Hi there is solution provided for the scenario below but I am still confused as to how to do the calculations. Would be much appreciated if someone show me the step by step calculations as to how the figure derived, Thanks.

Required

Prepare the consolidated financial statements of Barren Ltd at 30 June 2019.

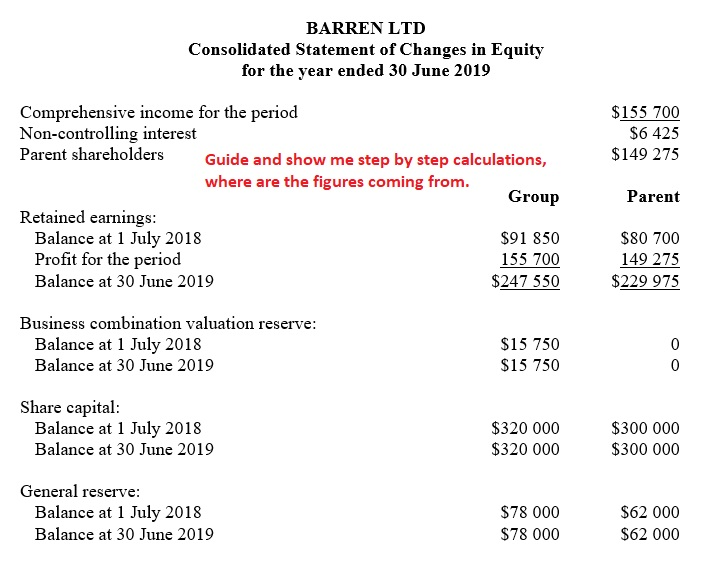

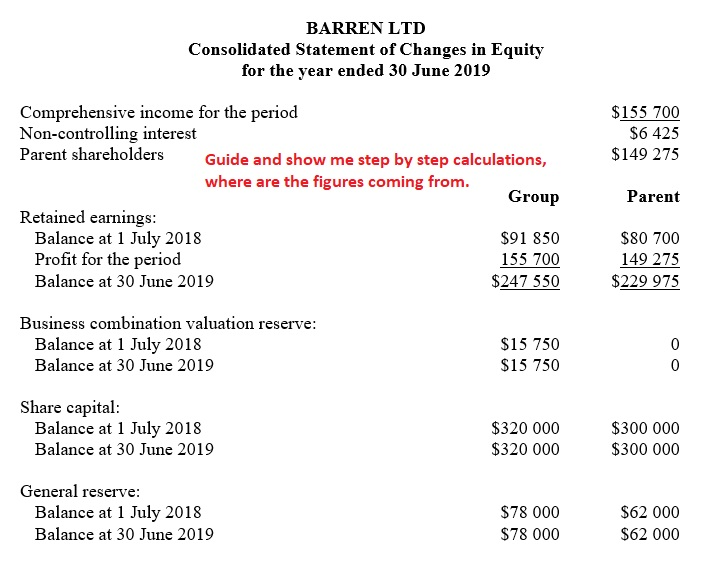

ANSWERS SOLUTIONS PROVIDED BELOW

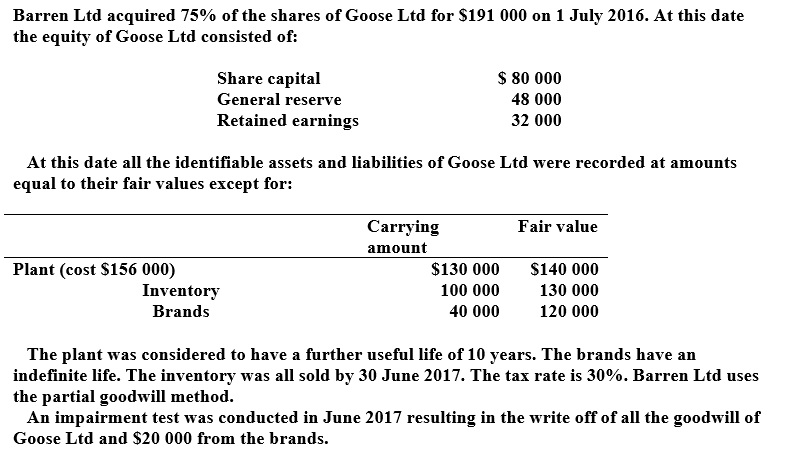

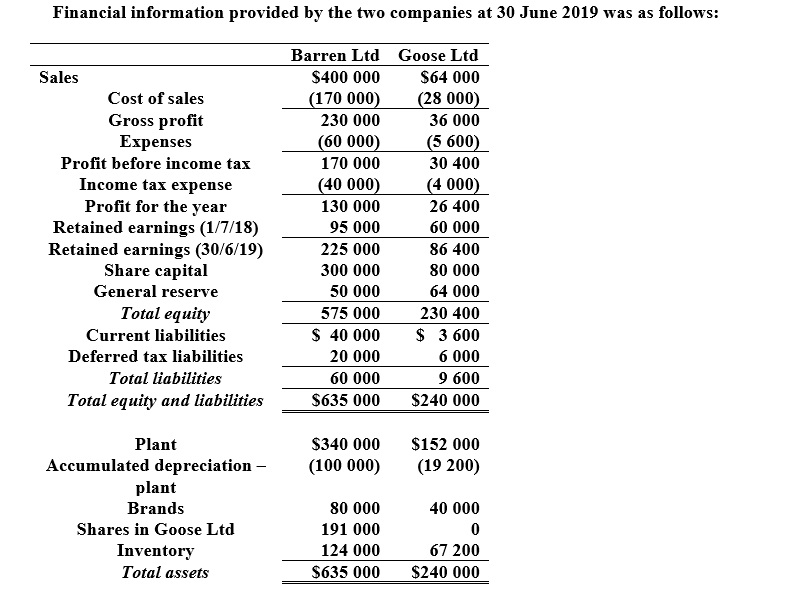

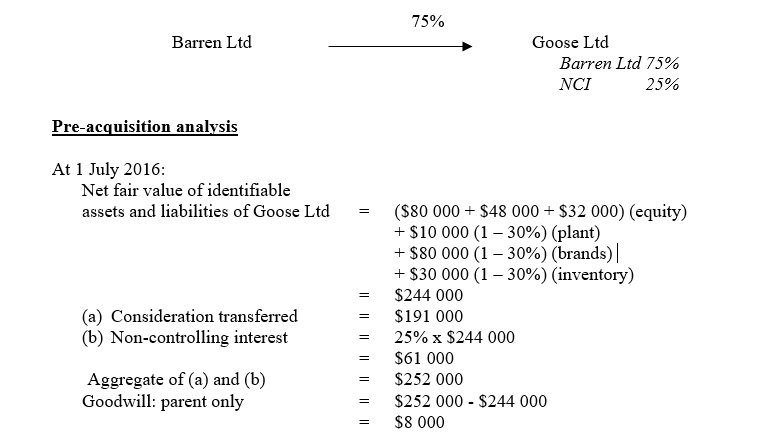

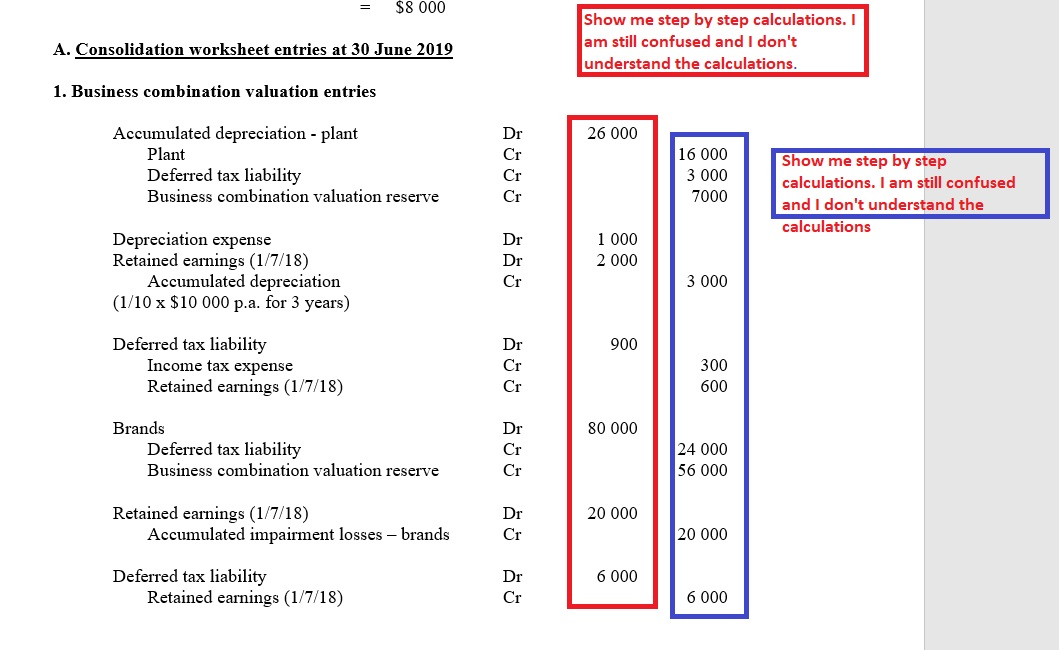

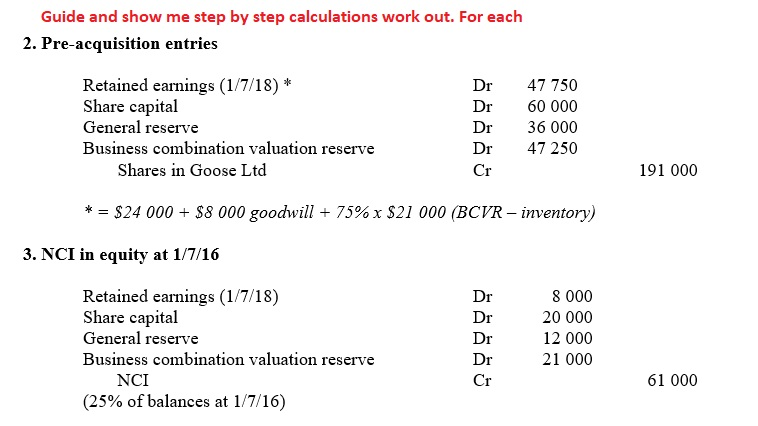

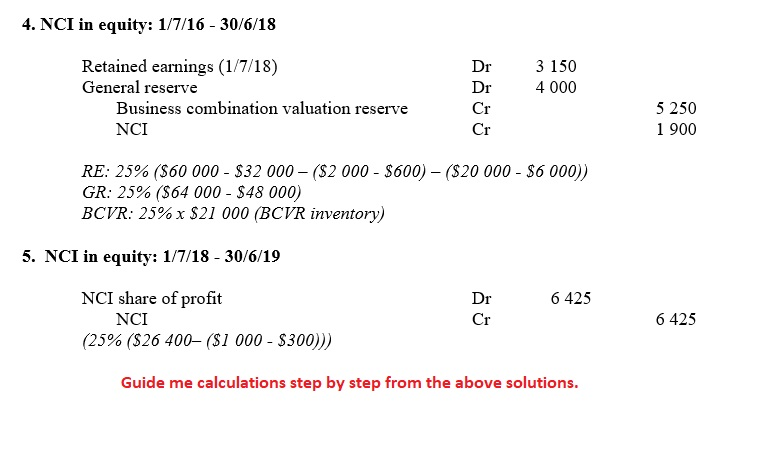

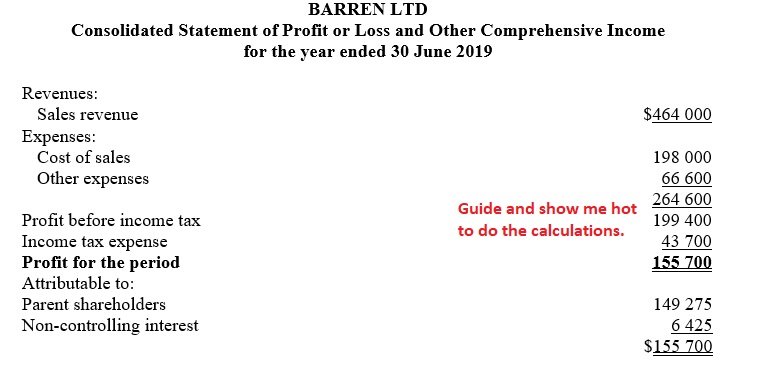

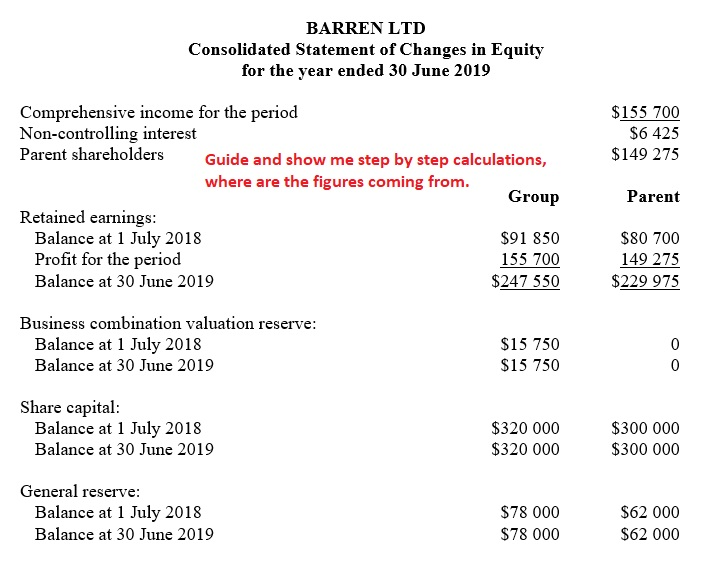

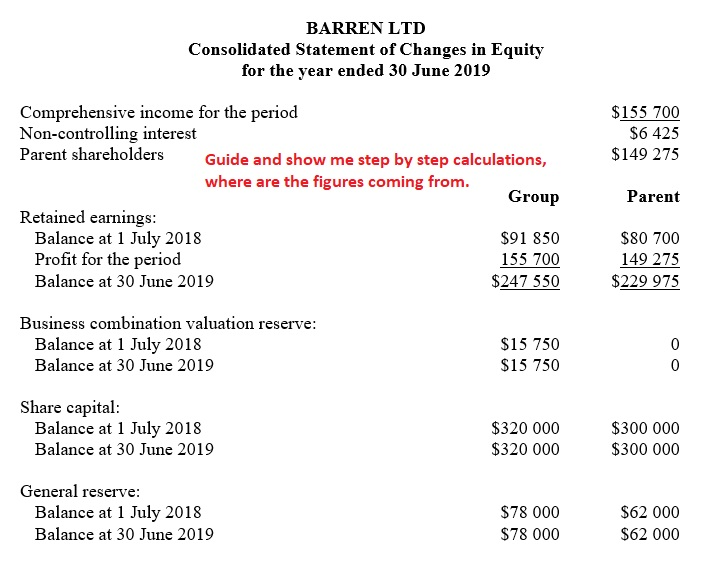

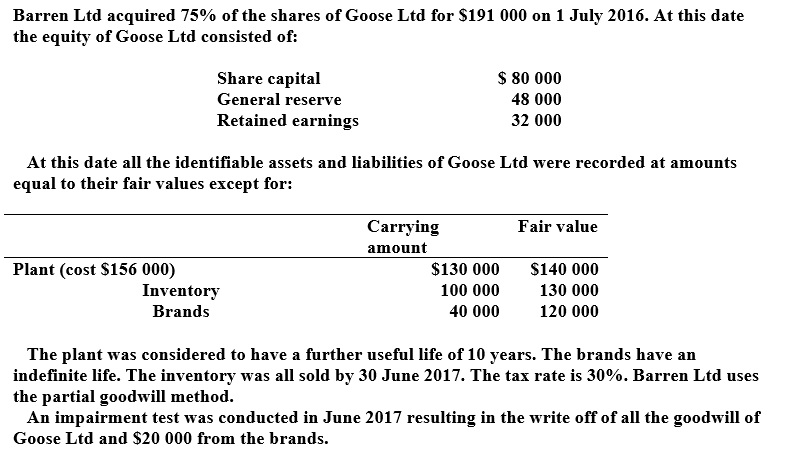

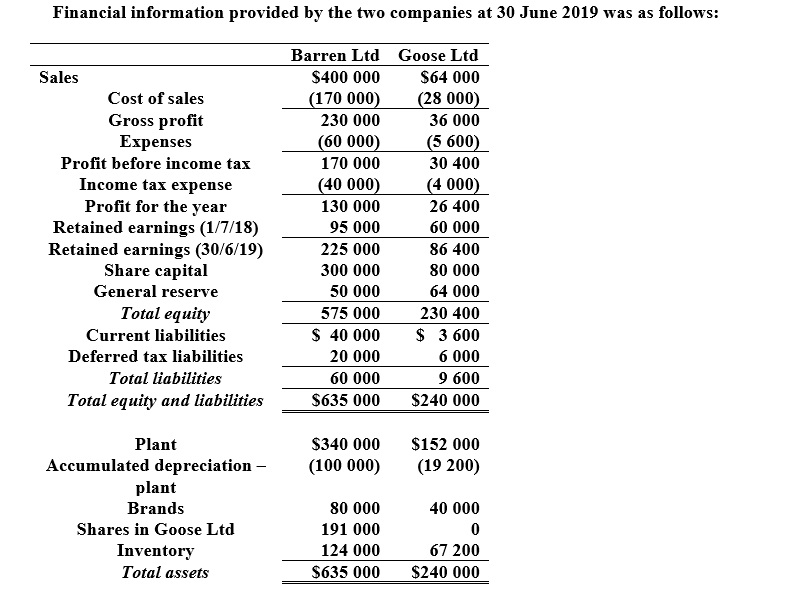

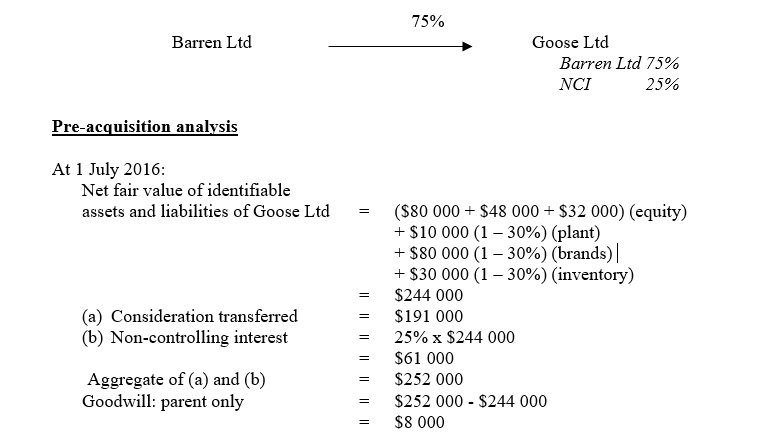

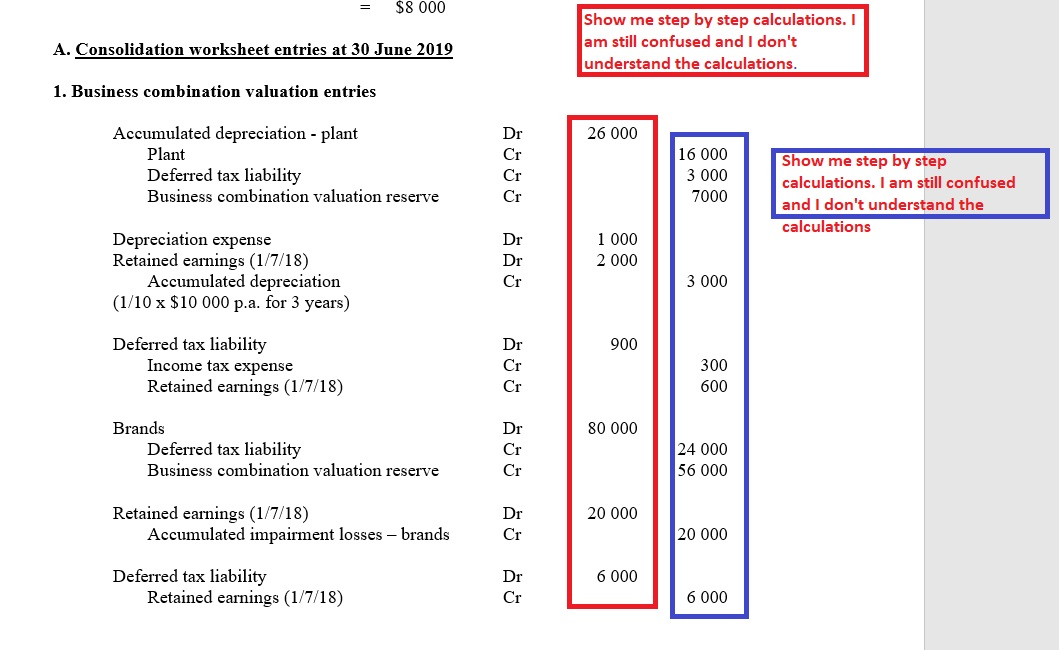

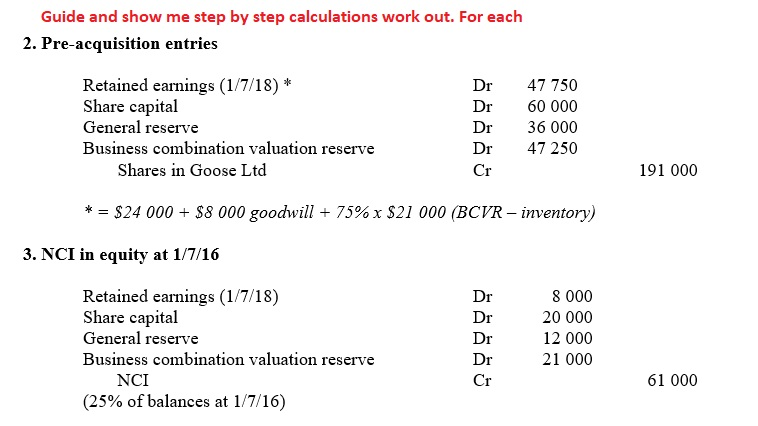

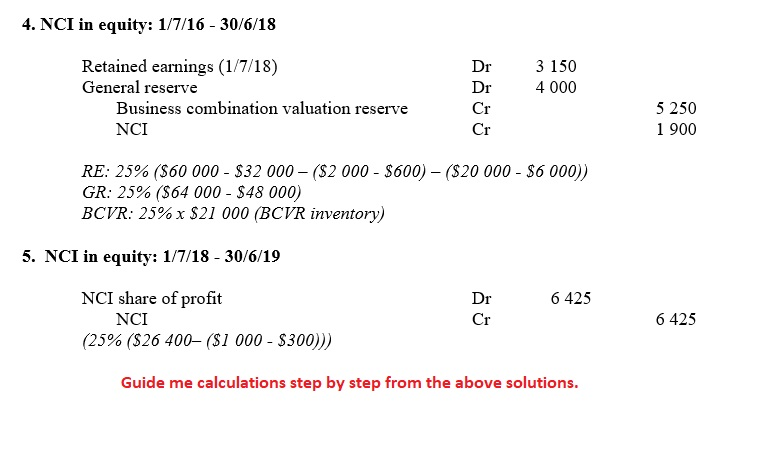

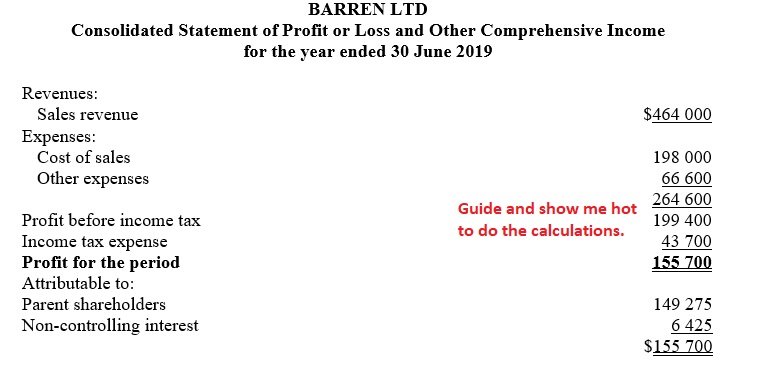

Barren Ltd acquired 75% of the shares of Goose Ltd for $191 000 on 1 July 2016. At this date the equity of Goose Ltd consisted of: Share capital General reserve Retained earnings $ 80 000 48 000 32 000 At this date all the identifiable assets and liabilities of Goose Ltd were recorded at amounts equal to their fair values except for: Fair value Plant (cost $156 000) Inventory Brands Carrying amount $130 000 100 000 40 000 $140 000 130 000 120 000 The plant was considered to have a further useful life of 10 years. The brands have an indefinite life. The inventory was all sold by 30 June 2017. The tax rate is 30%. Barren Ltd uses the partial goodwill method. An impairment test was conducted in June 2017 resulting in the write off of all the goodwill of Goose Ltd and $20 000 from the brands. Financial information provided by the two companies at 30 June 2019 was as follows: Sales Cost of sales Gross profit Expenses Profit before income tax Income tax expense Profit for the year Retained earnings (1/7/18) Retained earnings (30/6/19) Share capital General reserve Total equity Current liabilities Deferred tax liabilities Total liabilities Total equity and liabilities Barren Ltd Goose Ltd $400 000 $64 000 (170 000) (28 000) 230 000 36 000 (60 000) (5 600) 170 000 30 400 (40 000) (4 000) 130 000 26 400 95 000 60 000 225 000 86 400 300 000 80 000 50 000 64 000 575 000 230 400 S 40 000 $ 3 600 20 000 60 000 9600 $635 000 $240 000 6 000 Plant Accumulated depreciation - $340 000 (100 000) $152 000 (19 200) plant 40 000 Brands Shares in Goose Ltd Inventory Total assets 80 000 191 000 124 000 $635 000 67 200 $240 000 75% Barren Ltd Goose Ltd Barren Ltd 75% NCI 25% Pre-acquisition analysis At 1 July 2016: Net fair value of identifiable assets and liabilities of Goose Ltd = (a) Consideration transferred (6) Non-controlling interest ($80 000 + $48 000 + $32 000) (equity) + $10 000 (1 - 30%) (plant) + $80 000 (1 - 30%) (brands) + $30 000 (1 - 30%) (inventory) $244 000 $191 000 25% x $244 000 $61 000 $252 000 $252 000 - $244 000 $8 000 Aggregate of (a) and (b) Goodwill: parent only = $8 000 A. Consolidation worksheet entries at 30 June 2019 Show me step by step calculations. I am still confused and I don't understand the calculations. 1. Business combination valuation entries 26 000 Accumulated depreciation - plant Plant Deferred tax liability Business combination valuation reserve 050 16 000 3 000 7000 Show me step by step calculations. I am still confused and I don't understand the calculations 1 000 2 000 Depreciation expense Retained earnings (1/7/18) Accumulated depreciation (1/10 x $10 000 p.a. for 3 years) 3 000 Deferred tax liability Income tax expense Retained earnings (1/7/18) 300 0 0 600 80 000 Brands Deferred tax liability Business combination valuation reserve 0 0 24 000 56 000 20 000 Retained earnings (1/7/18) Accumulated impairment losses - brands 0 20 000 6 000 Deferred tax liability Retained earnings (1/7/18) 0 6 000 Guide and show me step by step calculations work out. For each 2. Pre-acquisition entries Retained earnings (1/7/18) * Share capital General reserve Business combination valuation reserve Shares in Goose Ltd 47 750 60 000 36 000 47 250 191 000 * = $24 000 + $8 000 goodwill + 75% x $21 000 (BCVR-inventory) 3. NCI in