Answered step by step

Verified Expert Solution

Question

1 Approved Answer

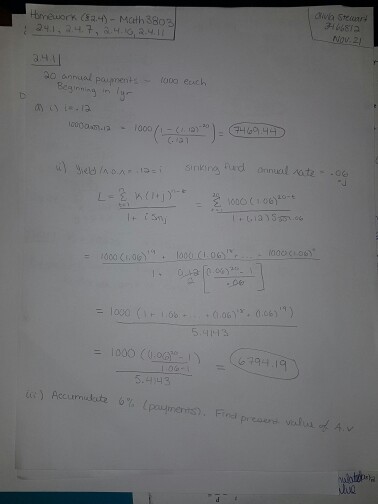

hi there, I need help with part a (only part iii) and all of part b. here is my part i&ii for part a answers

hi there, I need help with part a (only part iii) and all of part b. here is my part i&ii for part a

answers are: a) iii) 3813.44 b) i) 8.30% ii) 13.56% iii) 8.81%

SECTION 2.4 ,4 L Jones buys from Smith the right to receive 20 annual payments of 1000 each beginning 1 year hence. (a) In their discussion regarding this transaction, Smith and Jones consider three ways of determining the amount Jones must pay to Smith, Find this amount according to each of the following approaches: (i) The present value at i 12 (ii) A price to yield Jones an annual return of 12% while re- covering his principal in a sinking fund earning an an- nual rate of 6%, (iii) Accumulate the payments at 6% and then find the present value at 12% of that accumulated value. (b) Jones calculates his annual rate of return a number of differ- ent ways. In case (iii) part (a) earns annual rate of retum of 12% for the 20 years Find his annual "yield" ac- cording to each of the following approaches. (i (a)(i) above, assume that Jones can reinvest the payments at 6% per year, find Jones' average annual compound rate of return based on the accumulated amount after 20 years compared to his initial investment. (ii) Using the amount invested based on the approach in (a)(ii) as the present value of the annuity, find the un- known interest rate internal rate of return). (iii) Assuming that the full 1000 is deposited in the sinking fund at 6%, find the average annual compound rate of turn over the 20 years based on the accumulated value of the sinking fund and the initial amount invested in (a)ii)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started