HI! This would really be helpful with my notes. hehehe. Please help a struggling college student.

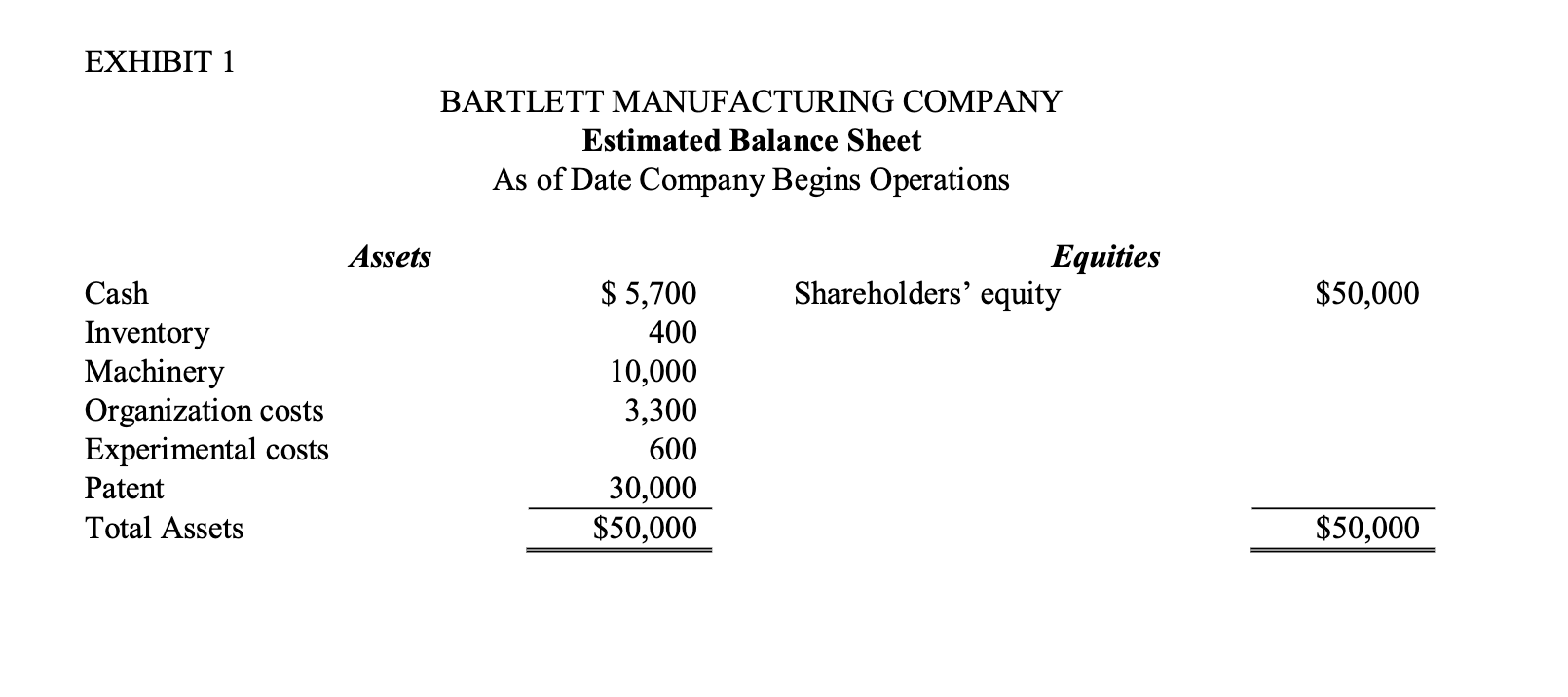

John Bartlett was the investor of a switching device that enabled a video-game or home computer to be connected to the antenna terminals of an ordinary television set. The switch would soon be given a patent whose legal life was 17 years. Having condence in the switch's commercial value but possessing no excess funds of his own, he sought among his iends and acquaintances for the necessary capital to put the switch on the market. The proposition that he placed before possible associates was that a corporation, Bartlett Manufacturing Company, should be formed with a capital stock of $50,000 par value. The project looked attractive to a number of the individuals to whom the inventor presented it, but the most promising among thema retired manufacturersaid he would be unwilling to invest his capital without knowing what uses were intended for the cash to be received 'om the proposed sale of stock He suggested that the inventor determine the probable costs of experimentation and of special machinery, and prepare for him a statement of the estimated assets and liabilities of the proposed company when ready to begin actual operation. He also asked for a statement of the estimated transactions for the rst year of operations, to be based on studies the inventor had made of probable markets and costs of labor and materials. This information Mr. Bartlett consented to supply to the best of his ability. After consulting the engineer who had aided him in constructing his patent models, Mr. Bartlett drew up the following list of data relating to the transactions of the proposed corporation during its period of organization and development: 1. The retired manufacturer would pay the corporation $20,000 cash for which he would receive stocks with a par value of $20,000. The remaining stock (par value, $30,000) would be given to Mr. Bartlett in exchange for the patent on the switch. 2. Probable cost of incorporation and organization, including estimated ofcers\" salaries during development period, $3,300. 3. Probable cost of developing special machinery, $10,000. This sum includes the cost of expert services, materials, rent of a small shop, and the cost of power, light, and miscellaneous expenditures. 4. Probable cost of raw materials: $1,000, of which $600 is to be used in experimental production. On the basis of the above information, Mr. Bartlett prepared the estimated balance sheet shown in Exhibit 1. EXHIBIT 1 BARTLETT MANUFACTURING COMPANY Estimated Balance Sheet As of Date Company Begins Operations Assets Cash 15 5,700 Inventory 400 Machinery 10,000 Organization costs 3,3 00 Experimental costs 600 Patent 30,000 Total Assets $50,000 Equities Shareholders' equity $50,000 $50,000 Mr. Bartlett then set down the following estimates as a beginning step in furnishing the rest of the information desired: 1. Expected sales, all to be received in cash by the end of the rst year of operation, $170,000. 