Answered step by step

Verified Expert Solution

Question

1 Approved Answer

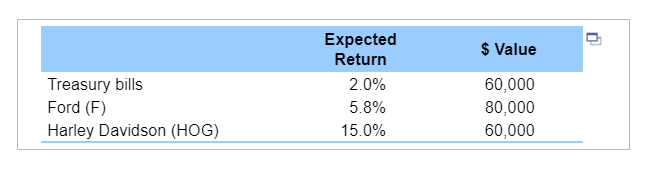

Hi there, I'm not looking for the answers to parts A B or C. I'm however asking for help finding the Weight. I'm using excel

Hi there,

I'm not looking for the answers to parts A B or C. I'm however asking for help finding the "Weight". I'm using excel so if there is a formula that could help me that would be wonderful. If you do feel able to help solve the rest of the equation I'm sure that would be very helpful for another student. I have tried to reach out to my mentor but I cannot get a time with one. Please note, I'm working in an excel notebook and would be very thankful for any help with formulas.

thanks!!! :)

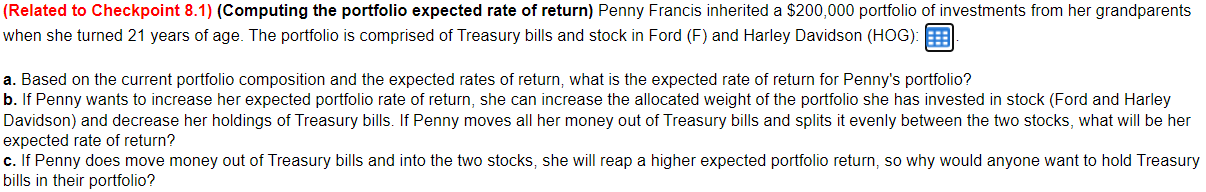

Related to Checkpoint 8.1 ) (Computing the portfolio expected rate of return) Penny Francis inherited a $200,000 portfolio of investments from her grandparents when she turned 21 years of age. The portfolio is comprised of Treasury bills and stock in Ford (F) and Harley Davidson (HOG): a. Based on the current portfolio composition and the expected rates of return, what is the expected rate of return for Penny's portfolio? o. If Penny wants to increase her expected portfolio rate of return, she can increase the allocated weight of the portfolio she has invested in stock (Ford and Harley Davidson) and decrease her holdings of Treasury bills. If Penny moves all her money out of Treasury bills and splits it evenly between the two stocks, what will be her expected rate of return? c. If Penny does move money out of Treasury bills and into the two stocks, she will reap a higher expected portfolio return, so why would anyone want to hold Treasury bills in their portfolio? \begin{tabular}{lrc|} & Expected Return & $ Value \\ Treasury bills & 2.0% & 60,000 \\ Ford (F) & 5.8% & 80,000 \\ Harley Davidson (HOG) & 15.0% & 60,000 \\ \hline \end{tabular} Based on the current portfolio: Based on the portfolio without Treasury billsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started