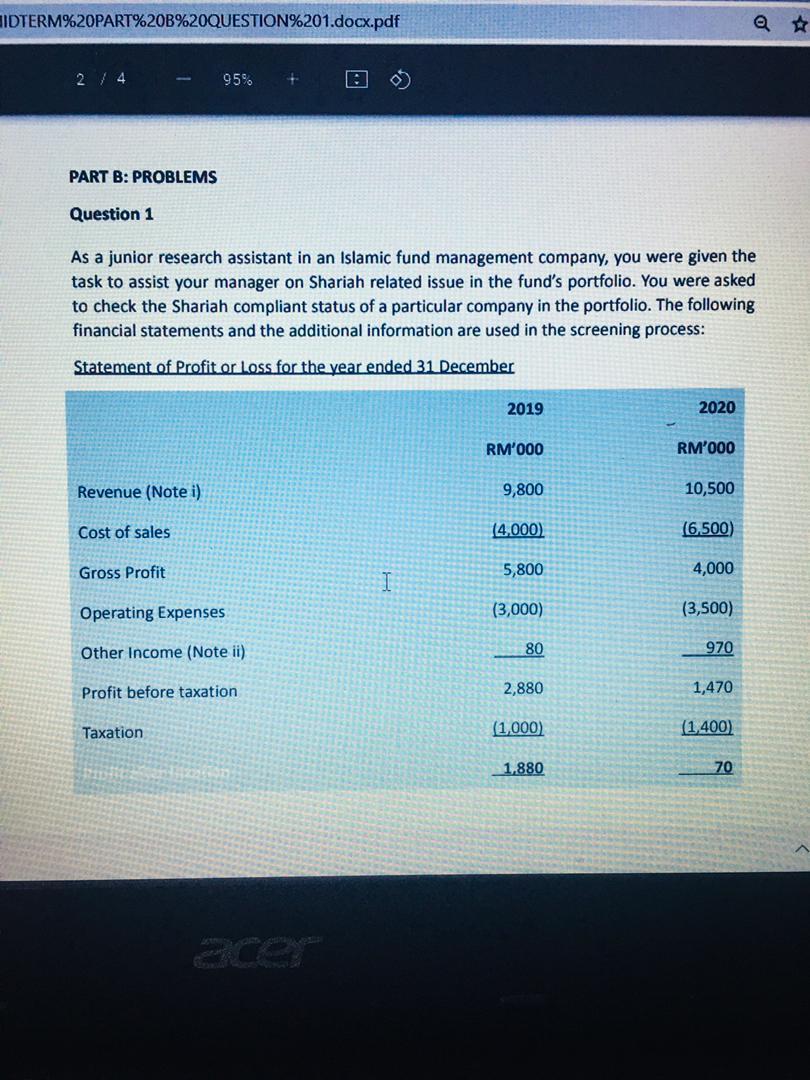

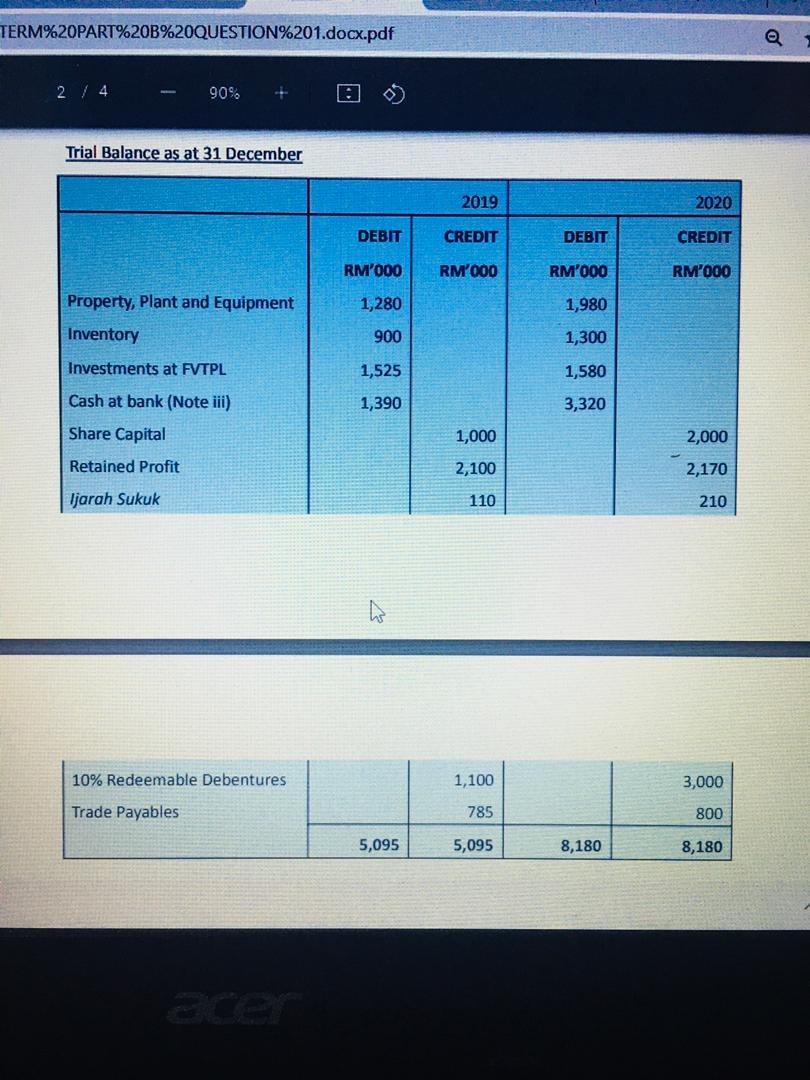

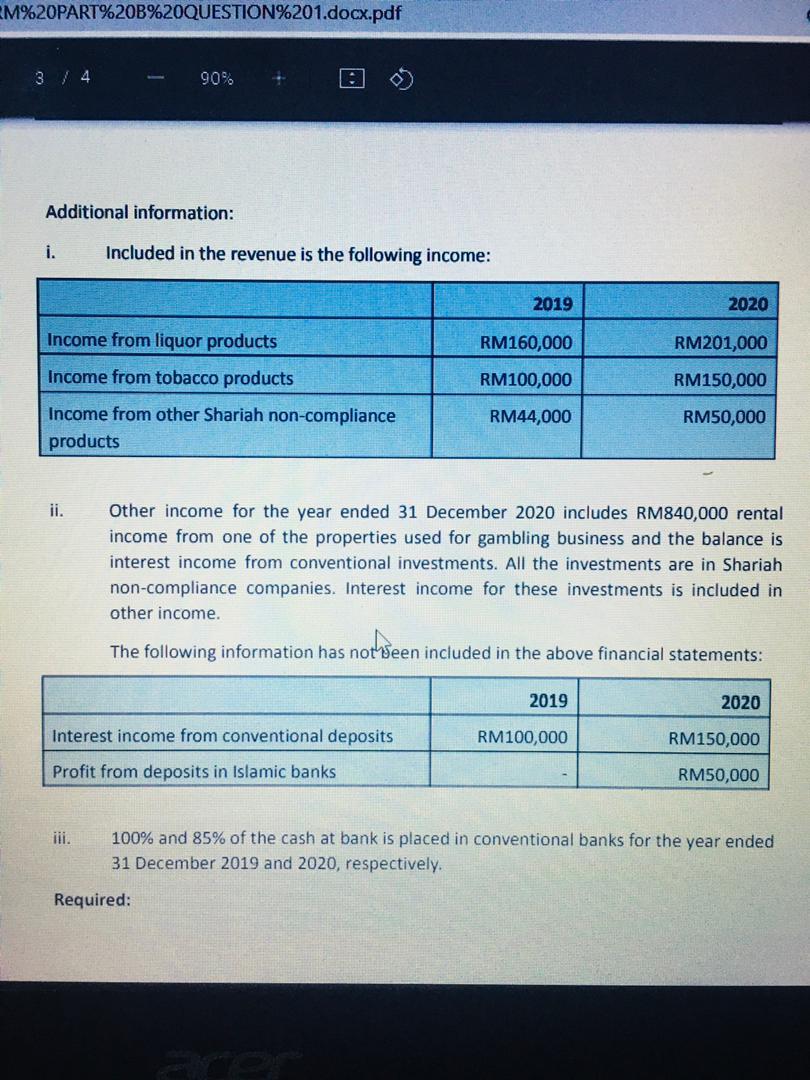

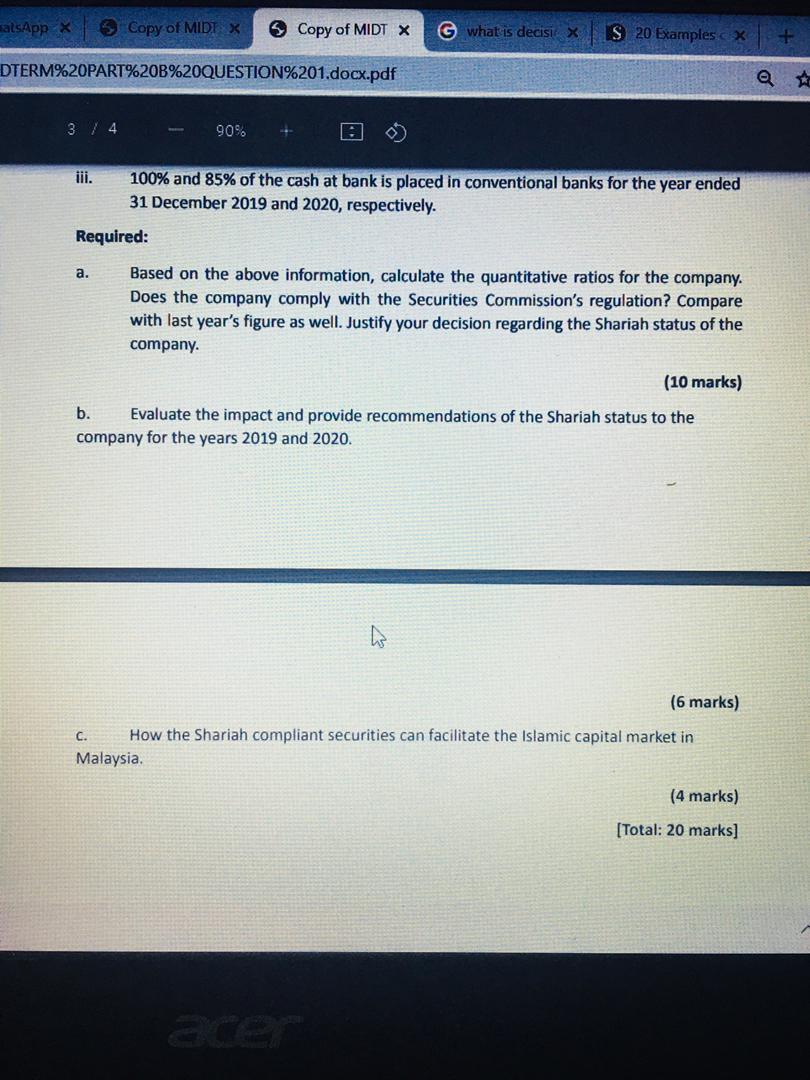

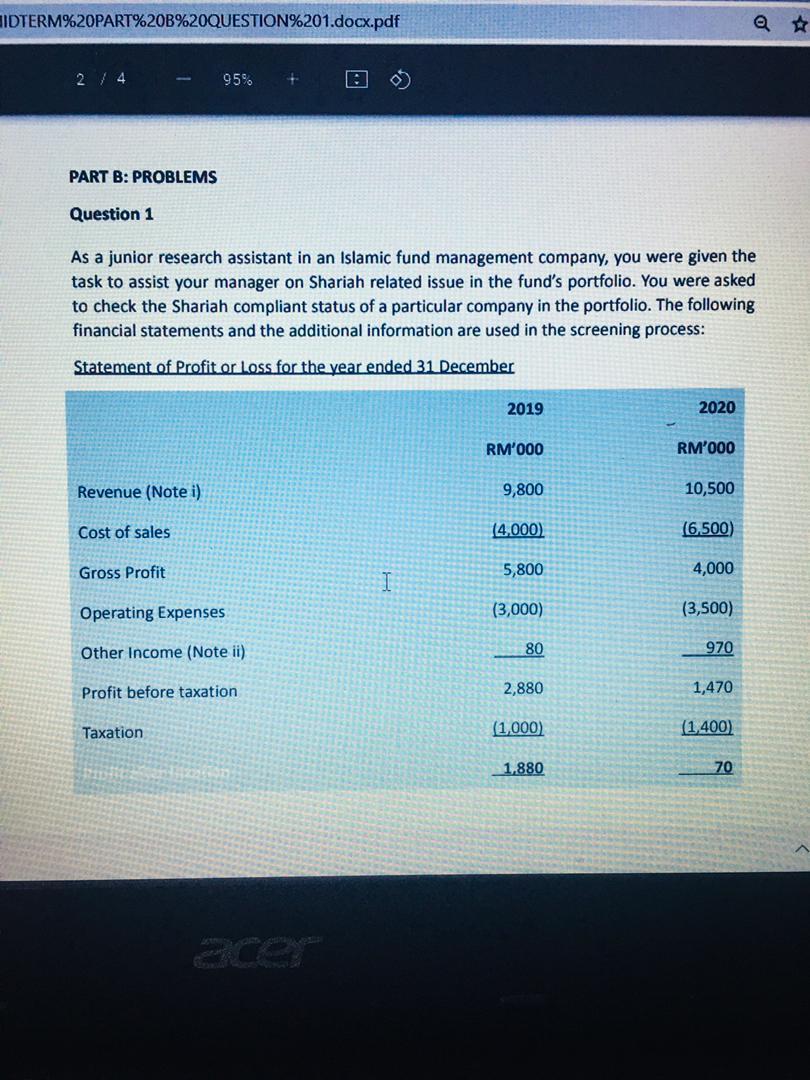

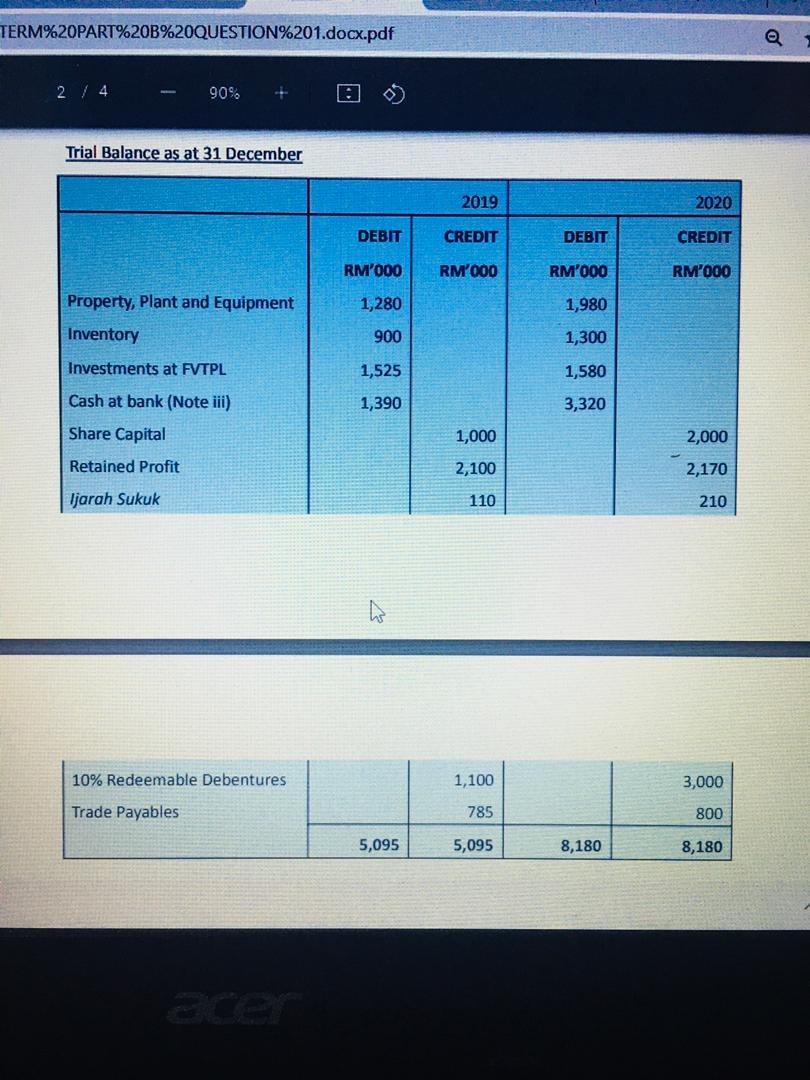

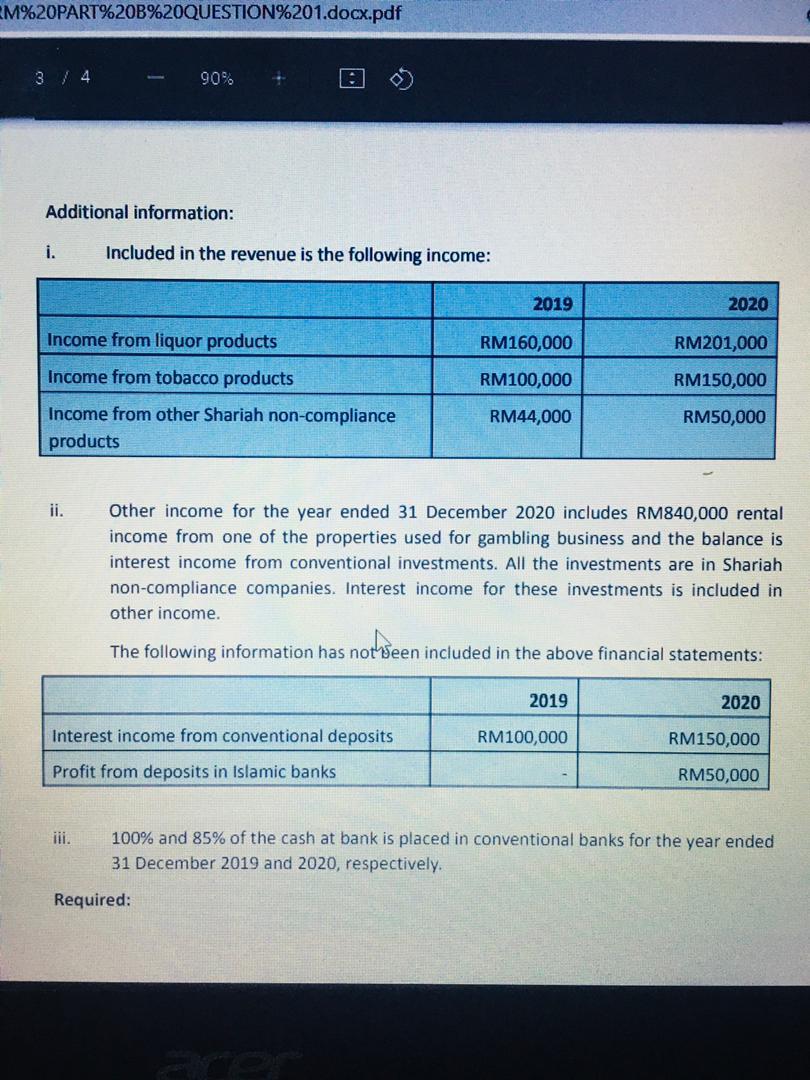

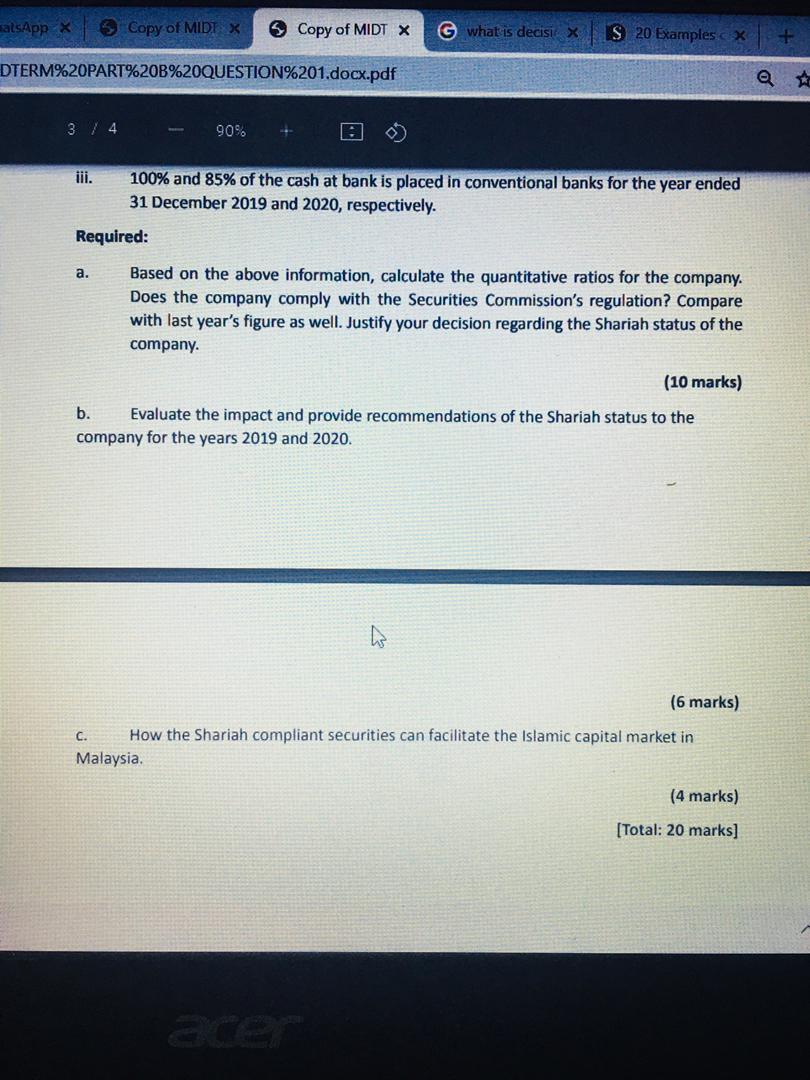

HIDTERM%20PART%20B%20QUESTION%201.docx.pdf 24 95% + PART B: PROBLEMS Question 1 As a junior research assistant in an Islamic fund management company, you were given the task to assist your manager on Shariah related issue in the fund's portfolio. You were asked to check the Shariah compliant status of a particular company in the portfolio. The following financial statements and the additional information are used in the screening process: Statement of Profit or Loss for the year ended 31 December 2019 2020 RM'000 RM'000 Revenue (Notei) 9,800 10,500 Cost