equity at 1/7/16 Retained earnings (1/7/18) Share capital General reserve Business combination valuation reserve NCI (25% of balances at 1/7/16) 8 000 20 000 12 000 21 000 61 000 BARREN LTD Consolidated Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2019 $464 000 Revenues: Sales revenue Expenses: Cost of sales Other expenses 198 000 66 600 Guide and show me hot to do the calculations. 264 600 199 400 43 700 155 700 Profit before income tax Income tax expense Profit for the period Attributable to: Parent shareholders Non-controlling interest 149 275 6 425 $155 700 BARREN LTD Consolidated Statement of Changes in Equity for the year ended 30 June 2019 $155 700 $6 425 $149 275 Comprehensive income for the period Non-controlling interest Parent shareholders Guide and show me step by step calculations, where are the figures coming from. Group Retained earnings: Balance at 1 July 2018 $91 850 Profit for the period 155 700 Balance at 30 June 2019 $247 550 Parent $80 700 149 275 $229 975 Business combination valuation reserve: Balance at 1 July 2018 Balance at 30 June 2019 $15 750 $15 750 Share capital: Balance at 1 July 2018 Balance at 30 June 2019 $320 000 $320 000 $300 000 $300 000 General reserve: Balance at 1 July 2018 Balance at 30 June 2019 $78 000 $78 000 $62 000 $62 000 BARREN LTD Consolidated Statement of Changes in Equity for the year ended 30 June 2019 $155 700 $6 425 $149 275 Comprehensive income for the period Non-controlling interest