Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi there, This is my homework for finance class. I have been using excel to get the answer, so if you could share a spreadsheet

Hi there,

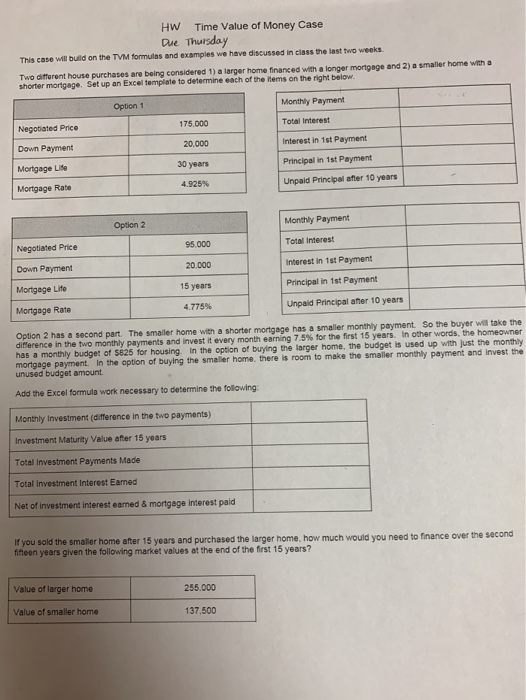

HW Time Value of Money Case Due Thursday This case will build on the TVM formulas and examples we have discussed in class the last two weeks Two different house purchases are being considered 1) a larger home financed with a longer mortgage and 2) a smaller home with a shorter mortgage. Set up an Excel template to determine each of the items on the right below. Option 1 Monthly Payment Negotiated Price 175.000 Total Interest Down Payment 20.000 30 years Mortgage Lite Mortgage Rate Interest in 1st Payment Principal in 1st Payment Unpaid Principal after 10 years 4.925% Option 2 Monthly Payment Negotiated Price 95.000 Total Interest Down Payment 20.000 Interest in 1st Payment Mortgage Life 15 years Principal in 1st Payment Mortgage Rate 4.775% Unpaid Principal after 10 years Option 2 has a second part. The smaller home with a shorter mortgage has a smaller monthly payment. So the buyer will take the difference in the two monthly payments and invest it every month earning 7.5for the first 15 years in other words, the homeowner has a monthly budget of $625 for housing in the option of buying the larger home, the budget is used up with just the monthly mortgage payment in the option of buying the smaller home, there is room to make the smaller monthly payment and Invest the unused budget amount Add the Excel formula work necessary to determine the following: Monthly Investment (difference in the two payments) Investment Maturity Valve after 15 years Total Investment Payments Made Total Investment interest Eamed Net of investment interest earned & mortgage Interest paid If you sold the smaller home after 15 years and purchased the larger home, how much would you need to finance over the second fifteen years given the following market values at the end of the first 15 years? Value of larger home 255.000 Value of smaller home 137.500 This is my homework for finance class. I have been using excel to get the answer, so if you could share a spreadsheet and show me how you did caluculation, that would be great.

(Upload a spreadsheet if possible)

Thank you,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started