Hi tutor. I am stuck and am in need of help. I will be sure to leave a great rating, stay safe.

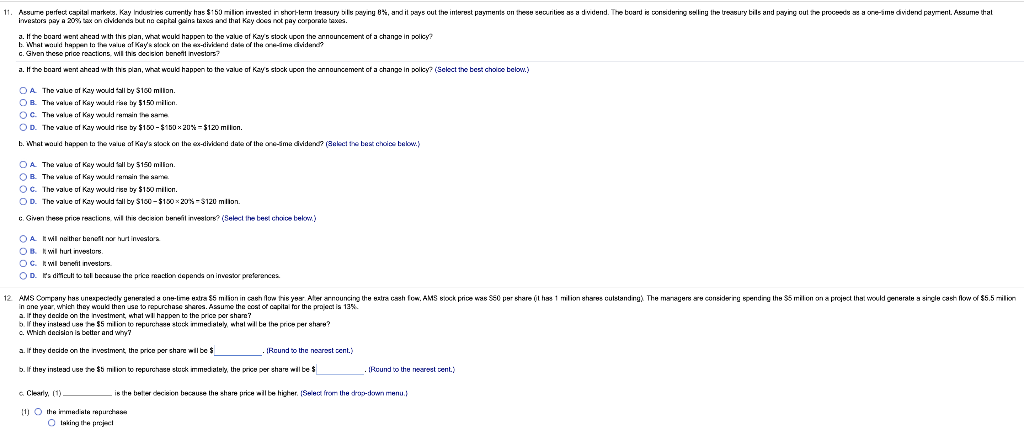

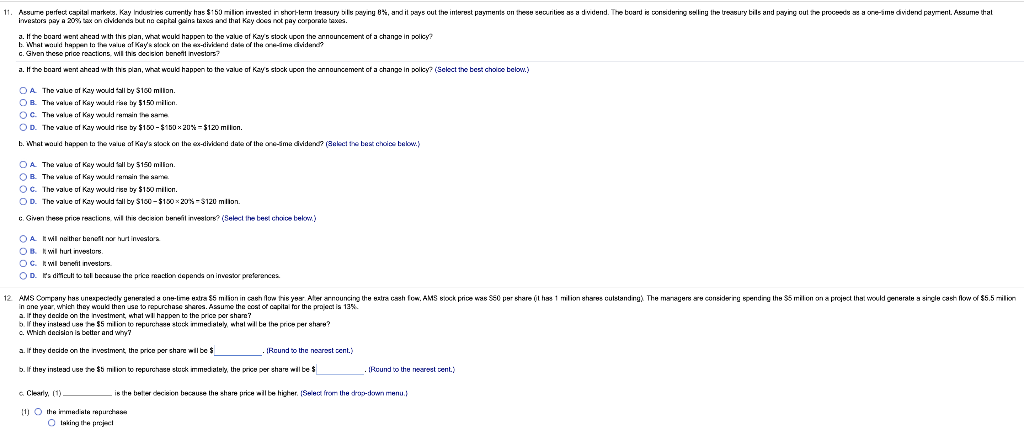

11. Assume perfect capital markets. Kay Industries currently has $150 million invested in short-term treasury bills paying 8%, and it pays out the interest payments on these securities as a dividend. The board is considering selling the treasury bills and paying out the proceeds as a one-ime dividend payment. Assume that investors pay a 20% tax on cividends but no capital gains taxes and that Kay does not pay corporate taxes. 3. If the board went ahead with this plan, what would happen to the value of Kay's stock upon the announcement of a change in policy? b. What would happen to the value of Kay's stock on the s-dividend date of the one-sme dividend? c. Given these price reactions, will this decision benett investors? a. If the board went ahead with this plan, what would happen to the value of Kay's stock upon the announcement of a change in policy? (Select the best choice below.) OA. The value of Kay would fall by $100 million OB. The value of Kay would ran by $150 milion. OC. The value of Kay would remain the same OD. The value of Kay would rise by $150-$150x20%-$120 milion b. What would happen to the value of Kay's stock on the co-divikend date of the one-sme dividend? (Select the best choics below.) OA The value of Kay would fall by $150 million. OB. The value of Kay would remain the same OC. The value of Kay would rise by $150 milion. OD. The value of Kay would fall by $100-$15020%-$120 millon c. Given these price reactions, will this decision benefit investors? (Select the best choice below) OA It will neither benefit nor hurt investors OB. I wil hurt investors OC. It will bene investors OD. It's difficult to ball because the price reaction depends on investor preferences. 12 AMS Company has unexpectedly generated a one-time extra $5 milion in cash flow this year. After announcing the extra cash fow, AMS slock price was 550 per share it has 1 milion shares outstanding). The managers are considering spending the $5 million on a project that would generate a single cash flow of $5.5 million in one year, which they would then use to repurchase shares. Assume the cost of capital for the project is 13%. a. If they decide on the investment, what will happen to the price per share? b. If they instead use the $5 milion to repurchase stock immediately, what will be the price per share? c. Which decision is better and why? a. If they decide on the investment, the price per share will be $ b. If they instead use the $5 million to repurchase stock immediately, the price per share will be $ Clearly, (1) 1) O the immediate repurchas O taking the project [Round to the nearest cent.) Round to the nearest cent.) is the better decision because the share price will be higher. (Select from the drop-down menu.) 11. Assume perfect capital markets. Kay Industries currently has $150 million invested in short-term treasury bills paying 8%, and it pays out the interest payments on these securities as a dividend. The board is considering selling the treasury bills and paying out the proceeds as a one-ime dividend payment. Assume that investors pay a 20% tax on cividends but no capital gains taxes and that Kay does not pay corporate taxes. 3. If the board went ahead with this plan, what would happen to the value of Kay's stock upon the announcement of a change in policy? b. What would happen to the value of Kay's stock on the s-dividend date of the one-sme dividend? c. Given these price reactions, will this decision benett investors? a. If the board went ahead with this plan, what would happen to the value of Kay's stock upon the announcement of a change in policy? (Select the best choice below.) OA. The value of Kay would fall by $100 million OB. The value of Kay would ran by $150 milion. OC. The value of Kay would remain the same OD. The value of Kay would rise by $150-$150x20%-$120 milion b. What would happen to the value of Kay's stock on the co-divikend date of the one-sme dividend? (Select the best choics below.) OA The value of Kay would fall by $150 million. OB. The value of Kay would remain the same OC. The value of Kay would rise by $150 milion. OD. The value of Kay would fall by $100-$15020%-$120 millon c. Given these price reactions, will this decision benefit investors? (Select the best choice below) OA It will neither benefit nor hurt investors OB. I wil hurt investors OC. It will bene investors OD. It's difficult to ball because the price reaction depends on investor preferences. 12 AMS Company has unexpectedly generated a one-time extra $5 milion in cash flow this year. After announcing the extra cash fow, AMS slock price was 550 per share it has 1 milion shares outstanding). The managers are considering spending the $5 million on a project that would generate a single cash flow of $5.5 million in one year, which they would then use to repurchase shares. Assume the cost of capital for the project is 13%. a. If they decide on the investment, what will happen to the price per share? b. If they instead use the $5 milion to repurchase stock immediately, what will be the price per share? c. Which decision is better and why? a. If they decide on the investment, the price per share will be $ b. If they instead use the $5 million to repurchase stock immediately, the price per share will be $ Clearly, (1) 1) O the immediate repurchas O taking the project [Round to the nearest cent.) Round to the nearest cent.) is the better decision because the share price will be higher. (Select from the drop-down menu.)