Parent shareholders Guide and show me step by step calculations, where are the figures coming from. Group Retained earnings: Balance at 1 July 2018 $91 850 Profit for the period 155 700 Balance at 30 June 2019 $247 550 Parent $80 700 149 275 $229 975 Business combination valuation reserve: Balance at 1 July 2018 Balance at 30 June 2019 $15 750 $15 750 Share capital: Balance at 1 July 2018 Balance at 30 June 2019 $320 000 $320 000 $300 000 $300 000 General reserve: Balance at 1 July 2018 Balance at 30 June 2019 $78 000 $78 000 $62 000 $62 000 Barren Ltd acquired 75% of the shares of Goose Ltd for $191 000 on 1 July 2016. At this date the equity of Goose Ltd consisted of: Share capital General reserve Retained earnings $ 80 000 48 000 32 000 At this date all the identifiable assets and liabilities of Goose Ltd were recorded at amounts equal to their fair values except for: Fair value Plant (cost $156 000) Inventory Brands Carrying amount $130 000 100 000 40 000 $140 000 130 000 120 000 The plant was considered to have a further useful life of 10 years. The brands have an indefinite life. The inventory was all sold by 30 June 2017. The tax rate is 30%. Barren Ltd uses the partial goodwill method. An impairment test was conducted in June 2017 resulting in the write off of all the goodwill of Goose Ltd and $20 000 from the brands. Financial information provided by the two companies at 30 June 2019 was as follows: Sales Cost of sales Gross