2. Expected additional purchases of raw materials and supplies during the course of this operating year, all paid for in cash by end of year, $60,000. 3. Expected borrowing om the bank during year but loans to be repaid before close of year, $4,000. Interest on these loans, $300. 4. Expected payroll and other cash expenses and manufacturing costs for the operating year: $66,000 of manufacturing costs (excluding raw materials and supplies) plus $12,000 for selling and administrative expenses, a total of $78,000. 5. New equipment to be purchased for cash, $2,000. 6. Expected inventory of raw materials and supplies at cost of period, at cost, $10,000. 7. No inventory of unsold switches expected as the end of the period. All products to be manufactured on the basis of rm orders received none to be produced for inventory. 8. All experimental and organization costs, previously capitalized, to be charged against income of the operating year. 9. Estimated depreciation of machinery, $1,200. 10. Dividends paid in cash, $6,000. 11. Estimated tax expense for the year, $9,000. Ten percent of this amount would not be due until early in the following year. It should be noted that the transactions summarized above would not necessarily take place in sequence indicated. In practice, a considerable number of separate events, or transactions, would occur throughout the year, and many of them were dependent on one another. For example, operations were begun with an initial cash balance and inventory of raw materials, products were manufactured, and sales of these products provided funds for nancing subsequent operations. Then, in turn, sales of the product subsequently manufactured yielded more funds. Questions 1. Trace the effect on the balance sheet of each of the projected events appearing in Mr. Bartlett's list. Thus, item 1, taken alone would mean that cash would be increased by $170,000 and that (subject to reductions for various costs covered in later items) shareholders' equity would be increased by $170,000. Notice that in this question you are asked to consider all items in terms of their effect on the balance sheet. 2. Prepare an income statement covering the rst year of planned operations and a balance sheet as of the end of the year. 3. Assume that the retired manufacturer received capital stock with a par value of $16,000 for the $20,000 cash he paid to the corporation, John Bartlett still receiving stock with a par value of $30,000 in exchange for his patent. Under these circumstances, how would the balance sheet in Exhibit 1 appear? 4. Assume that the management is interested in what the results would be if no products were sold during the rst year, even though production continued at the level indicated in the original plans. The following changes would be made in the 11 items listed above: items 1, 6, 7, 10, and 11 are to be disregarded. Instead of item 3, assume that a loan of $160,000 is obtained, that the loan is not repaid, but that interest thereon of $ 1 8,700 is paid during the year. Prepare an income statement for the year and a balance sheet as of the end of the year. Contrast these nancial statements with those prepared in Question 2