Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi There, Please can you explain me how to solve internal rate of return part 3. Thank you Hi there above are the pics again

Hi There,

Please can you explain me how to solve internal rate of return part 3.

Thank you

Hi there above are the pics again that i am responding. This is the full question thats all i have to solve.

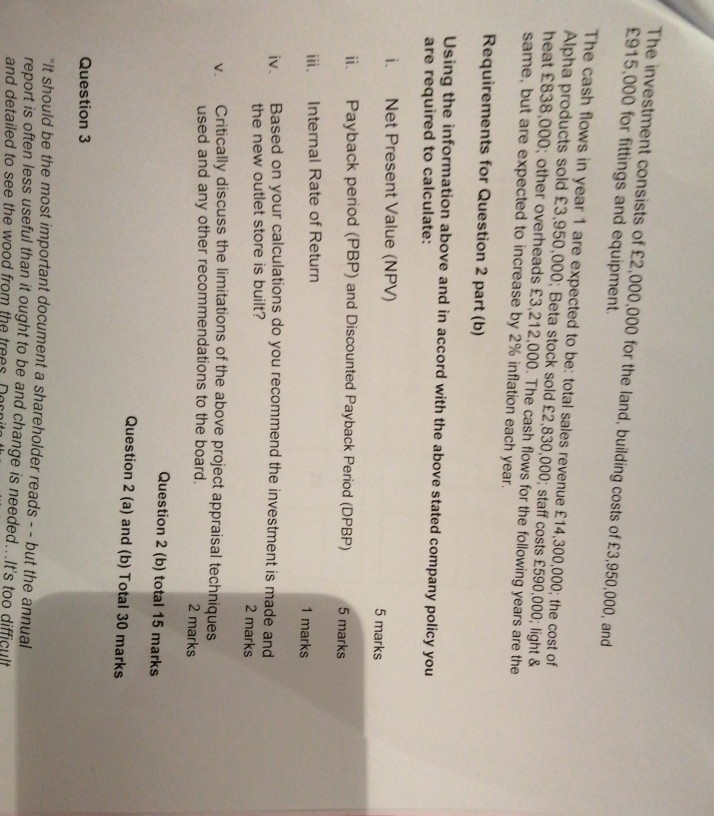

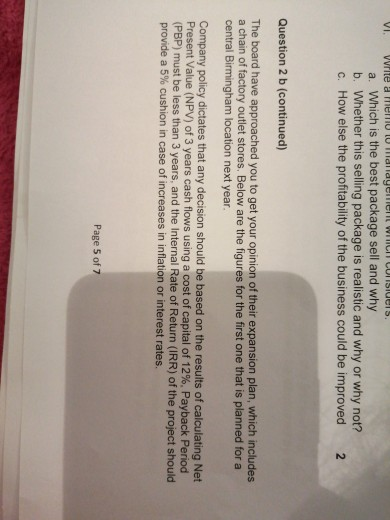

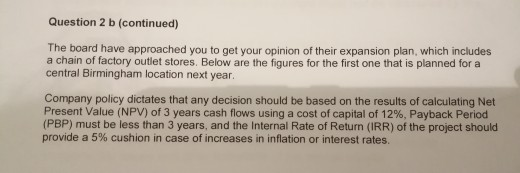

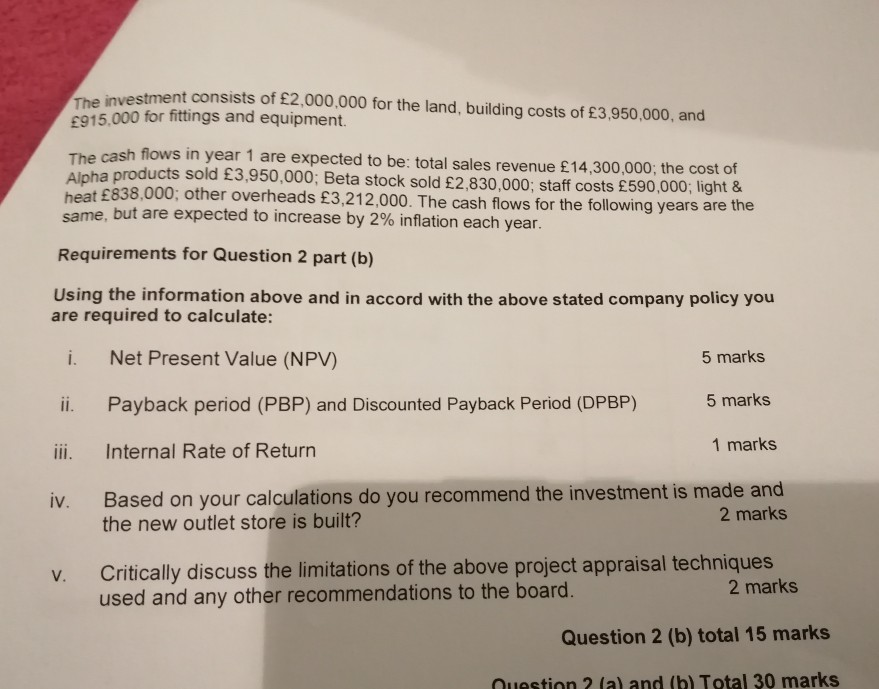

The investment consists of 2,000,000 for the land, building costs of 3,950,000, and 915.000 for fittings and equipment The cash flows in year 1 are expected to be total sales revenue 14,300,000, the cost of Alpha products sold 3,950,000; Beta stock sold 2,830,000; staff costs 590,000; light & heat 838,000; other overheads 3,212,000. The cash flows for the following years are the same, but are expected to increase by 2% inflation each year. Requirements for Question 2 part (b) Using the information above and in accord with the above stated company policy you are required to calculate: i. Net Present Value (NPV) 5 marks ii. Payback period (PBP) and Discounted Payback Period (DPBP) 5 marks ili. Internal Rate of Return 1 marks Based on your calculations do you recommend the investment is made and the new outlet store is built? 2 marks iv. V. Critically discuss the limitations of the above project appraisal techniques used and any other recommendations to the board. 2 marks Question 2 (b) total 15 marks Question 2 (a) and (b) Total 30 marks Question 3 "It should be the most important document a shareholder reads -- but the annual report is often less useful than it ought to be and change is needed...It's too diff and detailed to see the wood from the tre VI. Write a mem U Management wiICI CUISICIS. a. Which is the best package sell and why b. Whether this selling package is realistic and why or why not? c. How else the profitability of the business could be improved 2 Question 2 b (continued) The board have approached you to get your opinion of their expansion plan, which includes a chain of factory outlet