profit Expenses Profit before income tax Income tax expense Profit for the year Retained earnings (1/7/18) Retained earnings (30/6/19) Share capital General reserve Total equity Current liabilities Deferred tax liabilities Total liabilities Total equity and liabilities Barren Ltd Goose Ltd $400 000 $64 000 (170 000) (28 000) 230 000 36 000 (60 000) (5 600) 170 000 30 400 (40 000) (4 000) 130 000 26 400 95 000 60 000 225 000 86 400 300 000 80 000 50 000 64 000 575 000 230 400 S 40 000 $ 3 600 20 000 60 000 9600 $635 000 $240 000 6 000 Plant Accumulated depreciation - $340 000 (100 000) $152 000 (19 200) plant 40 000 Brands Shares in Goose Ltd Inventory Total assets 80 000 191 000 124 000 $635 000 67 200 $240 000 75% Barren Ltd Goose Ltd Barren Ltd 75% NCI 25% Pre-acquisition analysis At 1 July 2016: Net fair value of identifiable assets and liabilities of Goose Ltd = (a) Consideration transferred (6) Non-controlling interest ($80 000 + $48 000 + $32 000) (equity) + $10 000 (1 - 30%) (plant) + $80 000 (1 - 30%) (brands) + $30 000 (1 - 30%) (inventory) $244 000 $191 000 25% x $244 000 $61 000 $252 000 $252 000 - $244 000 $8 000 Aggregate of (a) and (b) Goodwill: parent only = $8 000 A. Consolidation worksheet entries at 30 June 2019 Show me step by step calculations. I am still confused and I don't understand the calculations. 