Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi these are Multi-Choice, All I need to know is the correct choice for each, and a brief explanation as to why this is the

Hi these are Multi-Choice, All I need to know is the correct choice for each, and a brief explanation as to why this is the case.

Thank you

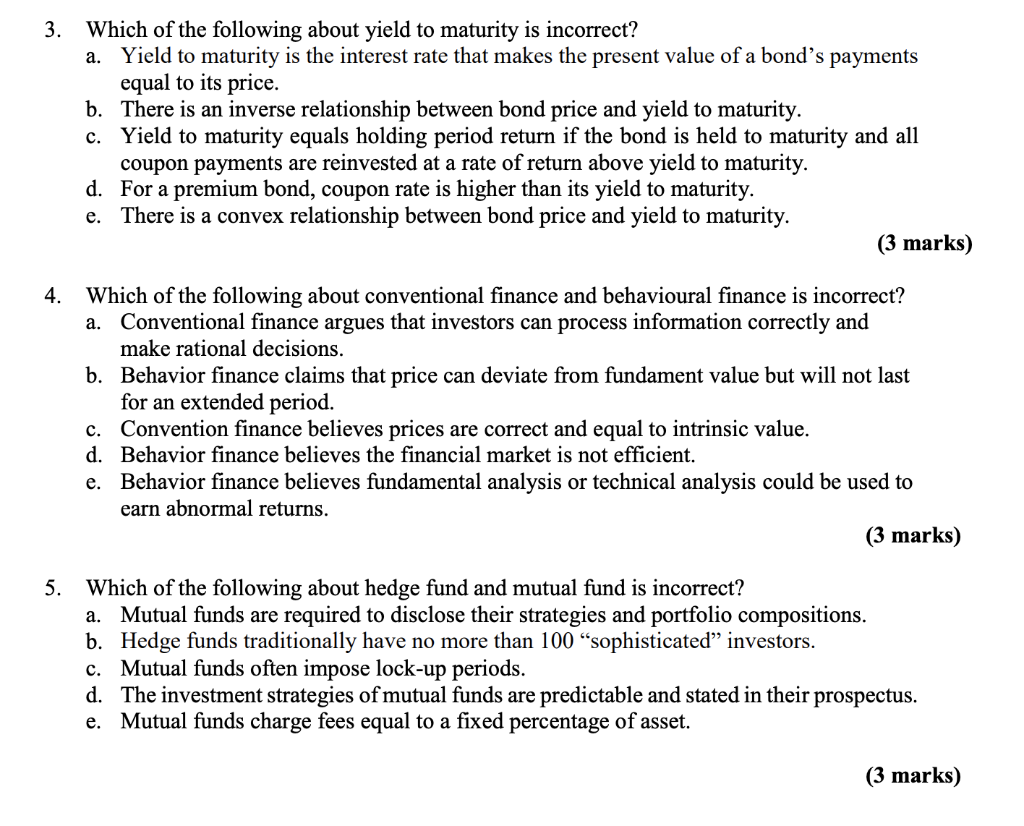

Which of the following about yield to maturity is incorrect? a. Yield to maturity is the interest rate that makes the present value of a bond's payments equal to its price b. There is an inverse relationship between bond price and yield to maturity. c. Yield to maturity equals holding period return if the bond is held to maturity and all coupon payments are reinvested at a rate of return above yield to maturity d. For a premium bond, coupon rate is higher than its yield to maturity. There is a convex relationship between bond price and yield to maturity 3. e. (3 marks) 4. Which of the following about conventional finance and behavioural finance is incorrect? Conventional finance argues that investors can process information correctly and make rational decisions b. Behavior finance claims that price can deviate from fundament value but will not last for an extended period. Convention finance believes prices a. are correct and equal to intrinsic value. C. d. Behavior finance believes the financial market is not efficient. Behavior finance believes fundamental analysis or technical analysis could be used to earn abnormal returns e. (3 marks) 5 Which of the following about hedge fund and mutual fund is incorrect? a. Mutual funds are required to disclose their strategies and portfolio compositions. b. Hedge funds traditionally have no more than 100 "sophisticated" investors. c. Mutual funds often impose lock-up periods d. The investment strategies of mutual funds are predictable and stated in their prospectus. e. Mutual funds charge fees equal to a fixed percentage of assetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started