Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi! This is for my Capital Budgeting Project. Please help me find the Discounted Payback Period. Thank you! Also please use Excel. And will also

Hi! This is for my Capital Budgeting Project. Please help me find the Discounted Payback Period. Thank you! Also please use Excel. And will also appreciate an explanation of the answer.

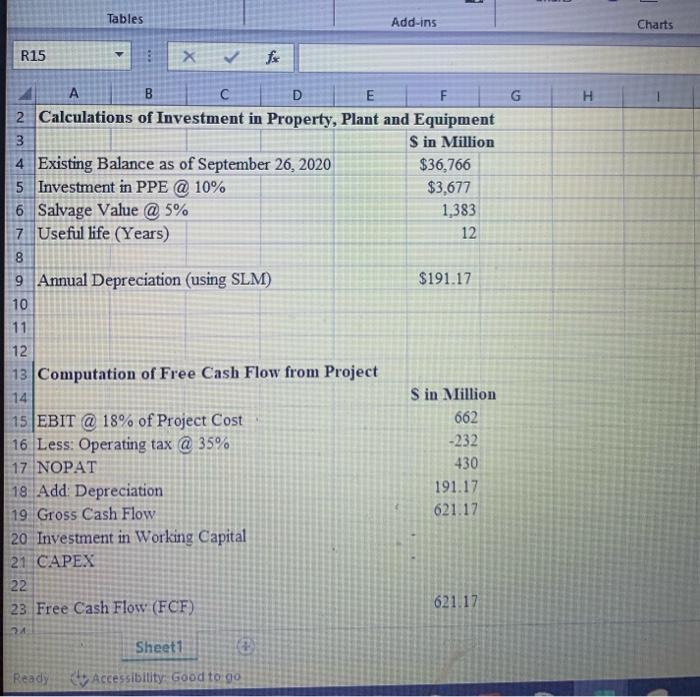

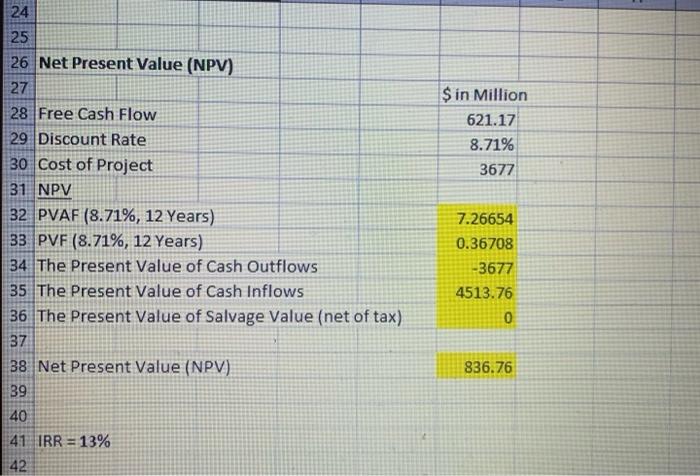

Tables Add-ins Charts R15 v X for G H 3 A B D E 2 Calculations of Investment in Property, Plant and Equipment 3 Sin Million 4 Existing Balance as of September 26, 2020 $36,766 5 Investment in PPE @ 10% $3,677 6 Salvage Value @ 5% 1,383 7 Useful life (Years) 12 8 9 Annual Depreciation (using SLM) $191.17 10 11 12 13 Computation of Free Cash Flow from Project 14 S in Million 15 EBIT @ 18% of Project Cost 662 16 Less: Operating tax @ 35% -232 17 NOPAT 430 18. Add Depreciation 191.17 19 Gross Cash Flow 621.17 20 Investment in Working Capital 21 CAPEX 22 23. Free Cash Flow (FCF) 621.17 24 Sheet1 Ready Accessibility Good to go 24 $ in Million 621.17 8.71% 3677 25 26 Net Present Value (NPV) 27 28 Free Cash Flow 29 Discount Rate 30 Cost of Project 31 NPV 32 PVAF (8.71%, 12 Years) 33 PVF (8.71%, 12 Years) 34 The Present Value of Cash Outflows 35 The Present Value of Cash Inflows 36 The Present Value of Salvage Value (net of tax) 37 38 Net Present Value (NPV) 39 40 41 IRR = 13% 42 7.26654 0.36708 -3677 4513.76 0 836.76

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started