1. Business combination valuation entries 26 000 Accumulated depreciation - plant Plant Deferred tax liability Business combination valuation reserve 050 16 000 3 000 7000 Show me step by step calculations. I am still confused and I don't understand the calculations 1 000 2 000 Depreciation expense Retained earnings (1/7/18) Accumulated depreciation (1/10 x $10 000 p.a. for 3 years) 3 000 Deferred tax liability Income tax expense Retained earnings (1/7/18) 300 0 0 600 80 000 Brands Deferred tax liability Business combination valuation reserve 0 0 24 000 56 000 20 000 Retained earnings (1/7/18) Accumulated impairment losses - brands 0 20 000 6 000 Deferred tax liability Retained earnings (1/7/18) 0 6 000 Guide and show me step by step calculations work out. For each 2. Pre-acquisition entries Retained earnings (1/7/18) * Share capital General reserve Business combination valuation reserve Shares in Goose Ltd 47 750 60 000 36 000 47 250 191 000 * = $24 000 + $8 000 goodwill + 75% x $21 000 (BCVR-inventory) 3. NCI in equity at 1/7/16 Retained earnings (1/7/18) Share capital General reserve Business combination valuation reserve NCI (25% of balances at 1/7/16) 8 000 20 000 12 000 21 000 61 000 BARREN LTD Consolidated Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2019 $464 000 Revenues: Sales revenue Expenses: Cost of sales Other expenses 198 000 66 600 Guide and show me hot to do the calculations. 