of sales 14.000 (6.500) Gross Profit 5,800 4,000 I Operating Expenses (3,000) (3,500) Other Income (Note ii) 80 970 Profit before taxation 2,880 1,470 Taxation (1,000) (1,400) 1,880 70 TERM%20PART%20B%20QUESTION%201.docx.pdf 2 / 4 90% --- Trial Balance as at 31 December 2019 2020 DEBIT CREDIT DEBIT CREDIT RM'000 RM'000 RM'000 RM'000 1,280 Property, Plant and Equipment Inventory 1,980 1,300 900 Investments at FVTPL 1,525 1,580 Cash at bank (Note iii) 1,390 3,320 Share Capital 1,000 2,000 Retained Profit 2,100 2,170 Ijarah Sukuk 110 210 1,100 3,000 10% Redeemable Debentures Trade Payables 785 800 5,095 5,095 8,180 8,180 M%20PART%20B%20QUESTION%201.docx.pdf 3/4 90% Additional information: i. Included in the revenue is the following income: 2019 2020 Income from liquor products RM160,000 RM201,000 RM100,000 RM150,000 Income from tobacco products Income from other Shariah non-compliance products RM44,000 RM50,000 ii. Other income for the year ended 31 December 2020 includes RM840,000 rental income from one of the properties used for gambling business and the balance is interest income from conventional investments. All the investments are in Shariah non-compliance companies. Interest income for these investments is included in other income. The following information has nothseen included in the above financial statements: nothseen 2019 2020 Interest income from conventional deposits RM100,000 RM150,000 Profit from deposits in Islamic banks RM50,000 iii. 100% and 85% of the cash at bank is placed in conventional banks for the year ended 31 December 2019 and 2020, respectively. Required: alsApp 5 Copy of MIDI X Copy of MIDT X G what is decisix S 20 Examples + DTERM%20PART%20B%20QUESTION%201.docx.pdf Q 9 3 / 4 90% iii. 100% and 85% of the cash at bank is placed