Hi,

Would you please help me with this assignment?

Thank you,

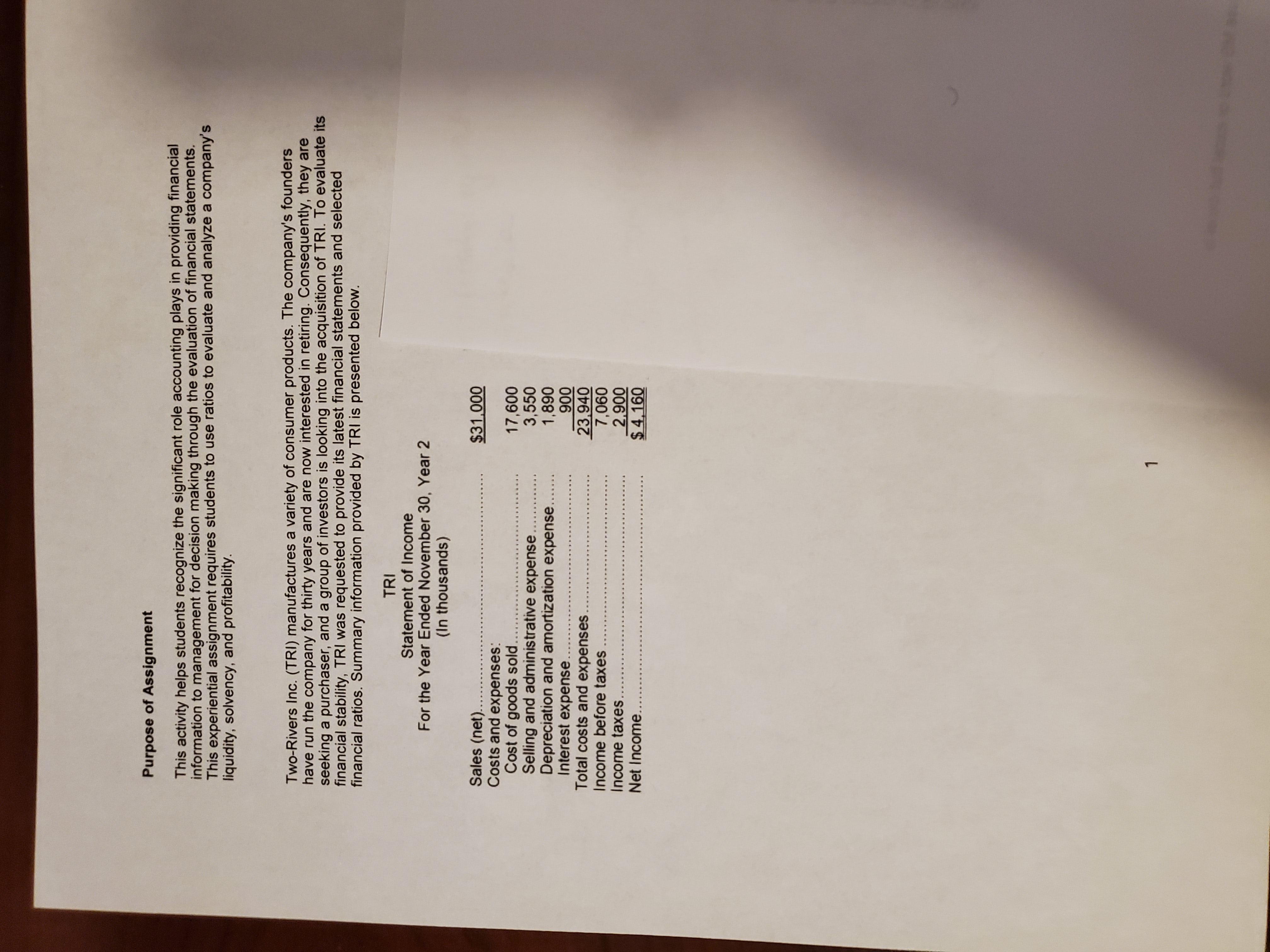

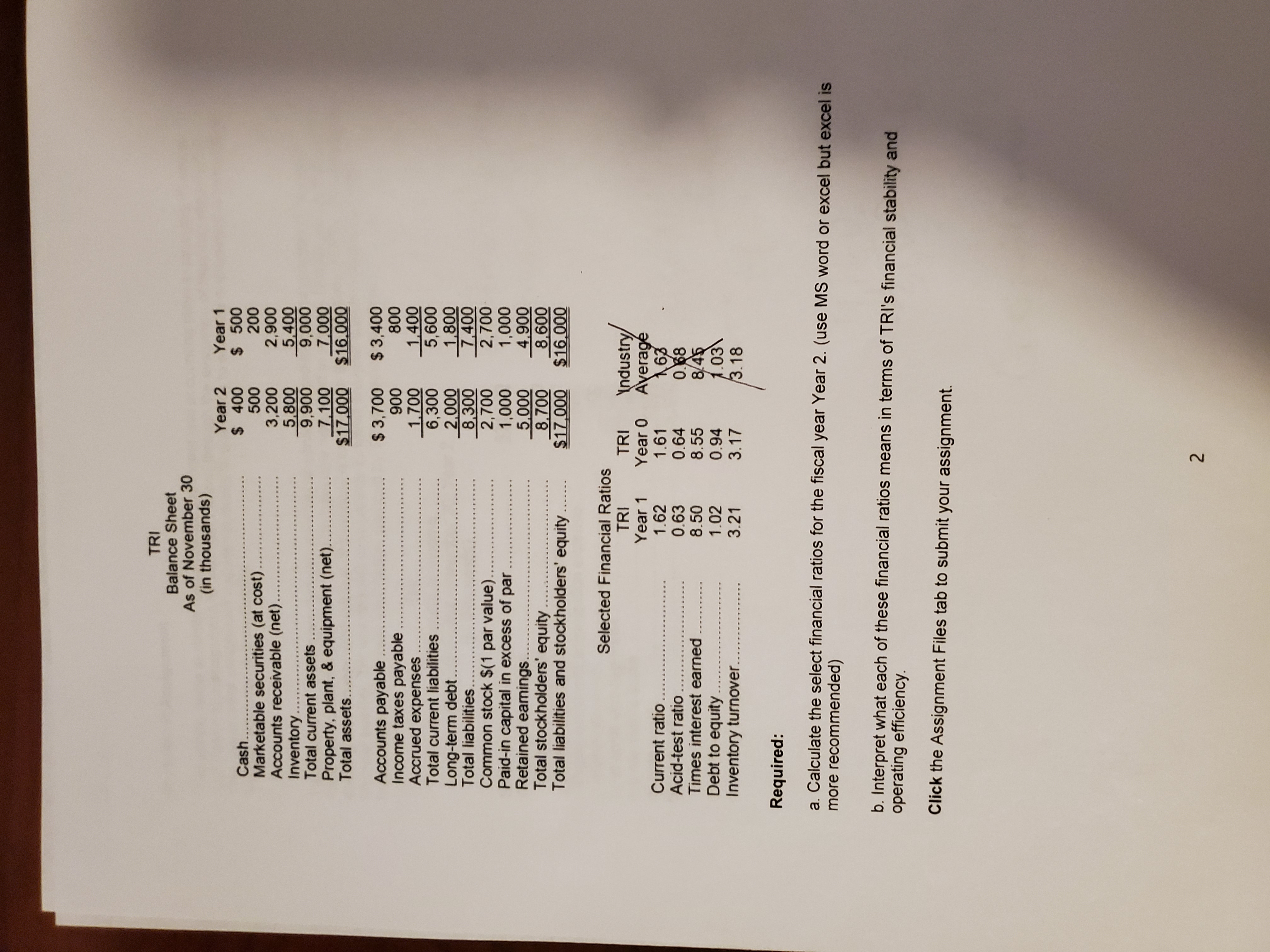

Purpose of Assignment This activity helps students recognize the significant role accounting plays in providing financial information to management for decision making through the evaluation of financial statements This experiential assignment requires students to use ratios to evaluate and analyze a company's liquidity, solvency, and profitability. Two-Rivers Inc. (TRI) manufactures a variety of consumer products. The company's founders have run the company for thirty years and are now interested in retiring. Consequently, they are seeking a purchaser, and a group of investors is looking into the acquisition of TRI. To evaluate its financial stability, TRI was requested to provide its latest financial statements and selected financial ratios. Summary information provided by TRI is presented below. TRI Statement of Income For the Year Ended November 30, Year 2 (In thousands) Sales (net ).................. $31,000 Costs and expenses: Cost of goods sold. 17,600 Selling and administrative expense ............. 3,550 Depreciation and amortization expense....... 1,890 Interest expense ...........- 900 Total costs and expenses. 23,940 Income before taxes 7,060 Income taxes.. 