Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Higgins Corporation (HC), a Montreal robot-manufacturing company, has developed a new advanced-technology robot called Helpmate. The firm would need a new plant to manufacture

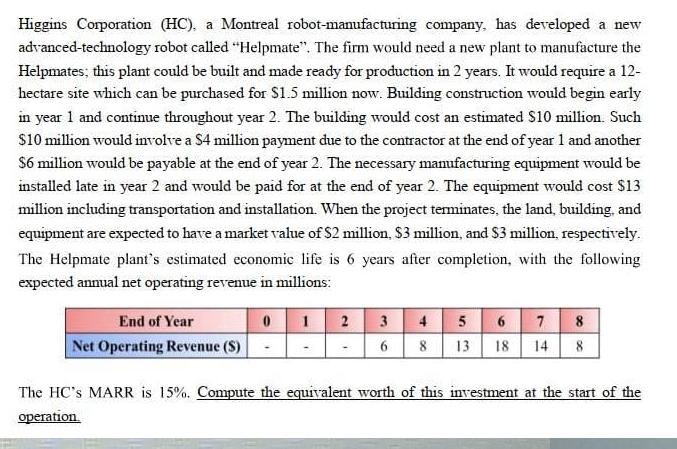

Higgins Corporation (HC), a Montreal robot-manufacturing company, has developed a new advanced-technology robot called "Helpmate". The firm would need a new plant to manufacture the Helpmates; this plant could be built and made ready for production in 2 years. It would require a 12- hectare site which can be purchased for $1.5 million now. Building construction would begin early in year 1 and continue throughout year 2. The building would cost an estimated $10 million. Such $10 million would involve a $4 million payment due to the contractor at the end of year 1 and another $6 million would be payable at the end of year 2. The necessary manufacturing equipment would be installed late in year 2 and would be paid for at the end of year 2. The equipment would cost $13 million including transportation and installation. When the project terminates, the land, building, and equipment are expected to have a market value of $2 million, $3 million, and $3 million, respectively. The Helpmate plant's estimated economic life is 6 years after completion, with the following expected annual net operating revenue in millions: End of Year Net Operating Revenue (S) 01 2 3 4 6 8 5 6 7 8 13 18 14 8 The HC's MARR is 15%. Compute the equivalent worth of this investment at the start of the operation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started