in conventional banks for the year ended 31 December 2019 and 2020, respectively. Required: a. Based on the above information, calculate the quantitative ratios for the company. Does the company comply with the Securities Commission's regulation? Compare with last year's figure as well. Justify your decision regarding the Shariah status of the company. (10 marks) b. Evaluate the impact and provide recommendations of the Shariah status to the company for the years 2019 and 2020. (6 marks) c. How the Shariah compliant securities can facilitate the Islamic capital market in Malaysia, (4 marks) [Total: 20 marks] HIDTERM%20PART%20B%20QUESTION%201.docx.pdf 24 95% + PART B: PROBLEMS Question 1 As a junior research assistant in an Islamic fund management company, you were given the task to assist your manager on Shariah related issue in the fund's portfolio. You were asked to check the Shariah compliant status of a particular company in the portfolio. The following financial statements and the additional information are used in the screening process: Statement of Profit or Loss for the year ended 31 December 2019 2020 RM'000 RM'000 Revenue (Notei) 9,800 10,500 Cost of sales 14.000 (6.500) Gross Profit 5,800 4,000 I Operating Expenses (3,000) (3,500) Other Income (Note ii) 80 970 Profit before taxation 2,880 1,470 Taxation (1,000) (1,400) 1,880 70 TERM%20PART%20B%20QUESTION%201.docx.pdf 2 / 4 90% --- Trial Balance as at 31 December 2019 2020 DEBIT CREDIT DEBIT CREDIT RM'000 RM'000 RM'000 RM'000 1,280 Property, Plant and Equipment Inventory 1,980 1,300 900 Investments at FVTPL 1,525 1,580 Cash at bank (Note iii) 1,390 3,320 Share Capital 1,000 2,000 Retained Profit 2,100 2,170 Ijarah Sukuk 110 210 1,100 3,000 10% Redeemable Debentures Trade Payables 785 800 5,095 5,095 