Question

Hickory Company manufactures two products - 14,000 units of Product Y and 6,000 units of Product Z. The company uses a plantwide overhead rate based

Hickory Company manufactures two products - 14,000 units of Product Y and 6,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is a considering implementing an activity-based costing (ABC) costing to allocate all of its manufacturing overhead to their products using four cost pools. The following additional information is available for the company as a whole and for Products Y and Z.

INSTRUCTIONS:

Set up an excel model to calculate the following (use the tab called "Your Excel Model" at the bottom of this screen):

1. The company's plantwide overhead rate.

2. Using the traditional plantwide overhead rate , the amount of manufacturing overhead cost allocated to Product Y and Product Z.

3. Total product cost for Product Y and Z under the traditional plantwide overhead rate system.

4. Total product cost per unit for Product Y and Product Z under the traditional plantwide overhead rate system.

5. The company switches to an ABC costing system for allocating overhead to product Y and product Z.

Calculate the overhead activity rate for the four cost pools (machining, machine setups, inspections

and general factory)

6. Using the ABC system, calculate total manufacturing overhead cost assigned to Product Y.

7. Using the ABC system, calculate total manufacturing overhead cost would be assigned to Product Z.

8. Total product cost for Product Y and Z under the Activity based costing system?

9. Total product cost per unit for Product Y and Product Z under Activity Based Costing

system.

10. Which product was overcosted when using the Plantwide rate, in comparison to ABC Costing?

11. Which product was undercosted when using the Plantwide rate, in comparison to ABC Costing?

---------------------------------------------------------------------------------------------------

PART 2:

1) Suppose the Total Activity Cost Pool for General Factory is $345855 and Product Y and Product Z have the following direct labor hours. What is the traditional plant wide overhead rate?

| Product Y | Product Z | |

| DL Hours | 12000 | 6000 |

2) What is total product cost for all units of Product Y using a traditional plant-wide overhead rate system using the following inputs (assume all other numbers are from the base scenario)

Change:

Total Cost Pool for Machining = $203764

Number of DL hours for Product Y = 7093

Number of DL hours for Product Z = 3980

3) What is total product cost PER UNIT for Product Z under ABC if:

Total Machine Setup Pool = $93214 Total Machine Hours = 6616 for Product Y and 3613 for Product Z

4) What is total product cost for Product Y under ABC if:

Total Machining Cost Pool = $182330 Total Inspection Activity = 10909 for Product Y and 13293 for Product Z

5) What is the cost per unit for Product Z under a traditional plant wide overhead rate system if :

Direct materials for all units of Product Z are $102386

Direct Labor for all units of Product Z are $57706

The number of units of Product Z that were produced are 6193

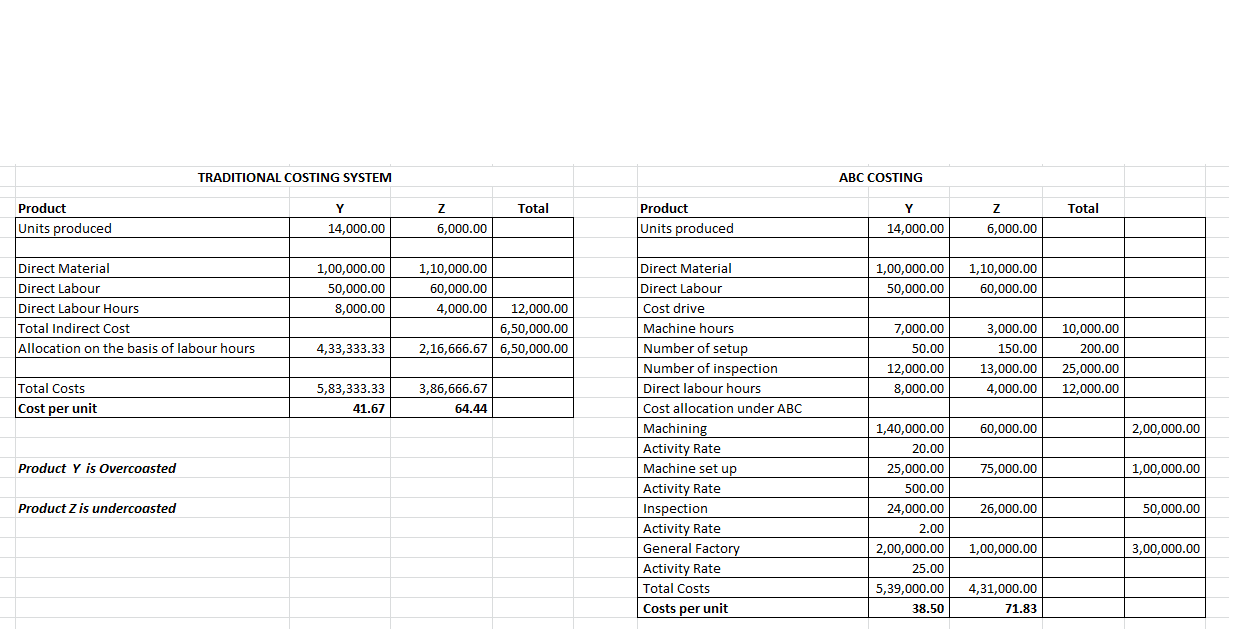

TRADITIONAL COSTING SYSTEM ABC COSTING Product Units produced Product Units produced Total Total 14,000.00 6,000.00 14,000.00 6,000.00 Direct Material Direct Labour Direct Labour Hours Total Indirect Cost Allocation on the basis of labour hours Direct Material Direct Labour Cost drive Machine hours Number of setup Number of inspection Direct labour hours Cost allocation under ABC Machinin Activity Rate Machine set up Activity Rate Inspection Activity Rate General Facto Activity Rate Total Costs Costs per unit 1,00,000.00 50,000.00 8,000.00 1,10,000.00 60,000.00 1,00,000.00 1,10,000.00 60,000.00 50,000.00 4,000.00 12,000.00 6,50,000.00 2,16,666.676,50,000.00 7,000.00 50.00 12,000.00 8,000.00 3,000.00 10,000.00 200.00 13,000.00 25,000.00 4,000.00 12,000.00 4,33,333.33 150.00 Total Costs 3,86,666.67 5,83,333.33 41.67 Cost per unit 64.44 1,40,000.00 20.00 25,000.00 500.00 24,000.00 2.00 60,000.00 2,00,000.00 ProductY is Overcoasted 75,000.00 1,00,000.00 Product Z is undercoasted 26,000.00 50,000.00 2,00,000.00 1,00,000.00 3,00,000.00 25.00 5,39,000.00 4,31,000.00 71.83 38.50Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started