Question

Hi! This is a very urgent request! I will give you a good review if you can answer as soon as possible. I need all

Hi! This is a very urgent request! I will give you a good review if you can answer as soon as possible. I need all parts in the picture completed. Thank you so much!!!!

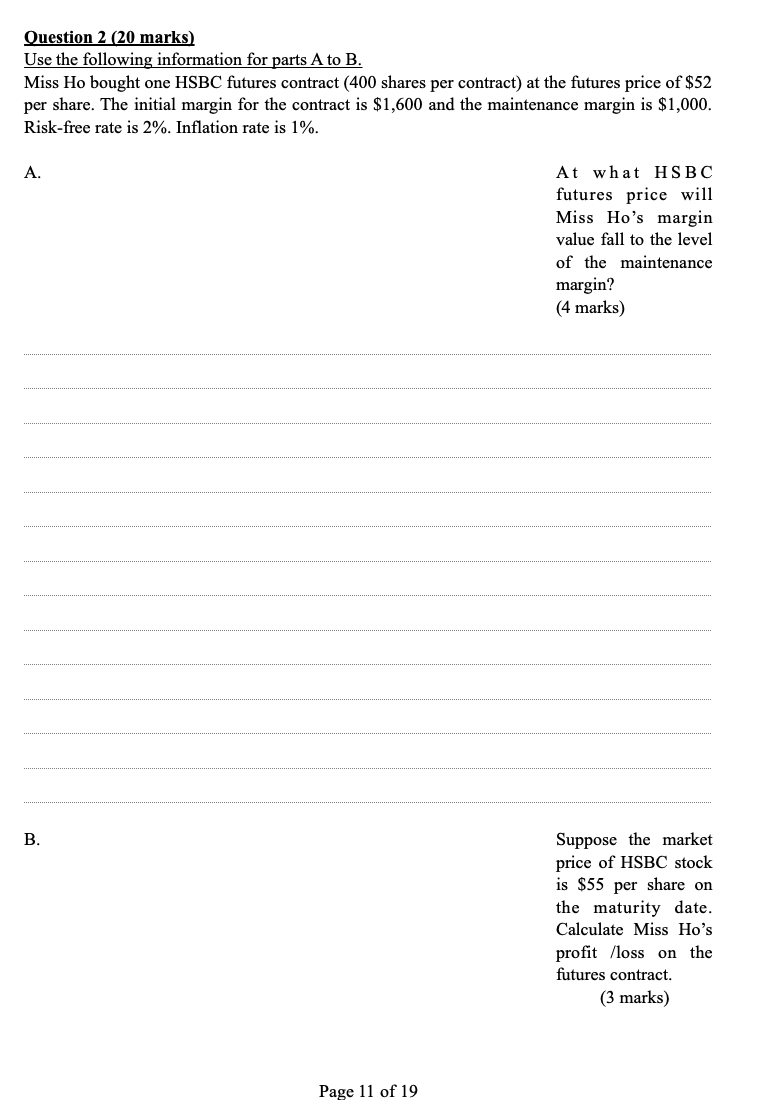

Question 2 (20 marks)

Use the following information for parts A to B.

Miss Ho bought one HSBC futures contract (400 shares per contract) at the futures price of $52 per share. The initial margin for the contract is $1,600 and the maintenance margin is $1,000. Risk-free rate is 2%. Inflation rate is 1%.

A. At what HSBC futures price will Miss Hos margin value fall to the level of the maintenance margin? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started