2,900 Net Income. $ 4,160TRI Balance Sheet As of November 30 (in thousands) Year 2 Year 1 Cash .................... 400 $ 500 Marketable securities (at cost) ...... 500 200 Accounts receivable (net) .... 3,200 2,900 Inventory ............ 5,800 5,400 Total current assets 9,900 9,000 Property, plant, & equipment (net). 7.100 7.000 Total assets....... $17,000 $16.000 Accounts payable $ 3,700 $ 3,400 Income taxes payable 900 800 Accrued expenses ..... 1,700 1.400 Total current liabilities 6,300 5,600 Long-term debt.... 2,000 1,800 Total liabilities 8,300 7,400 Common stock $(1 par value). 2,700 2,700 Paid-in capital in excess of par ..... 1,000 Retained earnings.. 1,000 5.000 4,900 Total stockholders' equity ............. 8.700 8.600 Total liabilities and stockholders' equity ....... $17,00Q $16.000 Selected Financial Ratios TRI TRI Year 1 Industry/ Current ratio ...... Year 0 1.62 Average Acid-test ratio ..... 1.61 163 Times interest earned . . ... 0.63 0.64 8.50 0.68 Debt to equity ........ 8.55 1.02 8/45 0.94 Inventory turnover... 3.21 3.17 1.03 3.18 Required: a. Calculate the select financial ratios for the fiscal year Year 2. (use MS word or excel but excel is more recommended) b. Interpret what each of these financial ratios means in terms of TRI's financial stability and operating efficiency Click the Assignment Files tab to submit your assignment. 2