Answered step by step

Verified Expert Solution

Question

1 Approved Answer

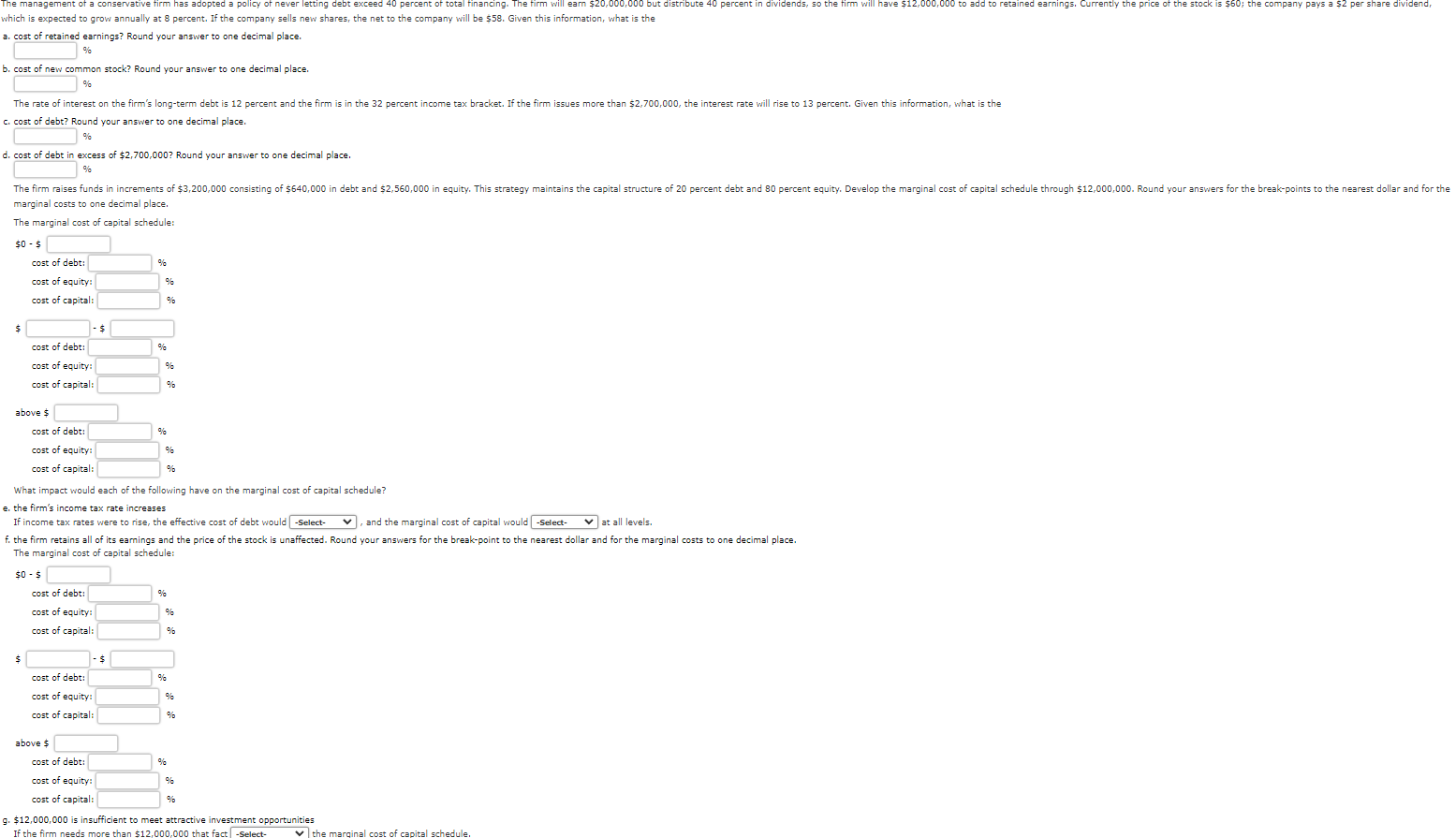

hich is expected to grow annually at 8 percent. If the company sells n rnat of ratained earnings? Round your answer to one decimal place.

hich is expected to grow annually at 8 percent. If the company sells n rnat of ratained earnings? Round your answer to one decimal place. 2. Fhat of retained ear . cost of new common stock? Round your answer to one decimal place. Eost of debt? Round your answer to one decimal place. Cost of debt in excess of $2,700,000 ? Round your answer to one decimal place. marginal costs to one decimal place. The marginal cost of capital schedule: $05 What impact would each of the following have on the marginal cost of capital schedule? e, the firm's income tax rate increases If income tax rates were to rise, the effective cost of debt would , and the marginal cost of capital would at all levels. The marginal cost of capital schedule: $05 above $ cost of debt: cost of equity: cost of capital: $12,000,000 is insufficient to meet attractive investment opportunities hich is expected to grow annually at 8 percent. If the company sells n rnat of ratained earnings? Round your answer to one decimal place. 2. Fhat of retained ear . cost of new common stock? Round your answer to one decimal place. Eost of debt? Round your answer to one decimal place. Cost of debt in excess of $2,700,000 ? Round your answer to one decimal place. marginal costs to one decimal place. The marginal cost of capital schedule: $05 What impact would each of the following have on the marginal cost of capital schedule? e, the firm's income tax rate increases If income tax rates were to rise, the effective cost of debt would , and the marginal cost of capital would at all levels. The marginal cost of capital schedule: $05 above $ cost of debt: cost of equity: cost of capital: $12,000,000 is insufficient to meet attractive investment opportunities

hich is expected to grow annually at 8 percent. If the company sells n rnat of ratained earnings? Round your answer to one decimal place. 2. Fhat of retained ear . cost of new common stock? Round your answer to one decimal place. Eost of debt? Round your answer to one decimal place. Cost of debt in excess of $2,700,000 ? Round your answer to one decimal place. marginal costs to one decimal place. The marginal cost of capital schedule: $05 What impact would each of the following have on the marginal cost of capital schedule? e, the firm's income tax rate increases If income tax rates were to rise, the effective cost of debt would , and the marginal cost of capital would at all levels. The marginal cost of capital schedule: $05 above $ cost of debt: cost of equity: cost of capital: $12,000,000 is insufficient to meet attractive investment opportunities hich is expected to grow annually at 8 percent. If the company sells n rnat of ratained earnings? Round your answer to one decimal place. 2. Fhat of retained ear . cost of new common stock? Round your answer to one decimal place. Eost of debt? Round your answer to one decimal place. Cost of debt in excess of $2,700,000 ? Round your answer to one decimal place. marginal costs to one decimal place. The marginal cost of capital schedule: $05 What impact would each of the following have on the marginal cost of capital schedule? e, the firm's income tax rate increases If income tax rates were to rise, the effective cost of debt would , and the marginal cost of capital would at all levels. The marginal cost of capital schedule: $05 above $ cost of debt: cost of equity: cost of capital: $12,000,000 is insufficient to meet attractive investment opportunities Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started