Answered step by step

Verified Expert Solution

Question

1 Approved Answer

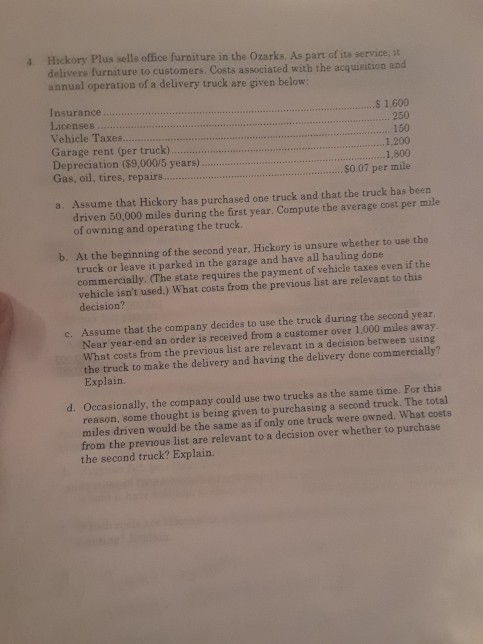

Hickory Plus selle office furniture in the Ozarks. As part of its service it delivers furniture to customers. Costs associated with the acquisition annual operation

Hickory Plus selle office furniture in the Ozarks. As part of its service it delivers furniture to customers. Costs associated with the acquisition annual operation of a delivery truck are given below: s Insurance Licenses Vehicle Tax Garage rent (per truck) $1,600 250 160 1,200 1,800 $0.07 per mile Gas, oil, tires, repair. a. Assume that Hickory has purchased one truck and that the truck bas been driven 50,000 miles during the first year. Compute the average cost per mile of owning and operating the truck b. At the beginning of the second year, Hickory is unsure whether to use the truck or leave it parked in the garage and bave all hauling done commercially. (The state requires the payment of vehicle taxes even if the vehicle isn't used.) What costs from the previous list are relevant to this decision c. Assume that the company decides to use the truck during the second year Near year-end an order is received from a customer over 1,000 miles away. What costs from the previous list are relevant in a decision between using the truck to make the delivery and having the delivery done commercially? Explain d. Occasionally, the company could use two trucks as the same time. For this reason. some thought is being given to purchasing a second truck. The total miles driven would be the same as if only one truck were owned. What costs from the previous list are relevant to a decision over whether to purchase the second truck? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started