8,180 8,180 M%20PART%20B%20QUESTION%201.docx.pdf 3/4 90% Additional information: i. Included in the revenue is the following income: 2019 2020 Income from liquor products RM160,000 RM201,000 RM100,000 RM150,000 Income from tobacco products Income from other Shariah non-compliance products RM44,000 RM50,000 ii. Other income for the year ended 31 December 2020 includes RM840,000 rental income from one of the properties used for gambling business and the balance is interest income from conventional investments. All the investments are in Shariah non-compliance companies. Interest income for these investments is included in other income. The following information has nothseen included in the above financial statements: nothseen 2019 2020 Interest income from conventional deposits RM100,000 RM150,000 Profit from deposits in Islamic banks RM50,000 iii. 100% and 85% of the cash at bank is placed in conventional banks for the year ended 31 December 2019 and 2020, respectively. Required: alsApp 5 Copy of MIDI X Copy of MIDT X G what is decisix S 20 Examples + DTERM%20PART%20B%20QUESTION%201.docx.pdf Q 9 3 / 4 90% iii. 100% and 85% of the cash at bank is placed in conventional banks for the year ended 31 December 2019 and 2020, respectively. Required: a. Based on the above information, calculate the quantitative ratios for the company. Does the company comply with the Securities Commission's regulation? Compare with last year's figure as well. Justify your decision regarding the Shariah status of the company. (10 marks) b. Evaluate the impact and provide recommendations of the Shariah status to the company for the years 2019 and 2020. (6 marks) c. How the Shariah compliant securities can facilitate the Islamic capital market in Malaysia, (4 marks) [Total: 20 marks]