Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, this is a practice test for my cost accounting class. If you could help me with the last two problems, it would be greatly

Hi, this is a practice test for my cost accounting class. If you could help me with the last two problems, it would be greatly appreciated!

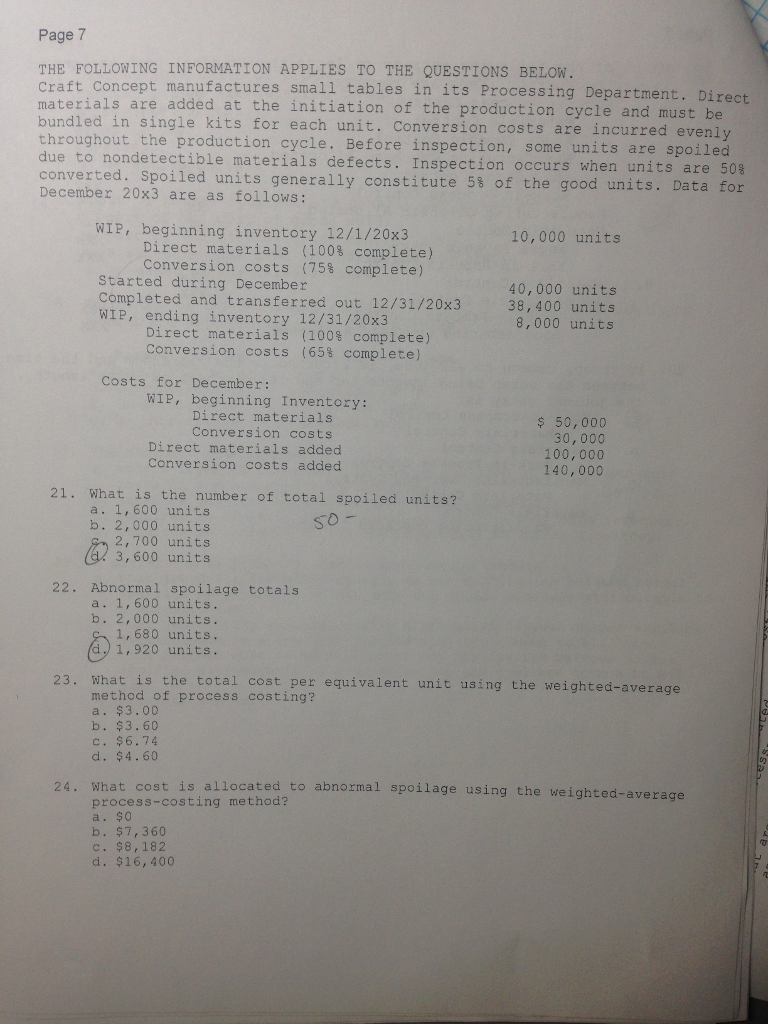

Page 7 THE FOLLOWING INFORMATION APPLIES TO THE QUESTIONS BELOW. Craft Concept manufactures small tables in its Processing Department. Direct materials are added at the initiation of the production cycle and must be bundled in single kits for each unit. Conversion costs are incurred evenly hroughout the production cycle. Before inspection, some units are spoiled due to nondetectib le materials defects. Inspection occurs when units are 508 converted Spoiled unitsgenerally constitute 5% of the good units. Data for December 20x3 are as follows: , WIP, beginning Direct materials (100% complete) Conversion costs (75% complete) inventory 12/1/20x3 10,000 units Started during December Completed and transferred out 12/31/20x3 WIP, ending inventory 12/31/20x3 40,000 units 38,400 units 8,000 units Direct materials (100% complete) conversion costs (65% complete) Costs for December: Direct materials Conversion costs Direct materials added Conversion costs added $ 50,000 30,000 100,000 140,000 21. What is the number of total spoiled units? a. 1,600 units b. 2,000 units 2,700 units 3, 600 units 22. Abnormal spoilage totals a. 1,600 units b. 2,000 units. 1, 680 units. d, 1,920 units. 23. What is the total cost per equivalent unit using the weighted-average method of process costing? a. $3.00 b. $3.60 . $6.74 d. $4.60 24. What cost is allocated to abnormal spoilage using the weighted-average process-costing method? a. $0 b. $7,360 c. $8,182 d. $16,400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started