264 600 199 400 43 700 155 700 Profit before income tax Income tax expense Profit for the period Attributable to: Parent shareholders Non-controlling interest 149 275 6 425 $155 700 BARREN LTD Consolidated Statement of Changes in Equity for the year ended 30 June 2019 $155 700 $6 425 $149 275 Comprehensive income for the period Non-controlling interest Parent shareholders Guide and show me step by step calculations, where are the figures coming from. Group Retained earnings: Balance at 1 July 2018 $91 850 Profit for the period 155 700 Balance at 30 June 2019 $247 550 Parent $80 700 149 275 $229 975 Business combination valuation reserve: Balance at 1 July 2018 Balance at 30 June 2019 $15 750 $15 750 Share capital: Balance at 1 July 2018 Balance at 30 June 2019 $320 000 $320 000 $300 000 $300 000 General reserve: Balance at 1 July 2018 Balance at 30 June 2019 $78 000 $78 000 $62 000 $62 000 BARREN LTD Consolidated Statement of Changes in Equity for the year ended 30 June 2019 $155 700 $6 425 $149 275 Comprehensive income for the period Non-controlling interest Parent shareholders Guide and show me step by step calculations, where are the figures coming from. Group Retained earnings: Balance at 1 July 2018 $91 850 Profit for the period 155 700 Balance at 30 June 2019 $247 550 Parent $80 700 149 275 $229 975 Business combination valuation reserve: Balance at 1 July 2018 Balance at 30 June 2019 $15 750 $15 750 Share capital: Balance at 1 July 2018 Balance at 30 June 2019 $320 000 $320 000 $300 000 $300 000 General reserve: Balance at 1 July 2018 Balance at 30 June 2019 $78 000 $78 000 $62 000 $62 000