stores. Below are the figures for the first one that is planned for a central Birmingham location next year. Company policy dictates that any decision should be based on the results of calculating Net Present Value (NPV) of 3 years cash flows using a cost of capital of 12%. Payback Period (PBP) must be less than 3 years, and the Internal Rate of Return (IRR) of the project should provide a 5% cushion in case of increases in inflation or interest rates. Page 5 of 7 Question 2 b (continued) The board have approached you to get your opinion of their expansion plan, which includes a chain of factory outlet stores. Below are the figures for the first one that is planned for a central Birmingham location next year. Company policy dictates that any decision should be based on the results of calculating Net Present Value (NPV) of 3 years cash flows using a cost of capital of 12%, Payback Period (PBP) must be less than 3 years, and the Internal Rate of Retum (IRR) of the project should provide a 5% cushion in case of increases in inflation or interest rates. The investment consists of 2,000,000 for the land, building costs of 3,950,000, and 1915.000 for fittings and equipment. The cash flows in year 1 are expected to be: total sales revenue 14,300,000; the cost of Alpha products sold 3,950,000; Beta stock sold 2,830,000; staff costs 590,000; light & heat 838,000; other overheads 3,212,000. The cash flows for the following years are the same, but are expected to increase by 2% inflation each year. Requirements for Question 2 part (b) Using the information above and in accord with the above stated company policy you are required to calculate: Net Present Value (NPV) 5 marks i. ii. Payback period (PBP) and Discounted Payback Period (DPBP) 5 marks Internal Rate of Return 1 marks iv. Based on your calculations do you recommend the investment is made and the new outlet store is built? 2 marks V. Critically discuss the limitations of the above project appraisal techniques used and any other recommendations to the board. 2 marks Question 2 (b) total 15 marks Question 2 lal and (b) Total 30 marksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started