vi) If a market risk analyst revealed that the bank's value-at-risk (VAR) equals to RM1100, and its adjusted value of credit-risk-weighted assets equals to RM3100. Is the SBB's capital still adequate? (3 marks) (b) A futures contract is a standardized agreement to buy or sell a specified quantity of a financial instrument on a specified future date at a set price, Explain the long trading position and the short trading position in a futures contract. (3 marks) (ii) Differentiate between initial margin and maintenance margin of the margin requirement in futures trading. (2 marks) This final assessment paper consists of 4 questions on 7 printed pages. 6 UBFB3013 BANKING OPERATIONS AND TREASURY MANAGEMENT Section B Q1. (b) (Continued) (iii) Explain the purpose of a margin call. (2 marks) (c) Suppose a bank wished to sell RM150 million in new deposits next month. Interest rates today on comparable deposits stand at 8 percent, but are expected to rise to 8.25 percent next month. Concern about the possible rise in borrowing costs, the management wishes to use futures contract. (0) (ii) Which type of trading position would you recommend? (1 mark) If the bank does not cover the interest rate risk involved, how much in lost potential profits could the bank experience? (2 marks) [Total: 30 marks] QI. (a) Summerset Bank Berhad (SBB) has the following balance sheet for the financial year ended 31 December 2020. Assets Cash Treasury Bills (30 days) Repurchase Agreements Short Term Loans Student Tuition Loans Student Home Mortgages Building and Furniture Loan Loss Reserves Municipal Backed Loans Total Amount (RM) 100 190 10 30 900 100 408 (40) 200 1,898 Liabilities & Equity Current Accounts Fixed Deposits Subordinated Debt Non Cumulative Preferred Stock Retained Earnings Common Stock Surplus Debentures Capital Reserve Amount (RM) 998 810 5 5 48 5 15 2 10 1,898 (i) SBB does not operate in international markets. Does it need to comply with the minimum capital requirement set in Basel Agreement? Why or why not? (2 marks) (ii) Calculate Tier 1, Tier 2 and total capital. ( (3 marks) (111) How much is the risk-weighted assets of SBB? (2 marks) (iv) Does SBB have adequate capital as per requirement imposed by the regulators? Show all workings and explain your answer. (9 marks) (V) How would a higher capital standard affect the bank's asset growth? (1 mark) (vi) If a market risk analyst revealed that the bank's value-at-risk (VAR) equals to RM1100, and its adjusted value of credit-risk-weighted assets equals to RM3100. Is the SBB's capital still adequate? (3 marks) (b) A futures contract is a standardized agreement to buy or sell a specified quantity of a financial instrument on a specified future date at a set price, Explain the long trading position and the short trading position in a futures contract. (3 marks) (ii) Differentiate between initial margin and maintenance margin of the margin requirement in futures trading. (2 marks) This final assessment paper consists of 4 questions on 7 printed pages. 6 UBFB3013 BANKING OPERATIONS AND TREASURY MANAGEMENT Section B Q1. (b) (Continued) (iii) Explain the purpose of a margin call. (2 marks) (c) Suppose a bank wished to sell RM150 million in new deposits next month. Interest rates today on comparable deposits stand at 8 percent, but are expected to rise to 8.25 percent next month. Concern about the possible rise in borrowing costs, the management wishes to use futures contract. (0) (ii) Which type of trading position would you recommend? (1 mark) If the bank does not cover the interest rate risk involved, how much in lost potential profits could the bank experience? (2 marks) [Total: 30 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started