Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi this is Taxation in Malaysia. Kindly help to answer related to Income tax Act Malaysia. Thank you a) Ibu Mertuaku Berhad manufactures paper boxes.

Hi this is Taxation in Malaysia. Kindly help to answer related to Income tax Act Malaysia.

Thank you

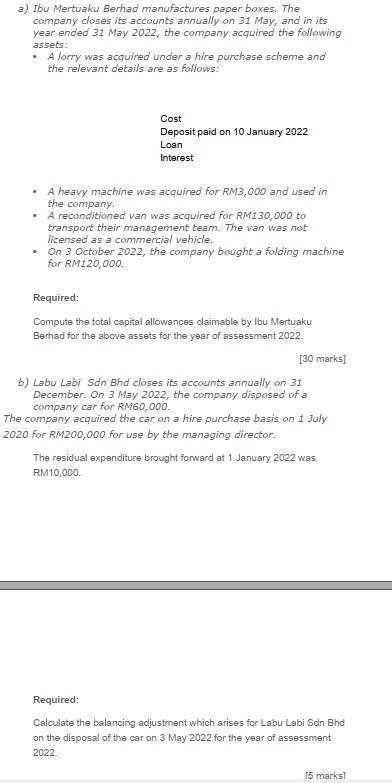

a) Ibu Mertuaku Berhad manufactures paper boxes. The company closes its accounts annually on 31May, and in its year ended 31 May 2022, the company acquired the following assets: - A lorry was acquired under a hire purchase scheme and the relevant details are as follows: Cost Deposit paid on 10 January 2022 Loan Interest - A heavy machine was acquired for RM3,000 and used in the company. - A reconditioned van was acquired for RM130,000 to transport their management team. The van was not licensed as a commercial vehicle. - On 3 October 2022, the company bought a folding machine for RM120,000 Required: Compute the total capital allowances claimable by lbu Mertuaku Berhad for the above assets for the year of assessment 2022 . [30 marks] b) Labu Labi Sdn Bhd closes its accounts annually on 31 December. On 3 May 2022, the company disposed of a company car for RM60,000. The company acquired the car on a hire purchase basis on 1 July 2020 for RM200,000 for use by the managing director. The residual expenditure brought fonward at 1 January 2022 was RM10,000. Required: Calculate the balancing adjustment which arises for Labu Labi Sdn Bhd on the disposal of the car on 3 May 2022 for the year of assessment 2022. a) Ibu Mertuaku Berhad manufactures paper boxes. The company closes its accounts annually on 31May, and in its year ended 31 May 2022, the company acquired the following assets: - A lorry was acquired under a hire purchase scheme and the relevant details are as follows: Cost Deposit paid on 10 January 2022 Loan Interest - A heavy machine was acquired for RM3,000 and used in the company. - A reconditioned van was acquired for RM130,000 to transport their management team. The van was not licensed as a commercial vehicle. - On 3 October 2022, the company bought a folding machine for RM120,000 Required: Compute the total capital allowances claimable by lbu Mertuaku Berhad for the above assets for the year of assessment 2022 . [30 marks] b) Labu Labi Sdn Bhd closes its accounts annually on 31 December. On 3 May 2022, the company disposed of a company car for RM60,000. The company acquired the car on a hire purchase basis on 1 July 2020 for RM200,000 for use by the managing director. The residual expenditure brought fonward at 1 January 2022 was RM10,000. Required: Calculate the balancing adjustment which arises for Labu Labi Sdn Bhd on the disposal of the car on 3 May 2022 for the year of assessment 2022Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started